Eve here. Angry Bear’s post is Calle a Calle a Recession Watch, but your post is really upgrading it to Stagflation Watch. That’s because Trump’s tariff effects, set to continue inflation and start kicking on the next few mounts, are not the case, at least until the economy is in many weeks, as bailouts are unlikely. Additionally, keep in mind that you’re seeing this slide fall into activity. The federal government continues to engage in “net spending” to carry out the long deficit that should strengthen its activities.

New Deal Democrat. Originally published on Angry Bear

“Recession Clock” American Economic Research Institute, as economically weighted ISM indexes show presentations

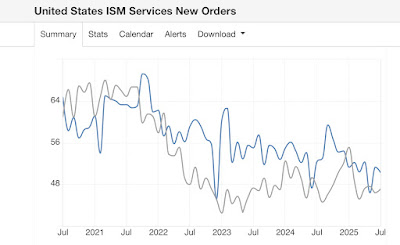

Two months ago, in response to a new order component of economically weighted ISM manufacturing and indexing services, I hoisted the yellow flag “recession clock.” That continues last month.

This month we also added economically weighted headline numbers to the contraction. With other negative readings from the economy’s commodity production sector, the yellow flag is now moving towards the economy-wide red flag “recession clock.”

Let’s start with this morning’s important report.

According to ISM, the services sector of the US economy grew at the lowest possible increase in July, at just 0.1 with a 50.1 balance point. The main new ordering components also grew slightly at 50.3.

In summary, because production has been much more accurate since 2000.

Starting with a new order, the last two months are now 51.3 and 46.4, and the 3 month Avage is 49.3. As reported yesterday, the three-month average of new order production was 47.0. This is like a voice [Note: all graphs from TradingEconomics.com. Blue is services, gray is manufacturing]:

The economically weighted avenge for the three months of new orders is 48.8, indicating contraction just like the past two months.

The difference this month is that contractions are also widening in number of headlines. The services division’s past two months were 50.8 and 49.9, an average of 49.1 over the three months. The three-month average for the Yesteday manufacturing industry was 48.5. This graph is as follows:

As a result, the economically weighted three-month average of heading indexes is 49.1. This has made all of the indexes *current *contraction, not just leads.

It is also worth noting that before I could draw a conclusion, it happened at the price paid to the komphont. Prices were 2.5 years high, similar to the 3 month revenge, at 69.9. As shown in the graph below, components paid by the manufacturing index price also hit a three-year high, but fell back in July.

In short, the combined index of ISM manufacturing and services means that they accelerate inflation, manufacturing shrinkage, and water-stroking services. Or, in other words, stagflation.

Two months ago, I concluded in a statement: “In the meantime, see if the short main indicator you want to delete falls into place.

As I have said in the last two months, I treat my hair “surveillance” and “warnings” like weather. “Clock” means the situation is correct, and the economy is at a significant risk of recession over the coming months. “Warning” means a recession is likely and almost imminent. The “recession clock” of the US economy is now justified. The only reason why it doesn’t upgrade to “Warning” is already the graph below.

With rare exceptions, stocks peak and are rejected before the recession begins, but initial unemployment claims rise more than 10% ahead. In addition to the above, I think we need another month of data to see if the recent recession in actual consumer spending is a frontline recovery of previous tariffs, or if it is a trend for durable tires.

But to repeat, consider this to start a “recession clock” across the US economy.