Eve here. The March 26th Presidential Order mandates require that the Treasury be nearly matched in check use and has been infected to receive tax payments by September 30th, making it hardly noticeable by gusts of other Trump actions.

This is yet another example of a saying stems from that great American philosopher Yogi Bella. “In theory, there is no difference between theory and practice. In reality, there is.”

In theory, it’s best to remove the check if you have at least a lot of processing habits. There are debatable seconds

However, the PMTS article explains in detail how Sep Termber 30 cannot achieve this goal. In fact, given the usability of the underlying payment processor system, it makes me wonder how many years the Fed will take from this initiative. $650 million to process all Treasury spending and receipts is couch lint.

And this shift will be even more difficult given Doge’s obsession with federal employees.

We’re behind the issue of the possibility that more costs can be spent on consumers to process payments.

I wish I could embed an 18-minute video from the PMTS site. The article doesn’t fully grasp the perplexed objections of Drew Edward, CEO of INGO Payments. From PMTS:

When Ingo Payments CEO Drew Edwards recently stayed in a conversation with Karen Webster, the bigger issue than Paper Check’s stubborn persistence is Deepper. Edwards’s content The real problem is that by the end of the paper checks mandated on September 30, they don’t have the digital data they need to make instant, accurate e-payments to millions of America.

The executive order’s goal of modernizing the system is hampered by data deficits. Edwards cited the Internal Revenue Service (IRS) as one of many federal agencies working from an outdated framework that leaps towards physical addresses rather than digital identifiers…

Traditionally, Edwards said the Treasury has mailed paper checks or processed direct deposits via automated clearinghouse (ACH) files. Sub-taxpayers have chosen to enter their routing and account numbers for direct deposits, but the large strip of recipients continues to receive Treasury checks by post. Also, if the government is aiming to eliminate checks entirely, everything should be updated, from how to collect consumer information to how to verify recipient identity.

“The biggest challenge is how we can get contact information from everyone who primarily seduces money from the federal government, besides its name and address,” Edwards explained. “How do you make sure the contact you have is the person you think it is?”

Authentication issues

Even if authorities identify viable digital payment systems, Edwards warned that the next obstacle is to renting secure, authenticated transactions. Insurance is covered by insurance, such as insurance, where INGO Money works with companies to cooperate with digital payment companies from checks to offload private data to verify an individual’s identity. The verification puzzle becomes even more complicated as government agencies pay everything from tax rerounds to veteran profits.

Additionally, many Americans do not establish relationships with the traditional Financial Institute or maintain standard checking accounts. Others use digital fire service paypal, cash apps and chimes as their main “bank” relationships. That lack of uniformity prevents a one-size-fits-all approach. Edwards emphasized that consumer preferences should be extended and multiple digital payment options should be expanded by the government.

However, fraud is not limited to paper. The transition to digital payment rails, particularly the promising ones, brings unique risks to faster or real-time transfers, he said. Direct deposits can be made immediately and ultimately, and if payments are made incorrectly by pretending to be fraudulent, or if an ER is made, the government can have fewer levers.

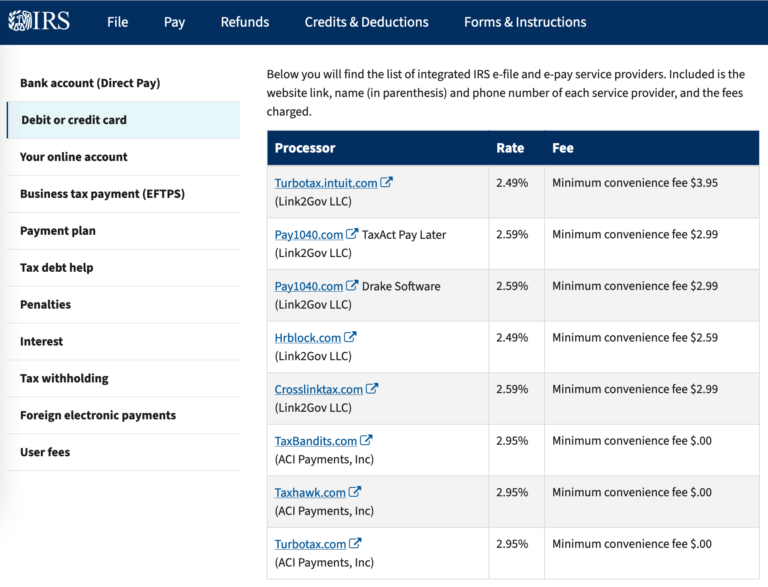

For my corporate tax deposits, I’ll make the IRS what I think is an air debit that is not charged to me. This is not the case for retail customers who use debit or credit cards.

Recent complaints about Reddit confirm that “convention fees” are not changes to Champ.

Needless to say, this will be a more moving target than Team Trump’s trends. stay tuned.

______

Executive Order text, modernisation of payments to American bank accounts. Participant readers may notice that they contain ambiguous languages that include the acceptance of encryption: “digital wallets and real-time payment systems,” and “other latest electronic payment options.”

Perhaps a “digital wallet” represents PayPal, a “real-time payment system,” and “Zelle.” But if “other latest e-payment options” means crypto, then do your best. The Treasury discovers that it is difficult to remove checks. Pray, how does it cherish all the codes?

By the authorities given to the President by the Constitution and by the laws of the United States of America, it is appointed as follows:

Section 1. the purpose. The ongoing use of federal paper-based payments, including checks and mail orders to and from the US General Fund, which may be considered a US bank account, imposes unnecessary costs. Dear; risk of fraud, loss of payment, theft, and improvisation. Postal theft complaints have increased significantly since the Covid-19 pandemic. Historically, Treasury checks are 16 times more likely to be reported as lost or stolen, stolen or altered or changed than e-fund transfers (EFTs). The main intersecting physical infrastructure and specialized technology for digitizing paper records will cost more than $657 million for prosecutors alone in 2024.

The order promotes operational efficiency by requiring the transition to electronic payments of all federal government payments and receipts by digitizing payments to digital payments under applicable law (but to establish a central bank digital currency to avoid doubt).

2 seconds. policy. It is the US policy to protect against financial fraud and inappropriate payments, increase efficiency, reduce costs, and enhance the security of federal payments.

3 seconds. Gradually paying paper checks and recipes. (a) To the extent permitted by Effective Scepter 30, 2025, and the extent permitted by law, the Secretary of the Treasury shall suspend the issuance of all federal payments, including within-government payments, benefits, vendor payments, and tax refunds, except as specified in Section 4 of this order.

(b) All enforcement departments and agencies (agents) must comply with this directive by moving to an EFT method that includes direct deposits, prepaid card accounts and other digital payment options, and take all necessary steps to register recipients for EFT payments, except as specified in Section 4 of this order.

(c) All payments to the federal government shall be processed electronically, except as posted in Section 4 of this Order, wherever federal government is practicable and for broad permission by law.

(d) The Secretary of State, Secretary of Treasury, Secretary of Health and Human Services, Secretary of Veterans Affairs, and Secretary of Homeland Security shall take appropriate measures to eliminate the need for the Department of Treasury’s Department of Physics. Costs are expenses for guessing payments for federal recipes, including fees, terminations, loans, and taxes. This electron is not specified in Section 4 of this instruction.

(e) The Secretary of the Treasury shall assist in the transition to digital payment methods, including providing access through the Treasury’s centralized payment system:

(i) Direct deposits.

(ii) debit and credit card payments.

(iii) Digital wallets and real-time payment systems. and

(iv) Modern electronic payment options.

Second 4. Exceptions and accommodation expenditures and receipts for paper gradual stages. (a) The Secretary of the Treasury will review, if necessary, procedures for granting limited exceptions that electronic payments and collection methods are ineligible, and include the following exceptions:

(i) an individual who has no access to banking services or electronic payment systems.

(ii) 31 Certain emergency payments where electronic spending causes excessive difficulty, as envisaged in CFR part 208.

(iii) National security or law enforcement-related activities in which non-EFT transactions are necessary or difficult. and

(iv) any other circumstances determined by the Treasury Secretary as reflected in regulations and other guidance;

(b) Alternative payment options shall be provided to individuals or entities subject to exceptions under this section or other applicable law.

5 seconds. Electronic transaction implementation and compliance. (a) The Secretary of the Treasury shall work with the head of the agency to develop and implement a comprehensive public awareness campaign that will inform federal payment recipients of the transition to electronic payments, including guidance on access and setup of digital payment options.

(b) The agency shall coordinate with the Ministry of Finance to promote the transition of Smos to digital payments and curb appropriate support for its impaired individuals and repetitive actions.

(c) The Secretary of the Treasury shall work with financial institutions, consumer groups and other stakeholders to address financial access to the unbanked population.

(d) The Secretary of the Treasury and the Director of the Agency will film all Black Steps through the implementation of this order and film all Black Steps to protect personally identifiable information and tax return information.

6 seconds. Reporting requirements. (a) The Director of the Agency shall submit a supplemental plan to the Director of Management and Budget within 90 days of the date of this order and within 90 days of the date detailing the strategy for eliminating paper-based transactions.

(b) The Secretary of the Treasury shall submit an enforcement report to the President within 180 days of the date of this order, and within 180 days detailing the progress of the matters stated in this order.

7 seconds. General regulations. (a) Nothing in this order is interpreted as unpopular or otherwise influencing.

(i) an authority or head of its authority granted by law to the enforcement department or agency; or

(ii) the function of the Director of the Administration and Budget Office in relation to budget, management, or legislative propositions;

(b) This order shall implement consumption under applicable law and shall be subject to availability of appropriation.

(c) This order is not intended to create, and is not substantive or procedural, any party’s right or interest to enforce in law or impartial terms to the United States, its department, agency or entity, its office, employee, or agent, or any other person.