Propublica is a nonprofit newsroom that investigates power abuse. Sign up for Dispatches. This is a newsletter that spotlights misconduct across the country, and receives your stories in your inbox every week.

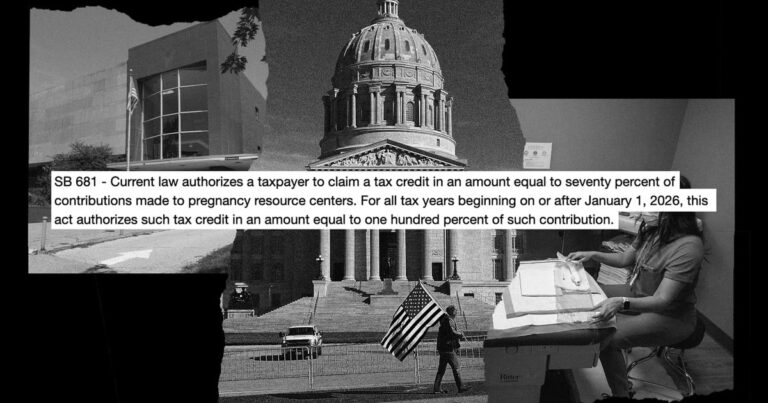

Missouri Republican lawmakers are moving forward with plans to allow residents to donate to the Pregnancy Resource Center in lieu of paying state income taxes in an unprecedented move to focus more public taxes on groups that oppose abortion.

The proposal establishes a 70% to 100% tax credit and sets a $50,000 annual cap for each taxpayer. The outcome: All Missouri households except those with the highest income can fully meet the state tax bill by redirecting payments from the state to pregnancy centers.

The move comes as the clinic began implementing the procedure again after overcoming abortion obstacles in the country four months after Missouri voters overturned one of the country’s toughest abortion bans.

Supporters of the bill, which cleared an important legislative hurdle at the Capitol last month, say taxpayers have more control over where taxes go, allowing them to support pregnant women and organisations that provide alternatives to abortions. Alissa Gross, CEO of Resource Health Services, which operates four pregnancy resource centers in the Kansas City area, told the committee in written testimony that the tax credits could lead to a surge in donations to her organization, and a 100% tax credit could bring more.

“The ability to influence more men and women in their lives and build healthy families was substantial,” she said.

Critics argue that state support for pregnancy resource centers, also known as crisis pregnancy centers, divert tax revenues from key services such as health care and public education, and provide funding for anti-abortion advocacy. They say that many centers do little to actually help women. Instead, they say it simply discourages women from having an abortion.

What we see

During Donald Trump’s second presidency, Propovica will focus on areas that need scrutiny. Below are some of the issues reporters watch, and how to safely communicate with them.

We are doing something new. Helpful?

“The 70% tax credit without caps was an overkill. Katie Bailey, a Kansas City area-based lawyer and reproductive advocate, wrote in testimony submitted to the committee. “It’s a shame for Missourians that our lawmakers are spending time even considering this bill.”

Tax policy and philanthropy experts said that tax credits for dollars for dollars are rare and can be much more expensive than intended, especially if pregnancy centers are actively promoting it.

According to experts, there is a huge psychological difference between a 100% tax credit and a 70% credit. At 70%, donors still have to pay taxes, but at 100% there is no reason to make a donation less than their tax liability.

“We could imagine the big promotional campaigns by these centres, or viral campaigns, and the possibility that a huge number of conservative Missouri people would decide to effectively give back to these pregnancy resource centers.”

But the expanding tax credits clashes with another Republican push to eliminate Missouri’s income tax altogether. It was unclear whether the two proposals to replace the higher sales tax recently advanced in the state Senate. If Missouri abolishes state income tax, the tax credits are pointless.

The bill represents another expansion of the measure Missouri lawmakers have grown for several years. Until 2021, Missouri taxpayers who donated to the Pregnancy Resource Center were able to request a 50% tax credit on their contributions. That is, for every $1,000 donation, taxpayer bills fell by $500. That’s when the expansion approved by Congress in 2019 took effect and increased the rate to 70%. Tax credits work by directly reducing the amount taxpayers owed to the state, thus increasing the cost of contributing to the state. Unlike deductions that reduce taxable income, tax credits are a reduction in dollars in tax liability. When these credits are redeemed, they prevent the state from collecting its revenue and effectively reduce the total revenue available to public services.

Congress also removed the program’s $3.5 million annual limit and expiration dates.

At the time, this change was Roev. It attracted little attention as it was pushed into the same law that created the Missouri Trigger Act to ban abortions if Wade was overturned. And there were few warnings about how much it would cost.

The bill’s official costs estimates were prepared by nonpartisan legislative oversight staff, but only predicted a small increase in taxpayer costs. It was expected that increasing the tax credit to 70% would increase the annual tax credit from $3.5 million to $4.9 million. That estimate assumes that the donation remains stable.

But they didn’t. The program has increased significantly, allowing a tax credit of $11.8 million over the past year alone. Still, that’s just a small part of Missouri’s overall budget. Gov. Mike Kehoe has proposed a $54 billion spending plan for next year.

Again, legislative research downplays the potential impact on Missouri’s budget. The bill’s fiscal notes only explain the jump from 70% to 100% tax credits, without considering the surge in donations that such incentives could trigger.

The memo says it is “unknown” whether the enhanced tax credits will encourage more people to contribute and claim credit.

Legislative research staff who created the Impact Statement declined to comment, and House sponsor of the bill, Rep. Christopher Warwick, did not answer questions from Propublica.

Warwick, a Republican from Bolivar in southwestern Missouri, told the Tax Reform Committee that his proposal allowed taxpayers to support important tasks “trying to verify which programs are working.” He also said he would oppose the requirement for pregnancy resource centres to report how to spend money.

Warwick’s bill will increase tax credits for donations to maternity housing from 70% to 100%, and diaper bank tax credits from 50% to 100%. The state has not yet studied the impact of these changes.

A consensus bill has been introduced in the Senate, but it has not yet progressed.

Rep. Steve Butz, a Democrat from St. Louis, argued that tax credits would effectively shift charitable contributions from individuals to the state.

“This will be the fourth bill I’ve heard. I think the revenues here are clearly your goals: to reduce income to the state,” Butz told Warwick during a legislative hearing on the bill. He argued that if the donor received a full tax credit on the contribution, they weren’t actually giving their money. “So I don’t know I’m thinking of giving up on charity that much.”

In an interview, Butz said that he thought he had a life of life and donated to the Pregnancy Resource Center and received a 70% tax credit. However, he said he does not believe that the program should not prioritize its tax incentives to grant to others who do not receive less or none.

Missouri’s approach to crisis pregnancy centers reflects the growing disparity between red and blue conditions. Republican-led states such as Florida, Texas and Tennessee are increasing funding for pregnancy resource centers, while Democrat-led states, including Massachusetts and California, are warning residents that they will mislead patients by misleading patients while avoiding medical clinics while moving away from abortion.

Missouri is one of the national leaders of per capita spending on pregnancy resource centers, even before tax credits are considered. Kehoe proposes to increase direct state funding by nearly 50% for the fiscal year beginning July 1st to more than $12 million.

In a statement, Gabby Picard, communications director at Kehoe’s Office, said the governor “is why his budget recommends increased funding for alternatives to abortion, including pregnancy resource centres, as he works to support services that help women choose to carry their fetus in terms.”

Missouri was the first state to use tax credits to fund pregnancy centers, and became the model for other states seeking to support the anti-abortion movement. One public health expert who tracked the impact of pregnancy centers said Missouri is the leader and innovator in the effort. “We’ve seen a lot of experience in the world,” said Andrea Swartzendruber, an associate professor of epidemiology and biostatistics at the University of Georgia.

Warwick’s initiative follows a radical change in Missouri’s abortion laws.

In November, voters approved constitutional amendments that guarantee abortion rights and other reproductive health decisions, with the US Supreme Court Roev. It effectively overturned the near-match ban, which had been in place since 2022, overturning Wade.

Texas banned abortions. The sepsis rate then skyrocketed.

The first abortion under the new amendment took place in Kansas City on February 15th.

In response, Republican lawmakers introduced a wave of bills aimed at limiting the impact of the amendment. Among the measures is another proposed constitutional amendment that restricts abortion and prohibits gender-affirming care for minors. This is an effort to combine what voters support with turning off abortion rights supporters.

Some supporters of Congress’s abortion rights are looking at the expanded tax credits as part of a wider push by anti-abortion lawmakers who were stabbed by the abolition of the abortion ban. After the amendment was passed, those lawmakers “needed some wins,” said Rep. Kemp Strickler, a Democrat from the suburbs of Kansas City.

“But even if the fixes were lost, they would probably have moved forward with these kinds of things,” Strickler said.