Trump and India are trapped in staring gazes, and the Neeshah side appears ready to blink. India appears to have relied on a recognition of the geographical importance of the previous Biden administration moving forward when enduring Russian oil purchases. So India appeared to ignore domestic pressure, as Lindsay Graham had stomped on Russian energy customers with poor imitations of Godzilla, threatening “bone-shattering sanctions.”

It is possible for a Trump to blink in advance. So far, all accounts say India has not retreated.

Trump was able to announce a massive increase in tariffs beyond the promised 25% level in India, but will provide a massive amount of carvout, just like Brazil at the 50% tariff. Trump vowed to say what he’s doing in 24 hours, but again, that’s a little bit. I’m bringing the toto back to deadlines and portraying India as negotiations.

First, it’s about the state of play and what the impact will be if Trump doesn’t retreat much. You can expect to receive an exemption from Apple phones. There, US production is bound by production that has been significantly reported by China to India. But everyone is guessing beyond that.

First, from Bloomberg, India, Trump has issued a 24-hour warning to Tarif, so from the braces for pain:

Trump said Tuesday it would increase 25% tariffs on India’s exports to the US “effectively over the next 24 hours” citing Asian countries’ trade barriers and high barriers to Russian oil purchases.

To Interjet: Despite Trump’s loud noises on Indian oil buyers, he has been trying to open the market to India with a big AG. It has been rising in recent years. From the Indian Express in late 2024:

A 2021-22 Financial Inclusion Survey of Rural India, released earlier this month, found that 57% of rural households in the country’s “agriculture” semi-urban centres with a population of less than 50,000 are “agriculture.” This was significantly higher than the 48% reported in previous surveys in 2016-2017.

Simply put, proports in rural India, which rely on agriculture as a source of liveliofo, recorded a sharp increase between 2016-17 and 2021-22. Even in farming families, the roe from agriculture rose as a share of their overall income. It addresses a small proportion of income from non-farm sources (government/private employment, self-employed, wage labor, rent, deposits, investments, etc.).

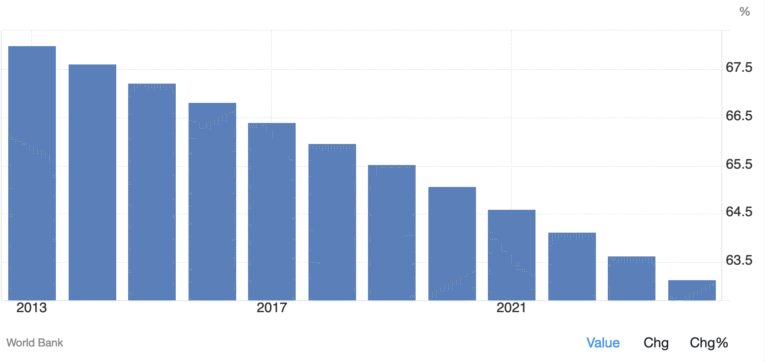

Using World Bank data (sometimes not included as 50,000), economics training shows that India is essentially rural.

Nevertheless, Bloomberg says India may throw bones at Trump by liberalizing restrictions on the dairy products market, such as cheese and condensed milk. India currently has a 60% tariff on dairy imports, excluding those using animal feed.

A Wall Street Journal report suggests there is reason why India hopes Trump will rely on him again.

Nevertheless, you refuse to retreat, suggesting that you intend to continue buying Russian oil. Politicians said Indian Prime Minister Narendra Modi calculated that Trump would determine that relations between the two countries are too critical to ultimately endangering trade spats. Many Indian experts believe Trump is spotlighting the issue to gain short-term leverage in ongoing trade negotiations with New Delhi, and believe he will be.

“This means that we are not loving the overall relationship and we don’t need to stomp,” said Sreeram Chaulia, dean of the School of International Affairs at OP Jindal Global University in Sonipat, India.

Bowomberg back:

The Indian government is currently putting the brakes on the ground for higher tariffs and is trying to limit the possibility of economic damage. Prime Minister Narendra Modi has urged Indians to buy more local merchandise to offset the sluggish global demand. The Ministry of Commercial and Industry is discussing ways to support exporters that are hit hardest, including gems, gems and textile sectors. Authorities say they will continue to ask for back-channel speeches to ease tensions…

To provide customs hikes, New Delhi officials are currently considering the export promotion plan, originally outlined in the Februry budget, which sets Rs 22.5 crore ($256 million) to support exporters. The budget amount could help businesses offset potential losses resulting from greater competition with local rivals.

The Alabama Moon points out that you have a small amount:

There are Indian products like medicines, and for this to be near monopoly and the US needs it. If it’s smart, it plays the same game China did with rare earths.

However, the tone of the business media reports is that India is not Ken about the climate. And India is not near China’s ability to quickly inflict pain on important US businesses, as China has along with rare earth and other technological products. And don’t forget that China had to retaliate before Trump helped with the download.

Today’s article in India on the impact of Indian sources does not portray the impact of Trump’s tariffs on the Indian pharmaceutical industry on the US as appropriate to provide India with a strong player. Remember that Trump’s Medicaid and Medicare cuts show that he has little concern about America’s health and medical costs. And Indian businesses are primarily generic. That is, (in the first pass) there are many brand alternatives for that export. From India today:

For a long time, the high-value US market has driven the growth of Storiesdoindian generic drug industry, where companies such as Cipla, Sun Pharma and Dr Reddy’s Institute challenged hundreds of unpaid drugs in the US and established a surge in business business there.

In 2014, India exported pharma products worth $8.7 billion (Rs 76,113 trillion) to the US.

However, the unbelievable threat of mutual tariffs of 25% from August 1st of the Donald Trump administration (now from 0 to 6.7%) has detained the Indian pharmaceutical industry…

Experts say that if tariffs from other API subsidiaries are higher than those of India, India could still be competitive even if higher tariffs on capacity materials (APIs) are capable.

Furthermore, the US will still depend on countries like India, as the cost of producing a particular drug in the US would be at least six times more converse than the one that would produce the same product in India, industry sources say.

According to Namit Joshi, chairman of Pharmexcil (Pharmaceuticals Export Promots Council), the US market, which has been heavily read in India due to APIs and low-cost generics, will have a hard time finding an alternative. “Efforts to move drug manufacturing and API production within other countries or within the United States will take at least three to five years to establish meaningful training,” he was quoted in a moderate report.

In other words, the impact of Trump’s tariffs on India that doesn’t open up medicines simply increases costs for America.

But go back and take a look at the chart from Bloomberg above for the major categories of India’s exports to the US. Pharma products are the largest single bubble, but consider large-scale products such as mobile phones, gem diamonds, cotton apparel, petroleum products, industrial machines, and more. Note that on a per Bloomberg basis, India’s first defense is to promote more purchases with Indian goods. It may absorb the sum of the capabilities dedicated to the United States for apparel and cotton. But a mobile phone? Jewel diamond? Industrial machinery?

Don’t forget that many experts warn that Trump’s tariffs are in scope

What’s already happening in a country with significant exports to the US is the deletion version of the music chair. They try to sell them to other countries, as India pointed out in its export promotion plan. We have already seen it in China in the second quarter with a surge in exports to Southiast Asia. That sub was definitely an increase in trans-sigment before the US got a better check. But it’s pure dumping. From the Bangkok Post in June:

According to Citigroup Incorporap, Vietnam, Thailand and Indonesia are among Asian countries who believe that China’s sharpest imports are generated in regional trade and trade…

Citi said floods — often cheap — chine products could list challenges in clergy countries and their local businesses. Indonesia has seen textile imports from China reach new monthly highs recently, putting pressure on the sturdy clothing sector, which has already fired thousands of workers.

It should be noted that Thailand was trying to contain China’s imports before Trump’s tariff actions. From the Bangkok Post in January:

The Joint Standing Committee on Commerce, Industry and Banking (JSCCIB) is calling on the government to take legal enforcement measures to help low-cost Chinese products affect the Thai market.

“The current measures are not strong enough to protect local manufacturers as they face flooding of these imports,” said Sanan Angubolkul, chairman of the Thai Chamber of Commerce, a member of the JSCCIB.

Remember that ASEAN collectively is China’s biggest export market, and source protectionist measures are further indications that too many goods are chasing too few customers.

It’s only ancedata, but I’ve already seen signs of deflation since there are no inflation in consumer goodness for two years. Therefore, the idea that continuing Trump’s pushing tariffs could create even more price pressure is not a problem, especially in light of the fact that China is already exporting deflation.

Again, there are many moving parts of this equation, but we see this problem.