The National Association of Mortgage Brokers (NAMB) sounds the alarm in its latest white paper, saying affordability is preventing Americans from achieving life milestones like homeownership and starting a family.

Housing affordability has been a perennial issue in the United States, with Gen Z and Millennials lagging behind in homeownership rates compared to older generations. The overall homeownership rate is also expected to decline in 2026, as soaring mortgage rates and home prices continue to discourage homeownership.

The National Association of Mortgage Brokers (NAMB) said in its latest white paper that affordability has reached a level that “threatens the foundations of the American Dream” unless the industry diligently pursues regulatory and legislative solutions. According to NAMB, these solutions include removing regulatory barriers for home builders and expanding financial assistance to homebuyers through legislative measures such as the 21st Century Housing Act, popular in the U.S. House of Representatives.

“The housing affordability crisis cannot be solved by single interventions,” the paper said. “Instead, meaningful progress will require coordinated action that simultaneously addresses supply constraints, financing barriers, regulatory inefficiencies, transaction costs, etc. The legal framework exists. Industry expertise is available. Political will is building. What remains is implementation.”

NAMB says the affordability crisis is exacerbated by worsening supply shortages (current estimates put it at between 1.5 million and 5.5 million homes), a widening gap between wage and house price growth, deepening first-time home buyers’ struggles to qualify for mortgages, and He said this is the result of five interrelated challenges, including steadily rising rents that are making it more difficult for Americans to save for homeownership, and burdensome federal, state, and local zoning and lending regulations that delay permitting, groundbreaking, and construction of housing. Finished product.

The association outlined four regulatory solutions aimed at expanding access to mortgage financing, particularly for “moderate-income” homebuyers, defined as 130 percent of area median income (AMI) in metropolitan areas. Currently, the AMI standard for Fannie Mae and Freddie Mac’s low-income down payment mortgage programs is set at 80%.

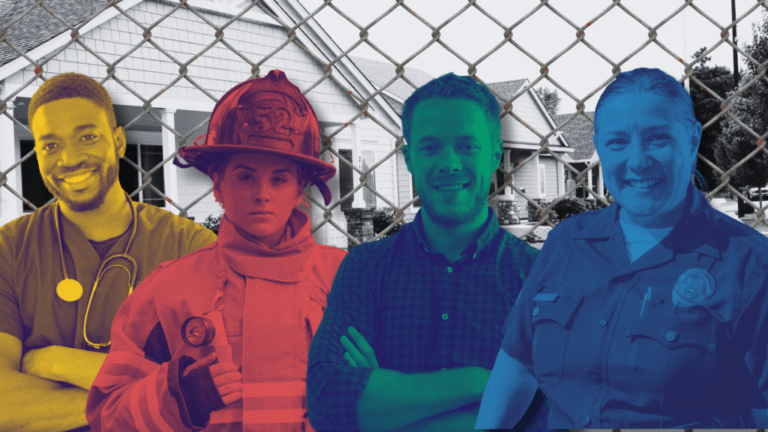

But NAMB said raising the cap to 130 per cent would help millions of professionals, including teachers, nurses and firefighters, who are still struggling to afford housing.

“Middle-income households are increasingly excluded from homeownership, despite stable employment and good credit,” the paper said. “In expensive metropolitan areas, 80% AMI can be $60,000 to $70,000 for a family of four, but even families making $90,000 to $120,000 (100% to 130% of AMI) have difficulty saving for a down payment while paying high rents. Home prices are rising faster than incomes, making the 80% standard increasingly inadequate.”

While local and state leaders are pushing legislation such as zoning and moratoriums on artificial intelligence data centers to prevent soaring energy costs, NAMB is setting its sights on federal reform through the One Big Beautiful Bill Act, the House’s 21st Century Housing Act, and the Senate’s ROAD to Housing Act. The group said each law provides an important piece of the affordability puzzle.

One Big Beautiful Bill Act (HR 1): Restores the mortgage insurance deduction, increases the cap on state and local taxes to $40,000, permanently extends the New Markets Tax Credit at $5 billion per year, and expands Opportunity Zones. Housing for the 21st Century Act (HR 6644): Streamlines zoning and permitting laws, encourages upzoning to increase housing density, expands access to development block grants, increases the use of manufactured housing, and improves financing options for homebuyers. ROAD to Housing Act (S. 2651): Has 40 provisions covering supply expansion, financing reform, and regulatory streamlining.

The association said failure to solve the affordability crisis would spell disaster not only for the industry but for society as a whole, as widespread access to housing is key to building stable households and communities.

“We encourage governments to put housing affordability at the center of policy, with measurable targets and accountability,” the paper said. “Most importantly, we remind policymakers that behind every statistic about housing affordability, there are families who just want to realize the American dream of homeownership: teachers and nurses, firefighters and police officers, young couples and aging parents. These families deserve access to the wealth-building opportunities and community stability that homeownership brings.”

In a similar vein to NAMB’s white paper, Bright MLS released a sentiment survey this month of 3,000 Americans, 9 out of 10 of whom said housing affordability was a major issue.

While NAMB identified housing supply as the main culprit, Bright survey respondents cited Americans’ low incomes as the main problem (55.5%). Research shows that their views are not unfounded, and the gap between wages and house prices began in 2020. The market started to soften in 2024, but not enough to bridge the gap.

“From 2010 to 2020, growth in household income and house prices broadly tracked, meaning that incomes typically grew almost as fast as house prices,” the report said. “However, there was a sharp divergence in 2020, when home prices, as measured by the S&P Cotality Case-Shiller Home Price Index, began to rise faster than median household income. Mortgage rates, which had fallen from their 2010 levels, began to rise rapidly in 2020 and then level off.”

“In contrast, over the past 15 years, residential construction, as measured by building permit activity, has actually appeared relatively strong, with the number of new residential construction permits being much higher than in 2010,” the report added. “Consumers who are thinking about the relatively recent past are right to point to slowing income growth and rising mortgage rates when they think about why they can no longer afford to buy a home.”

Similar to NAMB, survey respondents said they want federal intervention, with 84% saying tax credits and financial incentives for builders and buyers would be the biggest boost to affordability.

“Understanding residents’ perspectives on this issue is critical to building support for housing policy initiatives,” the study concluded. “Most Americans see value in providing incentives for first-time homebuyers (a demand-side solution) and in providing incentives for developers to build lower-cost housing (a supply-side solution). But there is generally relatively little support for communities to allow them to build more housing.”

Email Marian McPherson