One of the most well-known names in personal finance is to encourage Americans to increase financial literacy and encourage the country to do a better job of providing education.

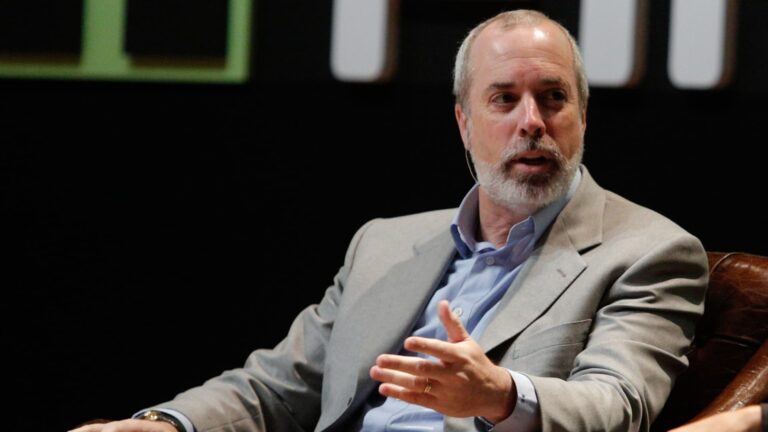

“We spend a lot of time trying to improve our financial literacy, and we stink it,” said Ric Edelman, founder of Edelman Financial Engines on CNBC’s “ETF Edge.”

Edelman thinks the issue is rooted in the fact that the United States has never had a great tradition of encouraging smart personal finances, and he says that it has never been important to fix it given how long people are now living. This increases the risks associated with losing money later in life, creating serious questions about standard investment models for long-term financial security, such as 60-40 shares and bond portfolios.

“We are the first generation who live long as part of the standard, like the baby boomer generation,” Edelman said. “Everyone in front of us, our parents and grandparents mostly died in their 50s and 60s. You didn’t have to plan your future.

One of his biggest concerns for young investors of the current generation is that they appear to believe in a rich, rich scheme. Many new investment websites are too encouraged by risky strategies that seduce young investors, he says, promoting financial gambling over investment. Over the past few years, options and zero-day options have become an important part of daily trading situations. According to data from the New York Stock Exchange, the percentage of retailers participating in the options market approached the 50% mark in 2022.

Edelman says the younger generation should be wary of America, a company that makes consumer finances more complicated than they should. This includes the production of overly sophisticated and expensive financial products. “They want to make it complicated, they want you to be hostage rather than customers,” he said.

He also warns young investors to make sure they have information about their personal funds from reliable sources. “When a lot of people get financial education from Tiktok, that’s a bit scary,” he said.

Edelman believes the cards are stacked against younger investors as high schools require personal finance courses. “The only way we can discover money issues is through hard knock schools as adults. We’re on our heads when it comes to car buying, mortgages, insurance and college savings,” he said.

That situation is improving for the next generation of adults. Utah was the first state to request a personal financial course for high school graduation in 2004, and by 2021, the list was now in place to include 11 states. As of this year, 27 states are currently requiring high school students to take semester-wide personal finance courses to graduate.

Another big challenge for young investors is that they often don’t have too much money to invest in, and recent college graduates have struggled to pay their bills, leaving little to go towards other financial goals. But there’s at least one reason to hope about young Americans, says Edelman: They are highly motivated to reach financial success.

“Young people today look at their parents and see that they are not ready to retire. They don’t want it to be their future,” he said.