Many people who discuss the WHO are actually paying for Tarif. Even many economists, including co-blogger Pierre Lemiux, are. But it’s important to see what people implicitly assume when making that claim.

Here’s what I wrote in the Defense Idea for December 19, 2024, “Taxes hurt Canadians and America alike.”

Many people, like me, who are critical of tariffs, claim that US consumers are owing the full cost of tariffs. For example, Rachel Lane of CBS News, who wrote in August 2019, said, “The fact is that companies here pay duties on US customs and border security when Chinese goods reach the US coast.” He says that. It is true that America writes checks. But one of the first things economists teach undergraduates about taxes is that knowing who writes a check doesn’t know exactly who is responsible for the tax. It is the relative elasticity of supply and demand that determines the division of the burden on producers (exports) and consumers (importers).

There are two extreme situations in which importers are responsible for the entire tax burden.

The first is when importers have an inflexible demand for profits that will be subject to customs duties. In such cases, the price of the customs duties will increase depending on the full amount of the customs duties. What it requires means that the amount of bougout will not change at all. (Show it on a graph of the vertical demand curve.) No one knows who believes that will happen. Even if you only order -0.1 or -0.2, there is always elasticity to the subject of demand.

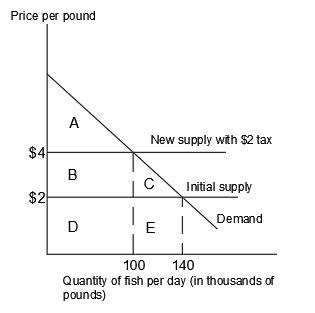

The second case of IRARS over the overall burden is when supply is infinitely resilient. In that case, the customs duties price will increase depending on the full amount of customs duties. (On graphs with horizontal supply curves, the case is shown in the accompanying graph.) This is more plausible than the Crapru case. If good hard exporters see a good alternative to oilizing their products, it will happen or approach it will happen.

This is an interesting tension.

If you pay a lot of attention to what’s going on in Canada, as I have, you know that many Canadians are mad at Donald Trump’s threatened tariffs. Masu. But Canadians should not be upset at all if the importers are owed all the burden. If the demand curve of exports is inelastic, even if the tariff rate is 25%, you will earn the same amount as selling exactly the same number of exports, as if the tariff rate is the same as today , is usually well below 25%.

In Oher’s hands, if the supply curve is completely elastic, Canadian exporters will not export like the US, but will sell the same number of items in the same price network of take earned before customs duties. Masu. . They may sell them to people in other countries and to Canadians, but their sales and online revival will not be affected.

My reasoning above means that Ais-Canadians are upset that nothing is possible, or that the 25% tariff burden will be split between Canadians and the US. My tendency is to believe in the latter.

As I wrote in the previous article, I believe it is not a uniform division, especially Americans, which burden most of the burden. However, as I pointed out in that article, even if the US is responsible for 80% of the burden, the big difference between the population of Canada and the US is that the burden per capita and the burden per household is that It means much higher.

Here’s what I wrote in that article:

The $95 billion loss to U.S. consumers has been stimulating for around 340 million people with a loss of $279 per person. That’s not that much, but the average household (with 2.5 people) costs $699.

The $23.75 billion loss to Canada has brought about around 41 million Canadians.