There is often a conflict between policies that make things better in the short term and policies that are optimal in the long term. This is one reason why I’m pretty pessimistic about global warming. The world’s political systems are poorly suited to deal with this problem.

Perhaps the most famous example in economics is public debt. Decisions to reduce public debt (tax increases and spending cuts) are highly unpopular in the short term and will only bear fruit in the distant future. Therefore, I expect the financial situation to worsen over time. Indeed, it is surprising that it did not become unsustainable until the mid-2010s.

Banking regulation is another area where this problem occurs. The best regulatory structure is probably no regulation at all. Unfortunately, the creation of deposit insurance and too-big-to-fail policies made that option unviable. Without regulation, banks would have an incentive to take significantly excessive risks with taxpayer money. One option would be to abolish both deposit insurance and banking regulation.

The next best policy is higher capital requirements. However, these are often so complex that smart banks sometimes find ways to circumvent the intent of the regulations.

And then there is “stronger surveillance.” This is much the same as politicians telling voters they intend to reduce the budget deficit by addressing “waste, fraud, and abuse.”

A recent article in Bloomberg caught my attention.

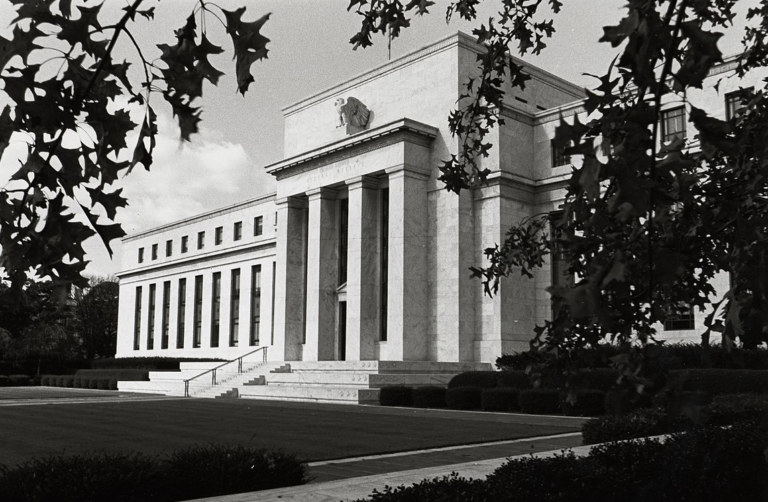

Advisers to President-elect Donald Trump are considering how to reshape the Federal Reserve’s leadership, including promoting Fed President Michelle Bowman to become the central bank’s next vice chair for oversight, according to people familiar with the matter. It is said that they are doing so. . . .

She speaks widely about banking regulation, often to community banking audiences. He strongly opposes the proposed Basel III bank capital proposals, which are part of an international agreement called Basel III and aimed at preventing future bank failures and further financial crises, and are a strong opponent of Basel III’s bank capital proposals, which are part of an international agreement aimed at preventing future bank failures and further financial crises. argued that an increase in the amount is likely to suppress lending activity. . Instead, banks need better supervision, she said.

Why aren’t there people like Christopher Waller?

Fed Director Christopher Waller, who had previously been considered as a possible chair, may not be seriously considered in the future because he supported a 0.5 point interest rate cut in September, people familiar with the matter said. President Trump said the Fed’s larger-than-usual interest rate cuts in the weeks before the presidential election were “a political move to keep someone in office.”

Even in the best of circumstances, stronger supervision is unlikely to adequately address problems in the banking system. But with the recent reversal of the Chevron decision, the chances of bank regulation being effective are even slimmer. Amy Howe is:

In a landmark ruling Friday, the Supreme Court drastically curtailed the power of federal agencies to interpret the laws they have jurisdiction over, ruling that courts should rely on their own interpretations of ambiguous laws. The decision is likely to have far-reaching implications across the United States, from environmental regulations to health care costs.

Banking regulation is based on some of the most obscure laws.