Propublica is a nonprofit newsroom that investigates power abuse. Sign up and receive the biggest story as soon as it’s published.

If a health insurance company refuses to pay for treatment, most people will unclearly accept the decision.

Few patients appeal. Some people don’t trust insurance companies to reverse their own decisions.

But the lesser known process of asking for plans for independent opinions outside the wall with insurance companies can force insurers to pay for something that could save lives. External reviews are one of the industry’s most maintained secrets, and only a small fraction of the qualified people they actually use.

Propublica recently reported on her husband with North Carolina couple Teressa Sutton-Schulman. Last year, L struggled with escalating mental health issues and needed intensive psychiatric care. Highmark Blue Cross Blue Shield issued multiple denials in their case, even after Sutton Shulman’s husband attempted suicide twice in 11 days.

The instructions for external review were buried on one page 7 of the rejection letter.

“Now you can request that your case be reviewed by a healthcare provider who is completely independent of your health plan or insurance company,” read the letter from the state health department in Texas where the treatment was performed.

Sceptical but hopeful, Sutton Shulman submitted an external review request. Their lawsuit was assigned to Dr. Neil Goldenberg, an Ohio physician who works as a side job at a third-party review company. After reading the massive appeal, Goldenberg overturned Highmark’s rejection, covering treatments that Sutton Shulman and L over $70,000.

Highmark previously said in a statement that the company is “passionate about providing appropriate and timely care” to its members. “Small errors by doctors and members could lead to delays and initial denials,” he admitted, but said they were amended in the appeal.

The lesson is simple, explained Kaye Pestaina, vice president of KFF, a nonprofit health policy think tank who studied external appeal.

“An appeal, appeal, appeal, appeal,” she said. “That’s all.”

While external appeals have been around for decades at the state level, in 2010, the Affordable Care Act expanded access to reviews for the majority of people who have health insurance through their work. Details regarding the external review process will vary depending on whether your insurance plan is regulated by state law.

Karen Pollitz helped draft federal regulations on external reviews during the Obama administration, but said widespread lobbying on behalf of insurers and employers weakened initial protections. Currently, only a small percentage of rejections eligible for external reviews will be hired by health insurance plans.

She said little has also been implemented for transparency requirements that require insurers to report data on denials and other metrics.

“There are all kinds of ways to tighten laws and regulations to make your health plan more responsible,” said Politz, who left the administration after the rollback and worked for KFF before resigning.

But for now, Politz could be the only appeal a patient has, Politz said. The benefit of the Affordable Care Act, she added, is that it has established the state’s consumer assistance program to help people get the guaranteed compensation.

Federal funding for these programs dried up a few years later, but around 30 states decided to find other ways to pay for the program. (Want to know if your state has one? Here’s a list from federal employees.) Families will benefit if the remaining 20 states, including Wisconsin and Ohio, include established programs.

“Every state needs one of these programs,” she said. “Healthcare is very complicated and people really need to rely on professionals.”

Fish-Parcham meets monthly with representatives of consumer assistance programs from around the country. The model differs depending on the condition. The program will be the State Attorney’s Office, a nonprofit organization, and even an independent agency. Supporting external attraction by patients or providers is an important part of the program’s role. Often, the first step is simply to let them know that both internal and external appeals are optional.

“We’re a great leader in health education advocacy,” said Kimberly Kammarata, director of the state’s Consumer Assistance Program, who is head of Maryland’s Health Education Advocacy. “And sometimes the information on whether the claim has been rejected or how to appeal is grossly unclear. Many of these resulting letters will say they have an outside appeal right, but they don’t tell you exactly where to go.”

Some states have enacted laws to combat that chaos. For example, Maryland insurance companies are no longer able to fill their denials with deep appeal information. Starting this month, new state law requires insurers to include information at the top of all denials of “prominent bold printing.” The declaration advises consumers that the letter filed an appeal and includes information on how to reach the Health Education and Advocacy Unit. The unit’s address, phone number, fax and email must also be included in the body of the notification.

Connecticut added similar information to the top of a rejected letter to the 2023 front page box. The office found the effect almost instantly. Over the next two years, more than 40% of referrals to the state’s healthcare advocate office came from people who received denials in the new language.

This office is not funded through taxpayer money. It is fully paid by the insurance company’s state valuation.

“We want to help people,” said Kathleen Holt, who was nominated by the Governor of Connecticut in 2024 and headed the office as a healthcare advocate for the state. “I think insurance companies know people don’t appeal and in a way they can be more aggressive towards rejection. They don’t expect people to come back.

Connecticut data shows that the Healthcare Advocacy Department was able to resolve or reverse the rejection in the favor of patients in about 80% of the time, Holt said. Some plans may charge up to $25 per external appeal, but Connecticut removed the fee a few years ago. Some states, including New York, track the outcomes of external appeals that the public can review.

“We can help people write their appeal,” Elizabeth Benjamin, vice president of health initiatives at the Community Services Association, said of New York residents. “We write appeals for them, sometimes going through thousands of pages of medical records, and 15 to 20 pages of appeal.”

Experts say these six things can help patients and healthcare providers after denial. We are journalists, not lawyers, so we cannot provide legal advice regarding this process.

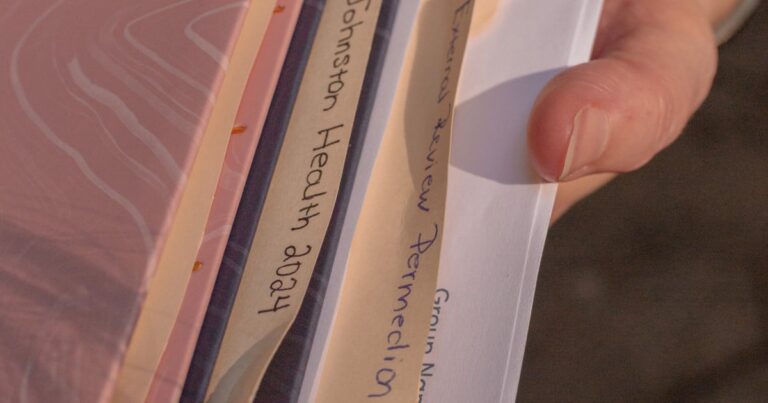

Collect information: Experts suggest not to throw away letters and notices from insurance companies, such as denial notifications, benefits explanations, communications, and planning documents. If you missed them, they said you could contact your insurance company for additional copies. We also recommend that you download or request a medical record. Most people can request a request file that they have rights under federal regulations. Does your state have a consumer assistance program? Not all states have consumer assistance programs. Here is a list of things that do. Supporters are encouraged to reach out and ask them to explain their denial. It might be as simple as missing or incorrect code. Their job is to use time, experience and resources to explain the process. Their service is free. Other programs and non-commercials also provide support. Why were you denied and what is your timeline for sue? Did the insurance company decide that treatment is not medically necessary, or is it being rejected because your plan didn’t cover it? Does your plan follow federal or state regulations? Experts say these distinctions may determine whether or not you plead for your denial. Most plans give you about 180 days from the date of the rejection notice to be appealed internally, but experts say you don’t wait. If you don’t know the answer to these questions, you can call your insurance company and ask. They need to provide you with a reason for denial. Can your healthcare provider help? The expert suggests reaching out to a doctor or therapist. They said some providers will file appeals on your behalf. Others write letters of support. At the very least, supporters agree. Most people should help you understand why your treatment was denied and what additional steps can be taken. File an internal appeal: Before filing an external appeal, you will generally need to try to resolve the dispute internally with the insurance company. This step may include one or two levels of internal appeal. How to Request an Outside Appeal: This is the last shot before considering a lawsuit. After you run out of internal appeals, you can contact your insurance company to request an external appeal. When you submit a request for a federal government external review, you will usually have a 5-day plan to consider your request.

If the insurance company agrees that the denial is eligible, it will provide instructions as to where to file the appeal. Experts say they will check to read the notifications forever.

“Just let me die”: One psychiatrist was their last hope after insurance repeatedly denied the couple’s claims.

Remember that only certain denials are subject to external appeals. These refusals usually include medical judgment, surprising medical costs, or the insurance company’s decision to retrospectively cancel coverage or determining that treatment is experimental. It is generally not eligible because of denials based on the terms of the plan, or because the service was out of the network.

Under federal regulations, third-party review companies usually spend between 45-60 days to determine the outcome of external reviews. If the situation is urgent, you can seek quick appeal. In these circumstances, you may be entitled to request an external review and to file internal and external appeals at the same time without exhausting the internal appeal. Typically, federal requirements require prompt external appeal to occur as quickly as possible, but within 72 hours it will not take time.

If an external reviewer decides to overturn your denial, the decision is binding. Insurance companies are required to accept decisions by law and pay treatment. If the reviewer rules against you, you may be able to file a lawsuit.