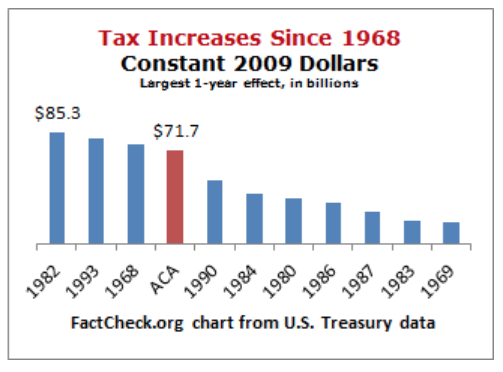

The recently announced car rates are expected to snatch up $100 billion in revenue per year. How does that compare to other major tax increases?

According to the Tax Foundation, previous records were $76.8 billion in the 2011 tax hike for funding for ACA (Obamacare).

In reality, car fares aren’t as long as the previous tax increases, but they are one of the biggest tax increases since 1968.

With tariffs coming soon, the ultimate Trump administration tariff program could be the biggest tax increase, even on actual terms. So, what do Democrats think about this policy, one of the most important changes in federal tax policy in my life?

I checked with the New York Times and as usual they had a very long art. I was particularly hampered by learning what Democrats thought about policy. This article presented views on many major politicians, but none of them were Democrats. Certainly, none of them were Republicans except Trump.

While you may think there is a liberal bias in the NYT, when Obama’s tax cuts were proposed, it is certainly true that the “recorded newspaper” provided at least a submission of Republican law views. Will Democrats plan car fares next time they take office? Do Republican lawmakers have an opinion on this issue? Shouldn’t we know about that subject?

It is certainly interesting to read that Trump’s tariffs are being opposed by leaders in Canada, Mexico and France, but given that taxes today are being paid by Americans, I wish they would abandon us what American politicians were thinking about this idea.

Here’s an overview of AI:

The US Constitution grants Congress the power to “collect and collect taxes, obligations, suspensions, and excisions” (Article I, Section 8, including tariffs), and to regulate commercial transactions with foreign countries. However, the President also has the power to impose tariffs under certain conditions, such as national security threats and unfair trade practices, particularly through delegated powers.

I have a hard time understanding the legal basis for the first tariff. It’s hard to believe Canada is a national security threat. The free trademark with Canada was negotiated by President Trump in 2020. Like last fall, he has replaced his best trade deal ever. Therefore, “unfair trade practices” do not seem to apply either.

In the past, the Supreme Court saw the view that the government could make quite a number of wishes. Thus, the “Takess clause” states that prominent areas only apply to projects with “public use,” but the court has found that public purposes are almost everything the government says is. Perhaps that reasoning applies here too.

The administration has denied that bombing attacks on Yemen are “war”, but still argues that “war power” can be used to deport Venezuelans. Therefore, war is also one of the things that must be defined rather loosely, and SEM is not bombing, but migration.

The bottom line is that the Constitution should not be expected to be an effective limit to the powers of the US government.

Poetry There will also be a massive tax cut that will be enacted later this year.