Connor: Remember when the Democratic establishment decided that Medicare for All was too expensive and that they needed to shore up the weaknesses in Obamacare?

By Phil Galewitz, senior correspondent for KFF Health News, covers Medicaid, Medicare, long-term care, hospitals and health issues in a variety of states. Originally published on KFF Health News.

As the federal government shutdown enters its fourth week due to an impasse over health insurance premiums for the 22 million Americans enrolled in Affordable Care Act plans, a new report finds that more than 154 million people with insurance through their employers are facing significant price increases, and the situation is likely to get worse.

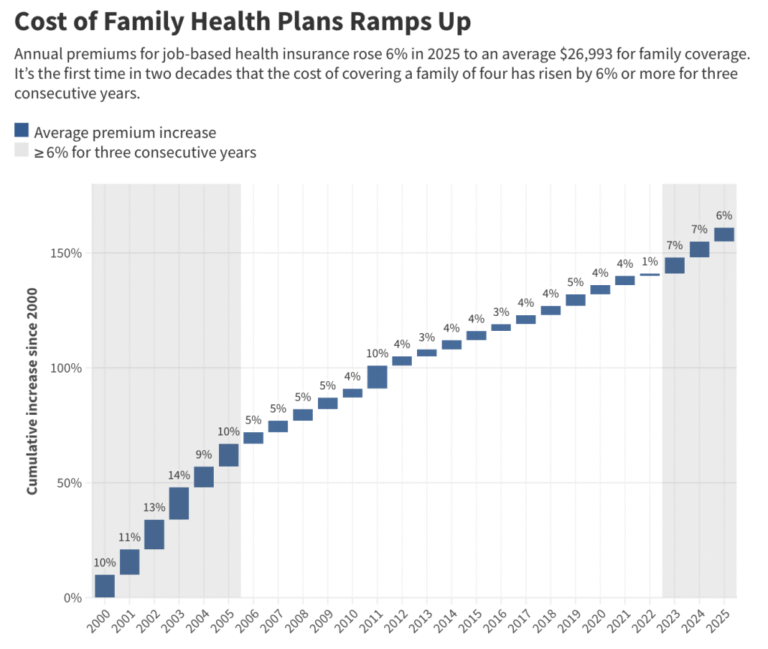

Premiums for job-based health insurance will rise 6% in 2025 to an average of $26,993 per year for family coverage, according to an annual survey of employers released Oct. 22 by KFF, a health information nonprofit that includes KFF Health News.

This is the first time in 20 years that the cost of covering a family of four has increased by more than 6% for three consecutive years, according to KFF data.

Over the past five years, average premiums for family coverage have increased by 26%, while worker wages have increased by 29% and inflation has increased by nearly 24%. The average cost of family insurance is now about the same as a new Toyota Corolla Hybrid.

The average annual premium for employer-sponsored individual health insurance increased 5% to $9,325, nearly $3,000 more than in 2016, according to the study.

“Health care costs continue to rise, so that’s a concern,” said Eric Trump, controller of Steve Reif, a small business in South Whitley, Ind., that specializes in sandblasting and painting heavy equipment.

Trump, who is not related to President Donald Trump, said his company’s health insurance premiums will increase by 8% in fiscal year 2026, about the same as increases in recent years.

Leaf employees pay about half of their health insurance costs. He said about half of the company’s 20 employees currently decline insurance coverage, either through family members or choosing to be uninsured. “There’s not much you can do because you don’t have enough employees to spread the cost.”

Most people with employment-based insurance pay for it, with the average worker contributing $1,440 to individual insurance and $6,850 to family insurance this year.

Over time, more workers pay deductibles, which are out-of-pocket costs that must be paid for medical services before insurance companies intervene. More than one-third of eligible workers are enrolled in plans with deductibles of $2,000 or more per individual. The percentage of workers with such plans has increased by 32% in the past five years and 77% in the past 10 years, the report said.

Rising pharmaceutical and hospital costs are often cited as the main causes of rising health insurance costs, and neither shows any signs of slowing down.

“Early reports suggest that cost trends will increase by 2026, potentially leading to higher premiums unless employers and insurers find ways to offset higher costs through benefits, cost sharing, and changes in plan design,” the KFF study said.

Note: Family premium estimates for 2004, 2006, 2011, 2012, and 2023 are statistically different (p < 0.05) from the previous year estimates shown. Source: KFF Employer Health Benefits Survey, 2018-25. Kaiser/Health Research & Educational Trust Employer-Sponsored Health Benefits Survey, 1999-2017 Credit: KFF Health News

One of the big concerns among employers is the high price of GLP-1 drugs for weight loss, and more companies are covering this. High prices and strong demand have led some workplaces to increase or eliminate compensation for weight loss.

“Large employers know that these expensive new weight-loss drugs are an important benefit for workers, but their costs often exceed expectations,” study author and KFF senior vice president Gary Claxton said in a press release. “It’s not surprising that some people are reconsidering the use of drugs for weight loss.”

Employers typically respond to rising health care costs by passing the costs on to workers, but it’s unclear how much financial pain workers can bear. The survey found that almost half of large employers said their employees were moderately or highly concerned about the level of cost burden.

The issue has received little attention on Capitol Hill in recent months, even though employer-sponsored insurance premium increases have outpaced general inflation. To pay for the extended tax cuts, President Trump’s Tax and Spend Act would cut billions of dollars in government spending on Medicaid, the state-federal health insurance program for 70 million low-income and disabled people. Congressional appropriators predict that cuts to Medicaid will leave millions more uninsured over the next decade.

The federal government has been shut down since Oct. 1 because Democrats have refused to vote on any new spending measures unless Republicans agree to extend tax credits that allow about 22 million people to buy health insurance through the ACA marketplaces. Without action from Congress, the tax credit will expire and many consumers’ insurance premiums will double starting in January.

KFF’s report is based on this year’s survey of 1,862 randomly selected non-federal public and private employers with 10 or more workers.