Eve here. In all emotional comparisons, automakers and their suppliers are still US employers. Western automakers eat lunch in Chinese EVs and allow buyers who don’t buy EVs for a variety of reasons. Even China is struggling with the catastrophic EV competition that the government is trying to deal with. So the industry as a whole is poor economic health, and Trump’s tariffs are another bang.

This article describes Soms in adaptation attempts.

According to Metal Miner, there are media sites related to Largenst Metals in the US, according to third-party ranking sites. Cross posted by oil price

US automakers are facing increased tariffs on imports such as steel and aluminum, as well as increased metal costs and potential shortages due to geopolitical disruptions belonging to key EV minerals. A 50% tariff on various metal imports can induce production costs for vehicles, affect the margins of car manufacturers, and increase consumer car prices. Automakers are mitigating risk by securing long-term fixed-price contracts for metals and attacking supplier diversification, regional sourcing, parts redesign and direct transactions with battery mineral mining companies.

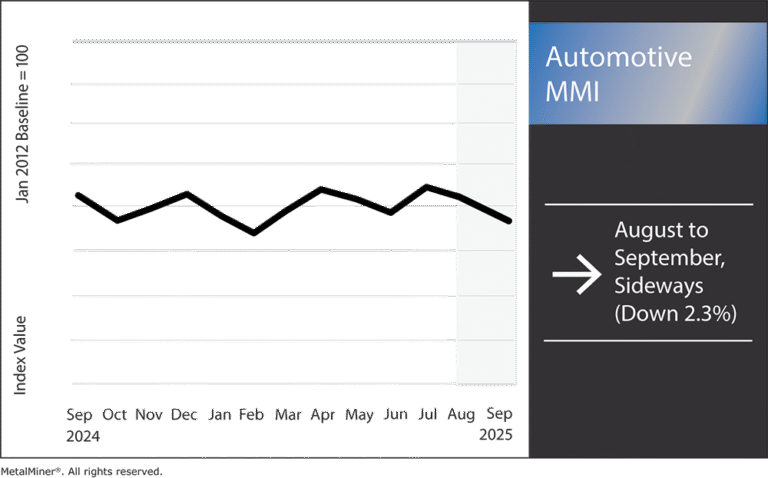

Automotive MMI (Monthly Metal Index) moved sideways, dropping just 2.3%. This is facing manufacturers in particular, especially manufacturers, facing one punch of rising costs and potential shortages in the metal supply chain. The main reason for this is the sudden tariffs on steel, aluminum and other inputs that are driving the costs of raw materials.

How are tariffs rising in the US auto market?

The US government has expanded its wide range of imported metal duties (initially 25%), including automotive steel and aluminum, to a wide range of 50%. These obligations serve as taxes for all cars built essentially of materials. Automotive Dive reports that a 25% steel fee alone will cost $1,500 for a typical vehicle, and double the tariffs will increase the burden. The industry as a whole means substantial additional spending that could directly threaten the margins of carmakers and ultimately boost consumers’ car prices.

Insights from Metal Minors in September 2025

Even companies that rely primarily on the US-supplied steel Allen’s Supreard, as domestic producers are increasing prices in parallel with the rise in tariff-fueled markets. In effect, automakers will encounter rising costs even when purchasing “Made in America” steel.

This leaves businesses with two options. It is to absorb the additional costs or hand them over to the buyer through a higher vehicle price. MetalMiner’s weekly newsletter offers free price updates on tariffs and pass ID-ID-Aong-Consumers-to-Consumers costs to help manufacturers manufacture aggressive purchasing decisions, rather than addressing the volatility within that newsletter.

What about important minerals?

It’s not just the problems facing the US automotive market. Important EV minerals such as lithium and rare earth elements carry their own supply risks. In early 2025, China stopped exporting certain rare earth metals needed for EV motors, prompting serious problems. According to Automotive Logistics, the move highlights the geopolitical shock of the automotive supply chain. Additionally, Chinese manages around 90% of the world’s rare earth refined tranati, which leads to car manufacturers facing serious shortages.

Related: China’s surge will slow global EV sales growth

Amid these changes, companies across the US automotive market are competing to ensure a more reliable source of information for the first minerals. For example, EV Maker Lucid Group recently began collaborating with several US mining and refineries aimed at increasing domestic production of battery metals and reducing reliance on overseas suppliers. Members of the Union are pursuing new mines and processing facilities to build the American battery material supply chain.

How do automakers respond to these risks?

So far, automakers have adopted several strategies to survive the storm. One approach is to lock long TRM contracts for major metals at a fixed price. This acts as a buffer adjustable cost spike. For example, General Motors has already signed two

Manufacturers are also diversifying their suppliers and increasing local sourcing. A network of subfarms is researching with parts, using less imported metals and recycling that helps to regain more scrap. As mentioned before, few automakers have made direct business with lithium and other battery mineral mining companies. Another strategy is to leverage better market intelligence. For example, procurement teams use specialized resources such as MetalMiner Select to track price trends, transaction actions and forecasts in real time.

What is your outlook for 2026? And how can procurement leaders navigate?

Sub-analysts predict that metal prices could stabilize or fall as the initial tariff shocks will be absorbed and bring life to buyers. However, volatility could be eliminated as EV demand is still increasing.

Success in this environment requires a proactive strategy. For example, large companies can use forecasts and benchmarks to guide their ES purchase plans. This provides additional protection. It is important to pay attention to policy shifts as trade rules may change in a short period of time. Internally, it is important to emphasize that boarding leaders in the US automotive market may come with upfront costs by building a more resilient supply line through dual sourcing or additional inventory, but ultimately it can prevent business disruption.

US companies procuring metals in 2025 are involved in the link between trade policy and the clean energy transition, presenting challenging scenarios. However, solid market intelligence, diversified sourcing and strategic partnerships can help procurement leaders lessen the disruption.