Eve is here. For now, at least, market activity confirms our thesis that even if significant long-term dollar weakness is possible, it will take a long time to materialize. BRICS fans have touted the global South’s GDP levels as an indicator of destiny. However, financial markets are dominated by investment flows, not by population or GDP proportions. We often have to point out that the excitement over countries circumventing US sanctions through the dollar regime by bilateral transactions in their own currencies is not so slight as to endanger the dollar. According to BIS research, trade transactions account for approximately 3% of foreign exchange transaction value. Similarly, a recent BIS study found that the dollar share of foreign exchange transactions will increase from 2022 onwards.

2025 Triennial OTC Forex Market Sales Survey Highlights:

The trading value of the over-the-counter foreign exchange market reached $9.6 trillion per day in April 2025 (on a “net-net” basis, 2 all foreign exchange products), an increase of 28% from $7.5 trillion three years ago. FX spot and outright forward sales increased 42% and 60%, respectively. Their share of global sales therefore increased from 28% and 15% to 31% and 19%, respectively. FX options trading volume more than doubled. The trading volume of foreign exchange swaps increased slightly, and its share fell to 42% (51% in 2022). The US dollar continues to dominate global foreign exchange markets, accounting for 89.2% of all trades, up from 88.4% in 2022. The euro’s share fell from 30.6% to 28.9%, and the Japanese yen’s share remained almost unchanged at 16.8%. The pound’s share fell to 10.2% (from 12.9%). The shares of the Chinese yuan and Swiss franc rose to 8.5% and 6.4%, respectively. Dealer-to-dealer transactions accounted for 46% of global sales (nearly unchanged from 47% in 2022). The percentage of transactions with “other financial institutions” was 50% (up from 47%). Transaction volume with other financial institutions was $4.8 trillion, an increase of 35% compared to 2022. This was primarily due to a 72% increase in outright futures trading and a 50% increase in spot trading with this counterparty group. Sales desks in the top four jurisdictions – the UK, US, Singapore and Hong Kong SAR – accounted for 75% (on a ‘net gross’ basis2) of all foreign exchange transactions. Singapore increased its market share, reaching 11.8% of the total (up from 9.5% in 2022).

GDP per capita in developed countries remains much higher. This, among other things, increases the funds available for investment.

So what could probably be detrimental to the dollar sooner or later is that dollar investing becomes obsolete. The flight in US Treasuries on Emancipation Day resulted in a corresponding notable depreciation of the dollar. Not only has this situation reversed somewhat, the VoxEU study found that U.S. Treasuries, at least for now, have returned to their status as a haven during times of perceived risk.

President Trump has declared war on the security of U.S. financial markets by pushing for continued deregulation and promoting crypto fraud. A collapse in AI or disruption in the private bond market could also lead to a flight from dollar investment and, ultimately, from the dollar.

Written by Wolf Richter, editor of Wolf Street. First appearance: Wolf Street

A widely talked about attempt to inflate cryptocurrencies, gold, silver, and even stocks is so-called “currency devaluation trading.” The idea is that enough traders will rally around a common theme and move the price in their direction for a long enough period of time to make large profits and generate fees from their trades.

The theme of this trade disparagement is a bet that government borrowing and money printing will dramatically and rapidly reduce the value of the US dollar, causing enough investors to flock to cryptocurrencies, gold, silver, and even stocks, causing the prices of those goods to explode. And they did.

But the huge bond market is betting against it, led by the $29 trillion government bond market, the $11 trillion corporate bond market, the $9 trillion residential MBS market, the $4 trillion municipal bond market, and other segments of the bond market where yields have been depressed this year and have remained in a relatively narrow range for the past three years.

These bond investors are betting that inflation will cool further in the long run, that the relatively low yields they receive on their securities will be enough to compensate them for the inflation and the risk they are taking, and that the cooling of inflation will push yields even lower in the future, thereby driving up the prices of previously high-yielding bonds.

If the bond market fears a rapid and deep decline in the US dollar (a theme promoted by down trade proponents), much higher yields will be required. But that wasn’t the case.

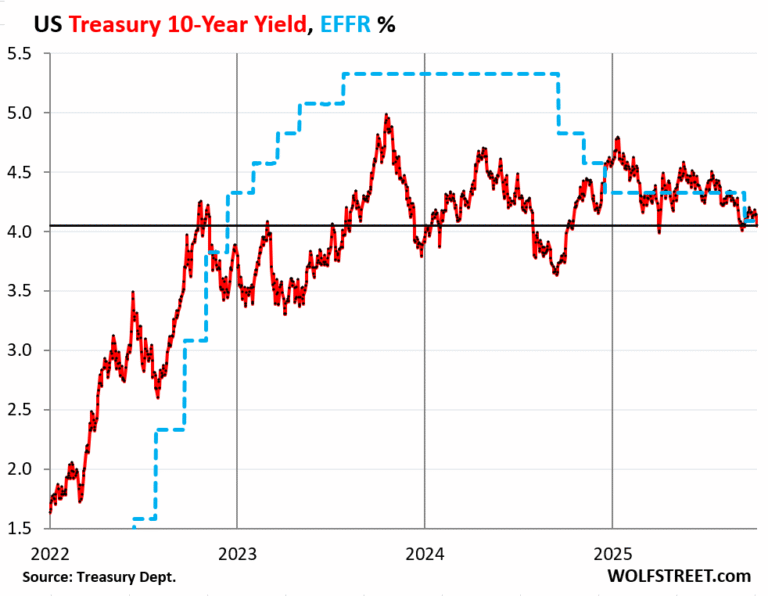

For example, the 10-year Treasury yield was barely above 4% as of Friday night (bond markets are closed today), but it has been trending lower this year and has been in the same range for the past three years.

But, but, but, the US dollar… The dollar’s fall in the first half of 2025 has been falsely promoted by clickbait headlines and manipulative talking heads on TV as the “deepest decline in more than half a century.”

What actually happened is that the dollar index skyrocketed in the last four months of 2024, hitting an all-time high at the end of December. And that four-month surge rebounded slightly in the six months from early January to early July, when the euro- and yen-dominated DXY dollar index fell 11% and the broader WSJ dollar index fell. [BUXX] It fell by 9% in the first six months of this year.

However, larger six-month declines were common and bottomed out during the following periods:

April 2023 September 2020 November 2010 August 2009 April 2008 June 2007 and so on, all the way back to Adam and Eve.

The only thing that was unique about the six-month decline in 2025 was that it started in early January. Only the start date was unique.

This chart shows the 6-month percentage change in the WSJ Dollar Index. [BUXX]tracks a basket of 16 major currencies.

The blue line shows a 9% decline over the six-month period from early January to early July. Note the even larger six-month decline above the blue line over the past 23 years.

And of course, the dollar has rebounded somewhat since early July, with today’s WSJ Dollar Index up 2.6% from its early July lows to 96.4.

The 16 currencies in the trade-weighted index are the euro, Japanese yen, Chinese yuan, Canadian dollar, Mexican peso, Korean won, New Taiwan dollar, Indian rupee, Hong Kong dollar, Singapore dollar, British pound, Australian dollar, New Zealand dollar, Norwegian krone, Swiss franc, and Swedish krona.

The Fed has been doing the opposite of “printing money” for over three years, shedding $2.4 trillion in assets to date — “non-printing money?” — and continues to shed assets under its quantitative tightening program, something those pushing downgrade deals should consider.

Other central banks, particularly the ECB and Bank of Japan, have also reduced assets under QT programmes. Here are the balance sheets of some major central banks, shown in relation to the size of the economy, and are another eye-opener to the problems facing degraded trade. It’s amazing how the world of money printing has been turned upside down.