Three homebuyers who are also military veterans claim that their mortgage company’s referral program led to them getting higher-priced loans.

Lawsuits are piling up.

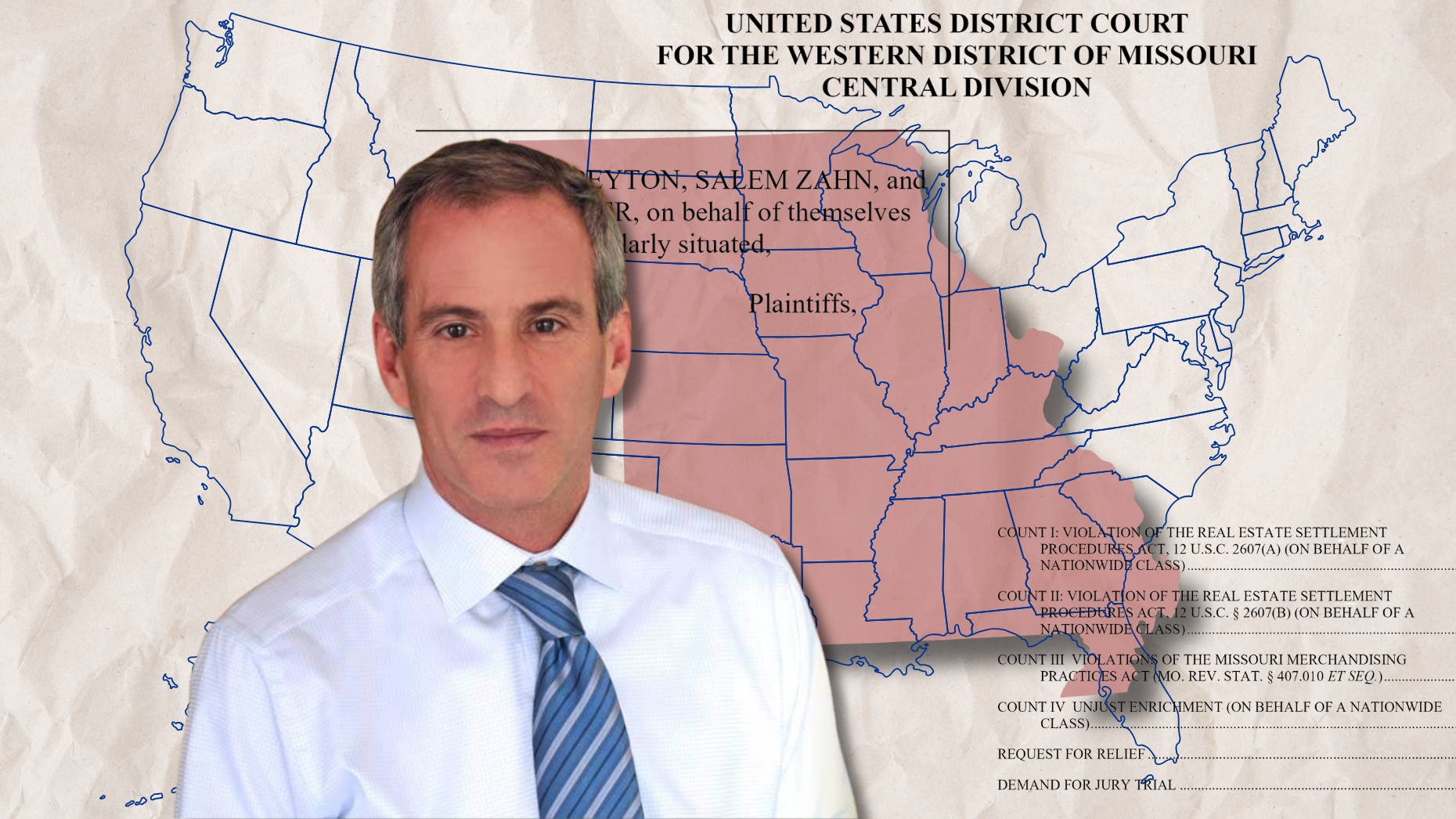

The law firm leading a series of lawsuits targeting the real estate industry filed a new lawsuit Wednesday accusing three Missouri mortgage companies of violating the Real Estate Settlement Procedures Act (RESPA) through schemes targeting veterans and military buyers.

Participate in the INMAN Intel Index Survey

The complaint was filed in the U.S. District Court for Western Missouri. This is the same court that oversaw the landmark Sitzer | The Barnett trial resulted in a $5.3 billion judgment against a major real estate company.

The new lawsuit alleges that the defendant mortgage companies falsely advertised themselves as if they were part of the U.S. Department of Veterans Affairs and that buyers were required to use their services to purchase a home.

The lawsuit was filed by three homebuyers who are military veterans from Tennessee, Texas, and Pennsylvania. They named it Veterans United Home Loan. Realty Search Solutions, also known as Veterans United Realty. and Mortgage Loan Research Center were named defendants.

“Our lawsuit against Veterans United has a dual meaning,” Steve W. Berman, managing partner and co-founder of Hagens Berman, said in a statement. Hagens Berman is a Seattle-based law firm representing the plaintiffs in the case. It also filed a lawsuit against the Mail Commission.

“First, we believe that Veterans United engaged in blatantly illegal conduct that harmed homebuyers through predatory lending practices,” Berman said in a statement. “Second, Veterans United sought to mislead our nation’s service members by pretending to be affiliated with the U.S. Department of Veterans Affairs.”

I worked on Sitzer | Boulware Law. He also represented the plaintiff in the Barnett case.

In a statement to Inman, Veterans United Home Loan said, “For 24 years, we have been dedicated to serving veterans and military families with love, compassion and respect.”

The company added, “We are aware that a lawsuit has been filed.” “We deny the accusations and look forward to disputing them through the legal process. As this matter is pending, we cannot comment further.”

The new lawsuit ultimately alleges that Veterans United has a network of “preferred” agents across the country who receive referrals and referrals from the company. These agents pay a portion of the commission (“approximately 35%” according to the lawsuit) at the end of the transaction.

“These agents also have a duty to induce their customers to use Veterans United for their home loans,” the complaint alleges. “If agents don’t do that, we stop generating leads.”

The lawsuit also alleges that loans generated through referrals cost more and have higher interest rates than those offered by other lenders.

The companies also allege they failed to inform homebuyer customers that they had other options for securing a mortgage. Active military customers believe that Veterans United is the same as the VA. Excessive financing costs are incorporated into loans, increasing costs. And the referral program’s “preferred agents” do not offer homebuyers alternative financing options.

In addition to two violations of RESPA, attorneys wrote in the complaint that the alleged conduct amounted to unjust enrichment and violated the Missouri Consumer Protection Act.

The proposed class would include anyone who purchased a home with a Veterans United Home Loan on or after January 1, 2020. The lawsuit seeks injunctive relief, treble damages, one-time damages and payment of attorney’s fees.

New suits follow other suits

The new suit was announced amid a flurry of activity on Hagens Berman’s part. In August, the company urged consumers to contact them if they entered into a home transaction in 2021 or later.

By September, Hagens Berman represented homebuyers in a class action lawsuit against Zillow, alleging that Zillow used “deceptive and illegal” practices to drive up costs for homebuyers through lead generation strategies.

The lawsuit was expanded two months later to add more state plaintiffs and new intermediary defendants, expanding the scope of the claims. The amended complaint adds new Racketeer Influenced and Corrupt Organizations Act (RICO) counts targeting Zillow Mortgage.

Email Taylor Anderson