(Bloomberg) — The ferocious rally in U.S. stocks this year is poised for the last time in 2024, even as the U.S. presidential election looms as a major wildcard, according to the latest research from Bloomberg Markets Live Pulse. It is expected that the period will be extended.

Most Read Articles on Bloomberg

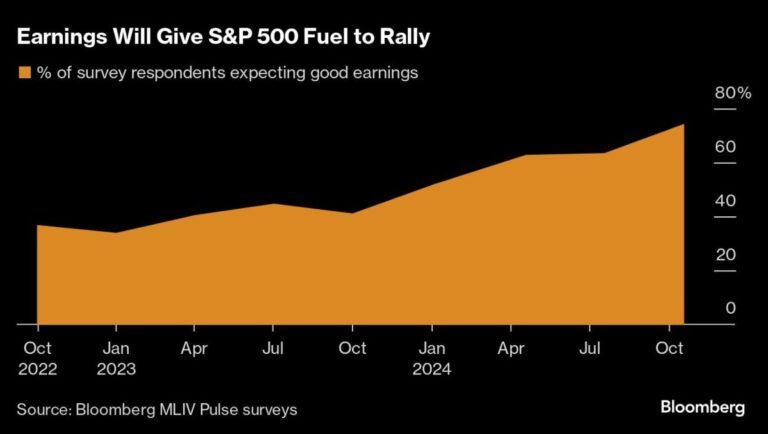

The S&P 500 is expected to approach 6,000 by the end of the year, based on median estimates from 411 survey participants. This is a record milestone of 2.3% above Friday’s closing price. Three-quarters of respondents expect this earnings season to push benchmarks higher, with the strength of Corporate America’s earnings more likely to weigh on stocks than who wins the November vote or the Fed’s policy direction. seen as more important to market performance.

U.S. stocks face a major earnings hurdle this week, with about 20% of S&P 500 companies scheduled to report earnings, including heavyweights Tesla and IBM. Approximately 70 companies have already announced their financial results, with 76% of them reporting higher-than-expected earnings. , according to data from Bloomberg Intelligence.

Following Tesla, other members of the so-called Magnificent Seven will begin reporting later this month. These technology giants, Apple Inc., Microsoft Inc., Alphabet Inc., Amazon.com Inc., Nvidia Inc. and Meta Platforms Inc., have been bearing the brunt of the stock price rally since last year. However, it fell short of the previous quarter as the Federal Reserve cut interest rates for the first time since 2020 to support sectors such as financials and utilities.

Survey respondents expect tech giants to take the lead again. The Magnificent Seven started October down 0.9%, but a combined 75% expect the Magnificent Seven to outperform or match the rest of the market this quarter. are. One reason investors remain bullish is that most of the S&P 500’s earnings growth still comes from the Magnificent Seven.

“After a lackluster quarter, Magnificent Seven’s comeback is an attractive deal to watch right now,” said Anastasia Amoroso, chief investment strategist at iCapital.

The median survey respondent expects the S&P 500 to end the year at 5,977, up from Friday’s close of about 5,865. This extends the index’s 23% rise through 2024 and marks 47 record closing highs, including twice last week.

The S&P 500’s historical median return from mid-October to December 31 has been about 5%, according to data from Goldman Sachs Group Inc.’s trading desk dating back to 1928. In election years, it’s even higher, at around 7%.

story continues

Profit first

With the race between Vice President Kamala Harris and former President Donald Trump close, with polls showing the two candidates nearly evenly matched, survey participants expressed optimism for U.S. stocks. It shows.

Recently, there has been talk of a resurgence in trading that is expected to benefit from Republican candidate Trump’s victory, such as Bitcoin and Trump Media and Technology Group stocks. The largest majority (45%) said this. While 39% said the strength of earnings was most important to their stock portfolio, 39% said the election result and 16% said the amount of Fed stimulus.

Brian Spinelli, co-chief investment officer at wealth advisory firm Hulbert Hargrove, said: “We know elections bring a lot of emotion depending on whether your candidate wins or not, but it’s important to incorporate that into your portfolio.” I hope not.”

One of the events that will be closely watched by tech stock watchers is Nvidia’s earnings results in November. The company’s last report sent its stock price down in the days that followed. This time, the largest group of survey respondents, 45%, think the result will boost stock prices. Nvidia is a symbol of the AI technology boom, with its stock nearly tripling this year.

While poll participants are showing a lot of enthusiasm for tech, there’s another sector they expect to lead the S&P 500 this quarter: finance.

Read more Banks post strong earnings, pushing stock prices beyond 2023 levels

The results are working well so far. The sector is up 5% in October, the biggest gainer among the 11 stocks in the S&P 500 index, helped by strong returns from Wall Street. When the Fed lowers interest rates, bank stocks tend to rise because they encourage borrowing and other economic activity.

The MLIV Pulse survey was conducted October 14-18 among Bloomberg News terminals and online readers around the world who chose to participate, including portfolio managers, economists, and individual investors. This week we ask how the US election will affect your wallet. Please share your opinion here.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP