Eve here. We repeatedly explained the long form in our 2015 work on the Greek rescue crisis. The Eurozone is a cockroach motel. It is impossible to leave without causing massive capital flights and collapse of the banking system, largely because it cannot be quickly or concealed. Lead times such as circulating new currencies are much longer than Excel and PowerPoint Jockeys imagine.

However, this post offers a completely different set of observations. And there are also unexplained benefits for the European Union and even the eurozone.

Born in Benjamin, Professor at the Finance and Management School of Macroeconomics, Lewis Haxel, a doctoral student at the University of Economics at Tubingen, Professor at the University of Economics at Tubingen, Johannes Pfeiffer of the Department of St. Macrometics at Coronin. Originally published on Voxeu

Recent events such as the announcement of tariffs have shown that even global shocks can be distinctive indigenous elements. This column found that the currency coalition shapes the effects of economic uncertainty on member states by effectively mitigating the negative effects of country-specific shocks. This does so by providing a nominal anchor that effectively eliminates price-level risks arising from country specifica. Additionally, this finding can prevent uneven exposure to uncertainty, reducing the need for policies at the national level, either by common central banks or by national prosecutors’ policies.

Donald Trump’s reelection brought height ancestors to the global economy (Grzana and Ildetzki 2025). The “liberation day” on April 2, 2025 and the surrounding whiplash and unstable tariff years are the perfect showcase. They caused major disruption in global financial markets (Benigno 2025).

All unhappy countries are unhappy in that way

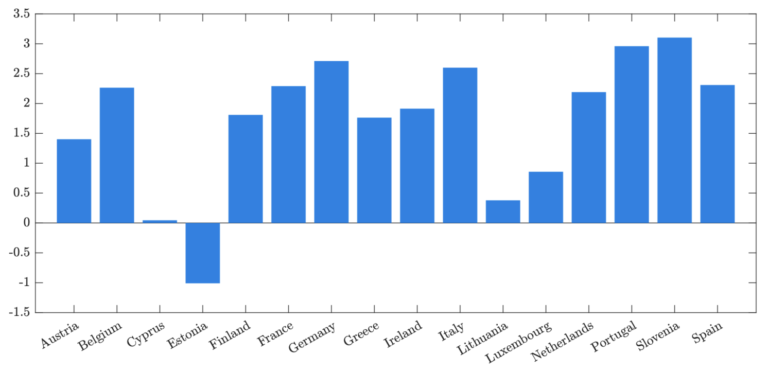

But even global uncertainty shocks, such as the announcement of Trump’s “liberation day” tariffs, do not affect all countries equally. Countries have a variety of exhibits, particularly in international trade with the United States. Figure 1 shows an unexpected increase in stock market volatility in April 2025 from the perspective of selected European countries. This is a widely used indicator of economic uncertainty. The uncertainty in Germany, Portugal and Slovenia has skyrocketed by almost three standard deviations. This is an event only at 0.3% of all months. At the same time, the influence in Cyprus and Lithuania was less pronounced. Given that the Tarse countries share a common Montary Poly with the Euro area, we may be concerned that the lack of the country’s distinctive Montary Poly Russe will allow us to elicit the shock effect. Certainly, it is well established that unnecessary shocks can cause side effects if Montary Poly does not respond due to the lower zero limit (Basu and Bundick 2017). The same may be true if exchange rate arrangements prevent monetary policy responses at the national level.

Figure 1 Increase in stock market volatility in April 2025

Note: In April 2025, stock market volatility was discontinued. Estimate AR(1) for monthly realized volatility of data data stream stock market performance indexes in each country. Shown are the residuals for April 2025, represented as a standard deviation of the country’s residuals.

New research shows that this speculation is wrong (Born etal. 2025). We investigate how economic uncertainty affects Euro Region (EA) countries, but not as strong as the wisdom received suggests.

Evidence from 30 countries

From 1999 to 2022, it analyzes quarterly data from 13 countries with 17 euro area members and floating exchange rates from 13 countries. Using Structural Bayesian Vector Authors (BVARs), we estimate the effects of uncertainty shocks based on two measures of economic uncertainty. Realised Stock Market Volatility, Bloom (2009), and Forecast Error-Based Uncertainty Indeboy cultivates ju apprentices. (2015) were compared by Commune and Nguyen (2023) of the Euro countries. Importantly, we identify general and country-specific uncertainty shocks for BUNs within the BVAR.

Figure 2 Output response to common (top) vs. country-specific (bottom) uncertainty shocks

Note: Impulsive responses of output to common (top) and country-specific (bottom) uncertainty shocks, according to the estimated BVAR (left) and structural model (right). The blue dashed line and the solid red line indicate the VAR response of the Euroarea countries (currency union), while the yellow line with the marker/green line indicates responsibility under the exchange rate (FLOAT). Shady areas show the highest density intervals of 68% and 90%. Horizontal axis: Time after impact in a quarter. Vertical axis: Actual GDP response of percentage.

The left panel in Figure 2 shows impulse responses. How does the impact of uncertainty affect economic activity measured by actual GDP? The top panel shows adjustments to the uncertainty shocks of countries with flexible exchange rates and EA. It’s not difficult. The bottom panel shows the results of country-specific uncertainty shocks. It lowers economic activity in countries with flexible exchange rates, but has little effect on the economic activity of the european countries. Compassion for the wisdom they receive, this is an amazing pattern. After all, monetary policy in the Euro region cannot and does not respond to the country’s inherent shocks.

Description: Price level expectations are fixed by members

This explains it in a structural two-country model of the currency union and expands the closed economic setup of Basu and Bundick (2017). In the model, the “home” country is small and affects it so that it does not affect the consent of the whole union, which determines general monetary policy. “Foreign” responsive and more rest of the union. The shock of uncertainty in the model broadens the distribution of sup or demand shocks. This model is estimated in Euroarea data to match the response of the impulse response to a typical uncertainty shock. We found that the estimation model actually predicts the Waker effect of country-specific uncertainty shocks compared to counterfactual shocks and floating exchange rates. These results are shown in the right panel of Figure 2 above. Ace Fianding is particularly noteworthy as no impulsive response to country-specific uncertainty shock occurred during model estimation.

Based on counterfactuals, we establish that the risk at the resulting price level is important. Without the Montary Union, if the country’s Montary Poly targets infections, the uncertain increase is associated with an increased risk at price levels. This is shown in the left panel in Figure 3. This shows a simulated long-term distribution of price levels after increased uncertainty and non-attached demand shock. As shown on the paper, price-level risks are harmful to consumption and investment. In contrast, even if country-specific uncertainties rise in countries operating within financial coalitions, long-term price levels remain fixed at the union level. As in Data (Bergin et al. 2017), long-term (relative) purchasing power parity prevents the country’s price level from converging to the union level in the absence of flexible exchange rates.

Figure 3 Union membership develops price-level risks

Note: After a 100-quarter long-term price level distribution and one standard deviation country-specific uncertainty shock (dotted line) under the floating exchange rate panel after a random one-time level demand shock derived from distribution from the mean uncertainty (solid line) (right panel). Horizontal axis: Price change rate. Vertical axis: Density.

Impact on policy

Our study highlights the key benefits of financial association members: reduction in price risk resulting from country-specific uncertainty shocks. The nominal anchors provided by the union not only eliminate inflation bias, as Offen argues, (Alesina and Barro 2002), but also form the dynamics of the business cycle. This discovery has the meaning of policy. Non-uniform exposure to inconsistencies may be less than expected. This reduces the need for target policies at the national level, whether by a common central bank or national prosecutor’s policy. Instead, even problematic waters may suffer nominal prejudice effects.

See original bibliographic submission