Eve here. Trump’s approach to tariffs is still a moving goal, but this post illustrates the principles he has repeatedly violated. I’ve written about it since 2007, based on the work of economist John Kay. The core idea lies in a complex system, which is doomed to fail, and is about to cut straight or simple passes that are likely to backfire. It’s a system Baxe like the terrain, with too many mazes and reacting to interactions to map.

So, given Trump’s strong preference for offensive frontal attacks, failure is almost guaranteed.

From a 2007 post, I quoted Kay from the financial era:

From the financial era:

If you want to go in one direction, the best routes include going the other. As paradoxically, goals are more likely to hurt if they are pursued indirectly. Therefore, the most profitable companies are not the most profitable Oriente, and the happiest people are not the people whose main purpose is happiness. What is the name of this idea? diagonal….

An oblique is a feature of a complex and incompletely understood system that changes its nature when involved in BYM. FORET has all the features. Fire is the forest’s biggest enemy…

Experience shows that too much effort to focus on disappearance is counterproductive. Time indicates whether the policy was going too far in one direction or the other, but only slowly. Forest management shows an angle. Forest conservation is not best pursued directly, but is managed through a holistic approach that takes into account multiple objectives and balances them.

Notices are not the only systems configured in this way. The oblique is restructured equally in our business and our bodies, our lives and our national economy. We do not maximize the value of our shareholders, the length of our lives, or the national products of our happy nation. You will not be buried in the inscription “I have maximized the value of shareholders.” Not only is it because there is less purpose for inspiration, but there is no way for scholars to gather whether or not you have achieved your goals, even in hindsight…

ICIs are not just companies that emphasize their financial goals more. I once said that Boeing’s grip in the global civil aviation market has become the most powerful market leader in the world business. Bill Allen was CEO from 1945 to 1968. This is because the company has established a dominant position. He said that his spirit and the spirit of his colleagues is to eat, breathe and sleep in the world of aviation. “The greatest joyful life you have to offer is satisfaction that flows from participating in difficult and constructive tasks,” I explained…

It only took me ten years to prove I was wrong when Boeing claimed that the market position in civil aviation is impregnable. The decisive change in corporate culture followed the acquisition of major US rival McDonnell Douglas in 1997. This transformation was demonstrated by CEO Phil Condit. He said that he must change now for Business Week, and that the company’s previous concerns about meeting “the best technical challenges” must change. “We’re entering a value-based environment where unit costs, return on investment and shareholder profits are measures you’re going to judge. That’s a big change.”

An oblique causes a profit-seeking paradox. The most profitable companies are not the most profitable orient. …

Unhappy companies refute each other: each successful company succeeds in its own way. Business outcomes depend on doing things others can’t – and even after others have the benefits they bring to their copycats, they still find it difficult to do.

There’s more to Kay’s meat essay, but his general point isn’t difficult to grasp. Success in challenging and dynamic situations involves committing to high-level goals and committing adaptability with regard to means and questioning simple immediate movements. As we have seen, Trump does not represent anything that saves his overlazing ego and saves his pursuit of the relay of opportunity for glyft.

Natalie Chen, Dennis Novi and Diego Solorzan. Originally published on Voxeu

In 2018 and 2019, the US administration hiked tariffs on imports from China. This column shows that imports from Mexico partially fill the gap and create exports and employment in Mexico. Using highly decomposed, firm-level data on Mexican exports, combined with detailed employer and employee data, the authors found that US tariffs on China were unskilled and young employees. This effect was concentrated in manufacturing industries aimed at technology and skills such as chemicals and automobiles.

The global trade environment is being reconstructed. The most notable fracture was the US-China trade dispute. Before the latest tariffs were lightly 2025, the US had already thrust into sweeping tariffs on imports from China in 2018 and 2019. Like in 2025, China retaliated. Policymakers and businesses were left to assess the impact of these policies, which had not been spotted for decades.

Recent research has begun to assess the global impact of US tariffs 2018/19. Fajgelbaum and Khandelwal (2022) review economic costs for both the US and China. Utar et al. (2023) found that higher US tariffs on China had a positive impact on Mexican exporters involved in the global value chain. Alfaro and Chor (2023) highlight the “great reallocation” of global supply chains, including countries such as Mexico.

In this context, our new study provides fresh evidence of how Mexico benefits through trade fun, and what means change for Mexican workers (Chen et al. 2025). We record how Mexico’s exports to the United States rose in response to US tariffs on China. Our data will become individual track kers over time. There is a positive labour market impact for Mexican workers, especially among traditionally disadvantaged groups.

Does protectionism help bystanders?

Protectionist trade policies are usually thought to benefit producers of protected countries at the expense of consumers and global efficiency. However, when a large economy like the US imposes tariffs on key trading partners, the result is that the reallocation of global trade creates opportunities for third exporters. This is known as the joy of trade.

Trade theory dates back to Vanner (1950) and points out that the classification of preferred trade and changes in the tariff could change trade. In our context, tariffs on China on the US made Chinese products more expensive and created an incentive for US importers to switch to other suppliers, such as Mexico.

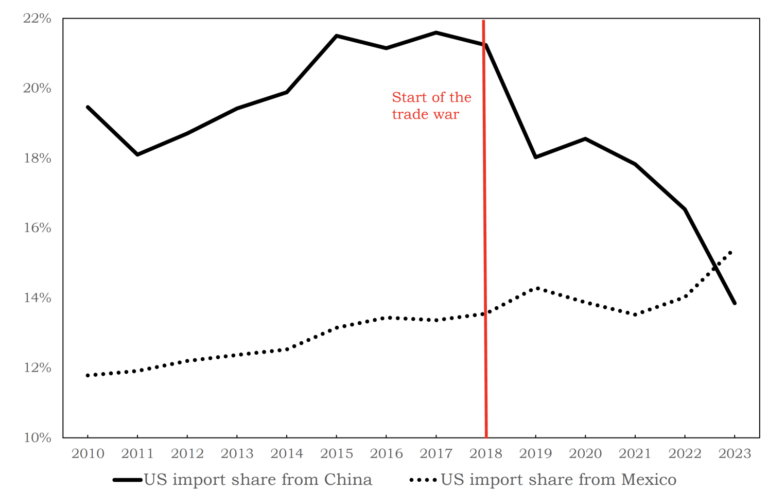

Figure 1 shows an impressive pattern based on aggregated data. Following the imposition of tariffs in 2018/19, import share from Mexico Rose as import share from the US is import share from China. This suggests that Mexico was able to fill some of the gap left by China’s decline in exports to the US.

Figure 1 (%) (%) of US goods imports from China and Mexico in total imports of US goods between 2010 and 2023 (%)

Note: The diagram shows imports of goods from Mexico and China as total US imports from 2010 to 2023.

Source: International Monetary Fund’s trade statistics instructions.

The setting of the Mexican economy is particularly suited to our purposes as there is a strong reason to believe that Mexico’s exports to the United States have increased in response to the higher US tariffs on China. First, the US costs of diverting imports from China to Mexico are relatively low due to the competitive labor costs and geographical proximity of Mexico. Second, Mexican Naphtha membership (replaced with the USMCA in 2020) makes it easier for the US to import more goods directly from Mexico than other countries. Third, Mexico and China are responsible for the US market in similar product categories (Utar and Torres 2013).

Evidence from corporate-level trade data

Use highly decomposed Mexican company-level export data at the 8-digit product level to investigate the trade fun hypothesis. These data are customs import duties to link to US changes and acquire China’s trade war magazine. This examines how Mexico responded to exports to the US.

US tariffs on Chinese goods estimate that Mexican exports increased by 4.2% at 25 percantate points. This increase occurred through the higher export volumes of Big (central margins) and more products exported (a wide margins).

From Trade to the World: Labor Market Results

Fun deals and you have important meaning to the world. Combine corporate-level export data with detailed Mexican employer and employee data to enforce labor market impacts. This allows you to track changes in employment and wages in workers, as well as long-term corporate-level changes.

It is estimated that Mexican corporate-level exports to the US, driven by higher US tariffs on China, have increased by 1%. Surprisingly, the profits from these wages were not evenly distributed. Increases in wages are concentrated among women, unskilled, young and inhumanly insured workers, and are generally paid lower than those of skilled, older people. For example, we see that women experienced an increase in wages, the magnitude of male increases.

This is an important outcome. Our findings suggest that the enjoyment of trade in this environment has made an equalism effort with companies. In other words, the aggressive export shock benefited lower wage workers than higher wage workers, reducing wage inequalities within the enterprise.

The effect of labor force composition

We run the springon at the corporate level. Trade enjoyment has a positive impact on employment and negatively affects average wages. Specifically, US-level exports increased by 1% due to increased US tariffs on China, resulting in an increase of 0.146% in employment and an average wage fell by 0.197%. These effects were concentrated in manufacturing industries with technology and skills such as “chemicals, rubber, plastics” and “machines and automobiles.”

We argue that the increase in employment is consistent with an increase in companies to meet the incidence of export demand caused by increased US tariffs. A decline in average wages is a compositional effect. An incredible company, we dispatched and hired low-wage workers, including women, unskilled, young and inhuman insured workers.

Impact on policy

Our results have important implications. First, the turbulence of third countries following the major trade policy changes in 2018/19 was realistic and quantitatively significant. As the US and China were two major economies registered in trade disputes, impacts ripple around the world, creating both disruption and opportunity.

Second, Mexican labor market benefits have been biased towards traditionally disadvantaged groups. This shows the impact of trade enjoyment that reduces inequality with businesses.

Finally, with regard to the latest trade dispute that began in 2025, we should also expect the bloody effects of trade and employment in third countries. However, this time, the US administration targets more countries and more industries with more uncertainty. The ultimate impact can be more complicated.

Author’s Note: The results of this study do not require the attitude of the office in Banco de Mexico, Mexico.

See original bibliographic submission