Eve here. We mentioned as we passed that the surge in commercial vacancy rates in the city centre was a crisis in urban budget production. First, in total, the current future new market reality, which corresponds to a lower value, is circulated to tax and tax receipts, especially when the owner hands over the property to a creditor. Secondly, many cities have their own sales tax on top of the state sales tax. You’ll be down as fewer people in downtown areas during workdays, and as a result, it’s declining in retail. Third, the reduced familiarity with meeting in-person activities and Zoom meetings almost certainly falls on business trips, which result in the sales taxes specific to these juicy hotels, as well as food and entertainment on the road.

This article usefully walks the fact that elements already being processed have been scuseed in terms of cost and revenue.

John Lenny Short, Professor Emeritus of Public Policy at the University of Maryland, Baltimore County. Originally published in conversation

Five years after the start of the Covid-19 pandemic, many US cities are still adapting to new normals, with more people becoming less remote and economically active in the city centres. Other factors, such as underfunded pension plans for employees, have pushed many urban budgets into the network.

The Struggles of urban prosecutors is not new, but historically they have produced small, poor or addled American cities primarily to incompetent managers. But today, even major cities like Chicago, Houston and San Francisco are exposed to severe financial stress.

This is an upcoming national threat driven by factors such as climate change, declining downtown activity, loss of federal funds, hibachi pensions and retirement commitments.

Many US systems remain, so many US cuts remain.

Why Cisies are struggling

Many US CISIEs have been in financial crisis for a variety of reasons for the past century. Most commonly, stress occurs after a recession or is a sharp decline in tax recursion.

Florida municipalities began to default in 1926 after the land boom collapsed. City defaults were common throughout the country during the Great Repression in the 1930s. As unemployment rates rose, the burden on Relietef has escalated and tax collections have been reduced.

In 1934, Congress amended the US bankruptcy laws to allow local governments to formally file bankruptcy. 27 states subsequently enacted laws that allowed cities to become debtors and seek bankruptcy protection.

Declaration Bankruptcy was not a cure. This allowed CISIE to refinance debts and extend payment schedules, but also allowed higher taxes and fees for residence, as well as lower wages and benefits for city employees. And it could be blamed on the city for years.

In the 1960s and 1970s, many urban residents and businesses left the city in the adjacent suburbs. Many cities, including New York, Cleveland and Philadelphia, found it difficult to pay off their debts as taxes shrink.

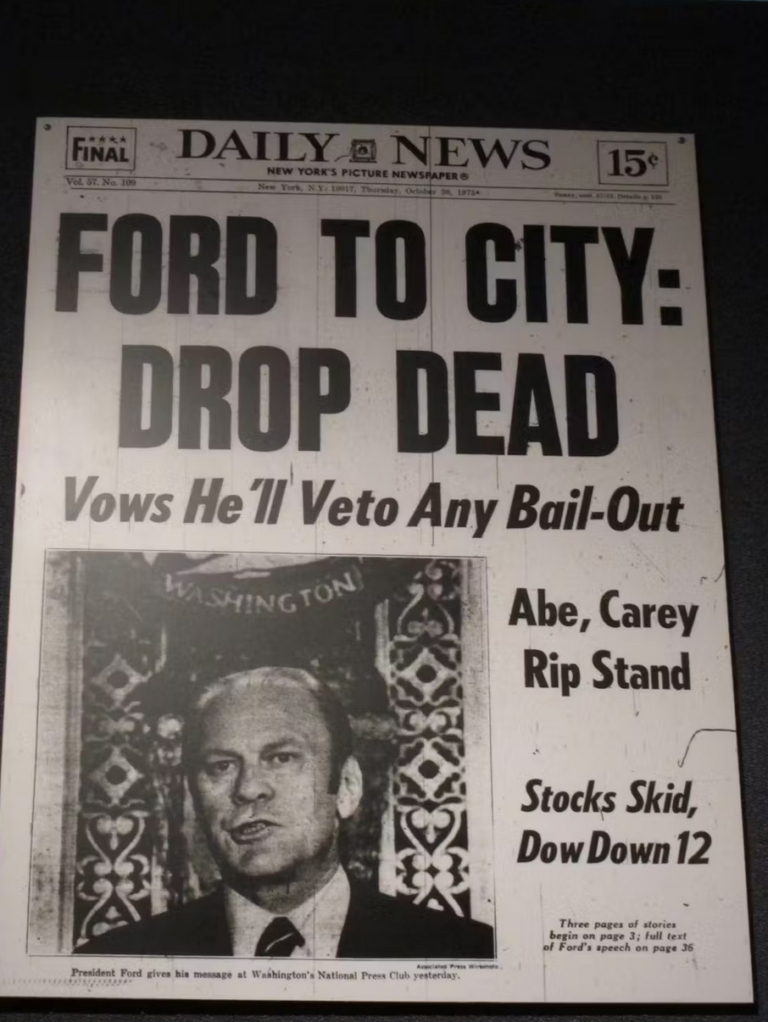

New York Daily News, October 30, 1975, after US President Gerald Ford ruled out federal aid to save the city from bankruptcy. A mandatory law allowing federal loans several months later.

The collapse of the housing market in 2008-2009 has led cities, including Detroit in San Bernardino, California and Stockton, California, to be burning due to bankruptcy. Other CISIEs faced similar challenges, but were in states that did not allow local governments to declare bankruptcy.

Even large, wealthy jurisdictions can deviate from the financial railroad. For example, Orange County, California, began in 2002 after Treasurer Robert Citron pursued a complex, mild, mild trading risky investment strategy and pursued a $1.65 billion taxpayer fund. It’s bankrupt.

Today, cities face convergence of rising costs and rebirth in many places. As I see, the urban prosecutor’s crisis is a now popular national challenge.

Climate-driven disasters

Climate change and the accompanying increase in its major disasters puts financial pressure on local governments across the country.

Events such as wildfires and floods have two effects on the city’s finances. First, you will need to spend money rebuilding damaged infrastructure, such as roads, water supply areas, and public buildings. Second, after a disaster, cities may be required under state or federal law to allow Eishers to act on their own or make expensive investments in preparing for the next storm or wildfire.

In Houston, for example, a court ruling after years of severe flooding forced the city to spend $100 million on street repairs and drainage by mid-2025. The requirement will increase Houston’s annual budget deficit to $330 million.

In Massachusetts, the town of Cape Cod has spent millions of dollars switching from purification systems to public sewage road lines and upgrading wastewater treatment plants. The growing population has led to a significant increase in water pollution in the cape, and climate change is promoting the flowers of toxic algae that supply the nutrients of wastewater.

An unclear increase in the total cost of mitigating and adapting climate change can avoid lead rating agencies to downgrade the city’s credit rating. This will increase the costs of borrowing money for climate-rising projects, such as coastline protection and improving wastewater treatment.

Pensions that are underfunded

Cities also spend a lot of money on their employees, and many Hibari cities are attractive to fund the pensions and health benefits of the workforce. Municipals live longer and require more health care, which increases costs.

Chicago, for example, is currently facing a budget deficit of around $1 billion. This is partly due to the lack of funding retirement benefits for nearly 30,000 civil servants. The city has $35 billion of unsubscribed pension liabilities and about $2 billion of unsubscribed withdrawals. Chicago teachers are being fed $14 billion in benefits.

Policy research has shown for many years that politicians tend to lack civil servant retirements and pension benefits. This approach excludes the real cost of providing police, fire prevention and education to future taxpayers.

A sturdy downtown and low federal support

Cities are only facing rising costs – they are also losing the Rivers. Many USIs have seen a decline in retail and commercial office economies. Developers are overbuilding commercial real estate, creating an oversupply. More real estate means a lower tax revival.

At the same time, pandemic-related federal aid that combines local government finances from 2020 to 2024 is declining.

The state and local governments received the $150 billion that received this crack – it’s over.

In my view, President Donald Trump’s administration is very unlikely to release bail in the Urlan region, particularly more liberal cities such as Detroit, Philadelphia and San Francisco. Trump calls Baltimore “rodent-soaked chaos” and portrays a metropolis ruled by Democrats in the darkest example of hair, called “the filthy, crime-filled death trap.” I think Trump’s animus against the metropolitan city, a staple of his 2024 campaign, could be a feature of his second term.

Detroit officials respond to Shirt’s remarks about the city by Donald Trump in a campaign speech held in Detroit on October 10, 2024.

Resistance against new taxes

Cities can generate revenue from taxes on sales, businesses, real estate and utilities. However, local government growth, particularly property taxes, could be Vley Difficul.

In 1978, California adopted Proposal 13. This is one of the Lows, which uses a voting measure that will raise property taxes to the inflation rate (2% per year). The famous campaign was created for the Wiseplado story of property taxes being out of control and making it difficult for local officials to help raise property taxes.

Property taxes are dealing behind inflation in many parts of the country, thanks to CAPS like Prov 13, as it is the public opinion that taxes are too high and there is political resistance.

Crunch

Collecting factors together, it looks like a prosecutor will come for our city. Small budget cities are particularly vulnerable. However, there are also bigger and wealthier cities, such as San Francisco, which are crumbling downtown office markets, and others such as Houston, New York and Miami, which face increasing costs due to climate change.

The Pacific Northwest needs to be more open and open in these difficult situations, politicians need to be more open and persuasive and strengthened how and why taxpayer money is being spent. He told me there was.

Efforts to balance urban budgets are an opportunity to build consensus with the public about municipal cans and at what costs. The coming months will show whether politicians and city residents are ready for the first tough conversation.