Does Stablecoins present a critical issue with monetary policy? I came up with this discussion in a recent conversation with Tyler:

Dixon: I think you are issuing the probability of every bank. All of these have users and customers. Banks need a button that says “Send Stablecoin.” What I want is that, around this creating a network effect, there’s something like that at your point, but it’s going to be alienated.

Cowen: Should the Federal Reserve lose control of money supply in that world? Create a Stablecoin. It is supported by the T-Building. Interestingly, it’s like operating a private open market. I’m fine with that. I don’t know if the Fed is managing money supply today. Is that scholarship a macro issue?

Dixon: I feel like I’m talking to a famous economist. [laughs] I’m in your territory now. I’m not an economist so it’s dangerous.

Cowen: Well, I didn’t understand this Myelf Everyher. I’m really asking the people of Valians. I asked Austan Goulsbee the same question I don’t know about.

In a recent post, Tyler said:

AI is your smartest reader. It is your most sympathetic reader.

So why are there “various people” here? Why not ask AI? The answer is that “the smartest” can be defined in many ways, and while top AI is the smartest in many rents, it is not the smartest in the most challenging fields. I asked ChatGpt about this issue and the answer is much lower than what I’m trying to provide. (I’m a bit of a prank here. Tyler says that AIS is smarter than me in the majority of questions, but not in an area where I have expertise.)

So my answer is: Stablecoins present no issues with monetary policy. The Fed still manages financial bases, and they have almost unlimited ability to coordinate the bow and a demand for basic funds. This means that you will be responding to the creation of the necessary alternatives to prevent the impact on macroeconomic objectives such as employment and price levels.

The Fed can directly manage the supply of basic funds through open market operations, namely through the purchase and sale of the Ministry of Finance. It is all the power needed to completely offset the impact that a stable coin has on the demand for basic funds. But they also have an additional powerful tool that will affect the demand for money, namely interest in bank reserves. With these two policy tools, the Fed has the technical ability to move price levels to their preferred positions. Of course, political considerations assume that Fed engineering moves extremely up and down at CPI, but that doesn’t matter if the Fed is trying to stabilize price levels in the face of a steady increase in use.

By the way, the subject of my view on monetary policy is controversial and not by some experts. I don’t think my view on this issue is at all controversial, unless the basic money demand falls to zero. This SEM is particularly unlikely removed, especially since stubcoins need to be backed up by government subformal amounts, and at least the submers continue to circulate.

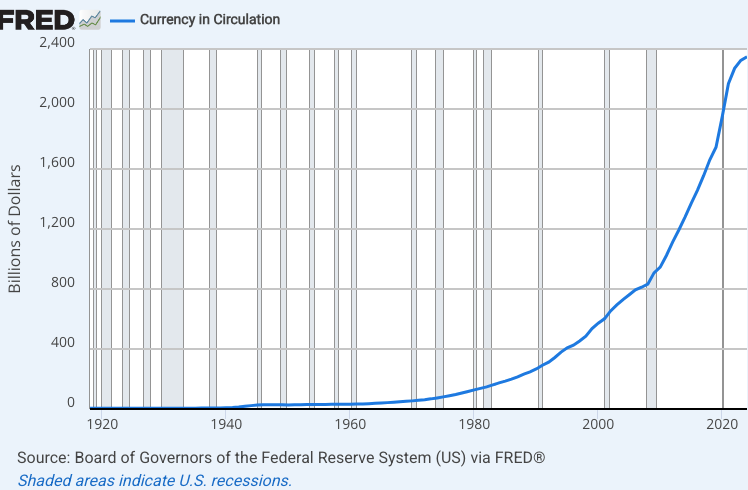

Poetry: Contrary to popular opinion, the demand for currency has not diminished as it moved to a “cashless economy.” Even with GDP shares, currency demand is higher today than it was 100 years ago when people used cash they purchased and purchased on a daily basis. This is because increased government regulations (i.e., war on drugs) and higher taxes sparked demand for currency as anonymous storage stores of value rose much more rapidly than the demand for currency was determined.

In maritalism, the recent slower growth in currency demand may be partly due to steady state, but it is likely that much higher nominal interest rates since 2022 have increased the opportunity cost of holding zero interest currency as a valuable reservoir.