Now, the largest stock in the US market, Nvidia’s AI boom and success have made the semiconductor sector one of the most closely monitored corners in the market. Nvidia’s rise to market capitalization of over $4 trillion has led to concerns over the S&P 500 concentration in a small number of high-tech stocks. But in another respect, focusing on chip stocks as an investment theme should look for aggressive, bent investors.

Wall Street is finding new ways to create bets that are more focused on the chip sector.

The Vaneck Semiconductor ETF (SMH) has become the norm for investors looking to gain sector growth. Its portfolio spans the global supply chain. NVIDIA design GPUs, TSMCs manufacture them, and ASML supplies the necessary equipment. According to Vettafi, it has grown to nearly $30 billion, and has grown nearly 30% since the start of the year.

Meanwhile, the Vanguard S&P 500 ETF and SPDR S&P 500 ET Trust (SPY) are up about 13%.

Last Monday, on CNBC’s “ETF Edge,” Vaneck’s product manager Nicholas Frasse said SMH is working for the top winners team. Structure was key to performance, especially as demand for AI is rising. Nvidia was once a game chip company, but now it’s the face of AI build-outs.

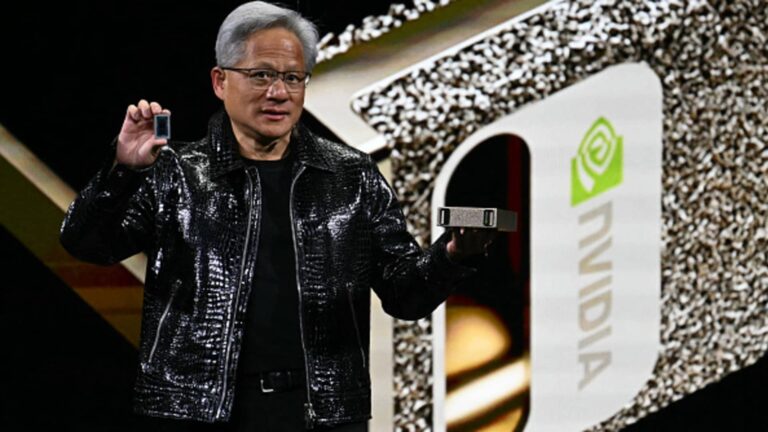

In the chipmaker’s latest revenue call, Nvidia CEO Jensen Huang described its Blackwell platform as “waiting for the next generation of AI world,” adding that the chip company’s head is nearing “extraordinary.”

The links between the tech sector and the economy as a whole are growing. On Thursday, NVIDIA announced that it would jointly develop data centers and PC chips with Intel, among the oldest companies in Silicon Valley security forces that the Trump administration has recently invested 10% stakes as a national security issue.

The popular Vanek Fund is not the only ETF that has benefited from the success of the semiconductor industry. The iShares Semiconductor ETF (SOXX) and the Investco PHLX Semiconductor ETF (SOXQ) each offer slightly different chip exposures, both portrayed by investors looking for ways to gain intensive exposure to the chip story.

Many of the same chip names are on top of these ETF holdings, but with different exact weights. However, another rapidly growing alternative is the SPDR S&P Semiconductor ETF (XSD). This distinguishes it from an equivalent weighting approach to inventory held in the underlying index. This means that small names like Astera Labs or Credo Technology get the equivalent expressions of Nvidia or Broadcom.

Suitable case: The fund’s NVIDIA weight is currently less than 3%, compared to the weight of Vaneck semiconductor ETFs over 20%. 12% of Invesco ETFs. Approximately 8% of the iShares Fund. The Nvidia on the S&P 500 currently weighs around 8%.

According to Vettafi, which is much smaller than SMH and Ishares’ Soxx, the SPDR S&P Semiconductor ETF has $15.1 billion in assets under management. However, the fund has grown by around 26% since the start of the year, earning Ishares ETF performance.

SPDR S&P Semiconductor ETF Top Holdings

Astera Labscredo TechnologyImpInjrigetti ComputingRambus

Source: Vettafi

The fund offers more widespread bets across the sector, thus reducing the risk of single-family home concentration to investors.

“If the maximum weight is rising, be aware of what’s going on in the other spaces,” a senior ETF & technical strategist at Strategas Securities Todd Sohn told CNBC. “It benefits you and can hurt you with flaws,” he said.

Another way to play themes is the Invesco Semiconductors ETF (PSI) rather than using traditional inventory indexes (Invesco’s SOXQ uses PHLX semiconductor indexes). This differs from some market cap weighted or equal weighted chip funds, and is usually expected to overlap between chip names in any of these portfolios, but typically includes several mid-cap chip designers and manufacturers that may not be included in larger ETFs.

Investco Semiconductors ETF TOP HOLDINGS

Micron Technology ResearchBroadcomkla CorporationQualcomm

Source: Vettafi

The Investco Semiconductors ETF is suitable for investors looking for exposure that is not controlled by Mega-Cap companies.

“If you’re very bullish about technology growth, you’ll want to add more semiconductor ETFs to your portfolio,” Sohn said.

Focusing on Fabless Semiconductor companies is one of the latest ETF products on the market. Fabless Chipmaker designs and sells chips, but outsources manufacturing. Vanek released Vanek Fabless Semiconductor ETF (SMHX) on August 27th.

Sohn said the approach is for investors who want exposure “focused on “the type of company involved,” as opposed to the overall spectrum of the semiconductor space.

In some respects, it’s not that different from what’s already offered within Semi ETFS. For example, Nvidia is the first hold of 18% or more. However, pure play Fabless Companies such as Cadence Design Systems are expensive among their holdings. It also includes some interesting take on the subject as part of the AI and Chip Story, as well as companies working on chips to reduce energy usage in data centers to help funds acquire monolithic power, to cut their top 10 holdings.

“I believe this is a super cycle,” Frasse said. “We’re in very early innings.”

Sign up for our weekly newsletter beyond the livestream and take a closer look at the trends and numbers that shape the ETF market.

Disclaimer