Many teens who are unsure of what they want to do to make a living take business courses for good reason. There are a variety of jobs in the business sector, and the best job is to work as a CPA (certified public accountant). This sector is huge, constantly growing, and many opportunities are open to the present and future. How to become a CPA includes answers to commonly asked questions and helpful advice from successful people in this field.

Free Posters

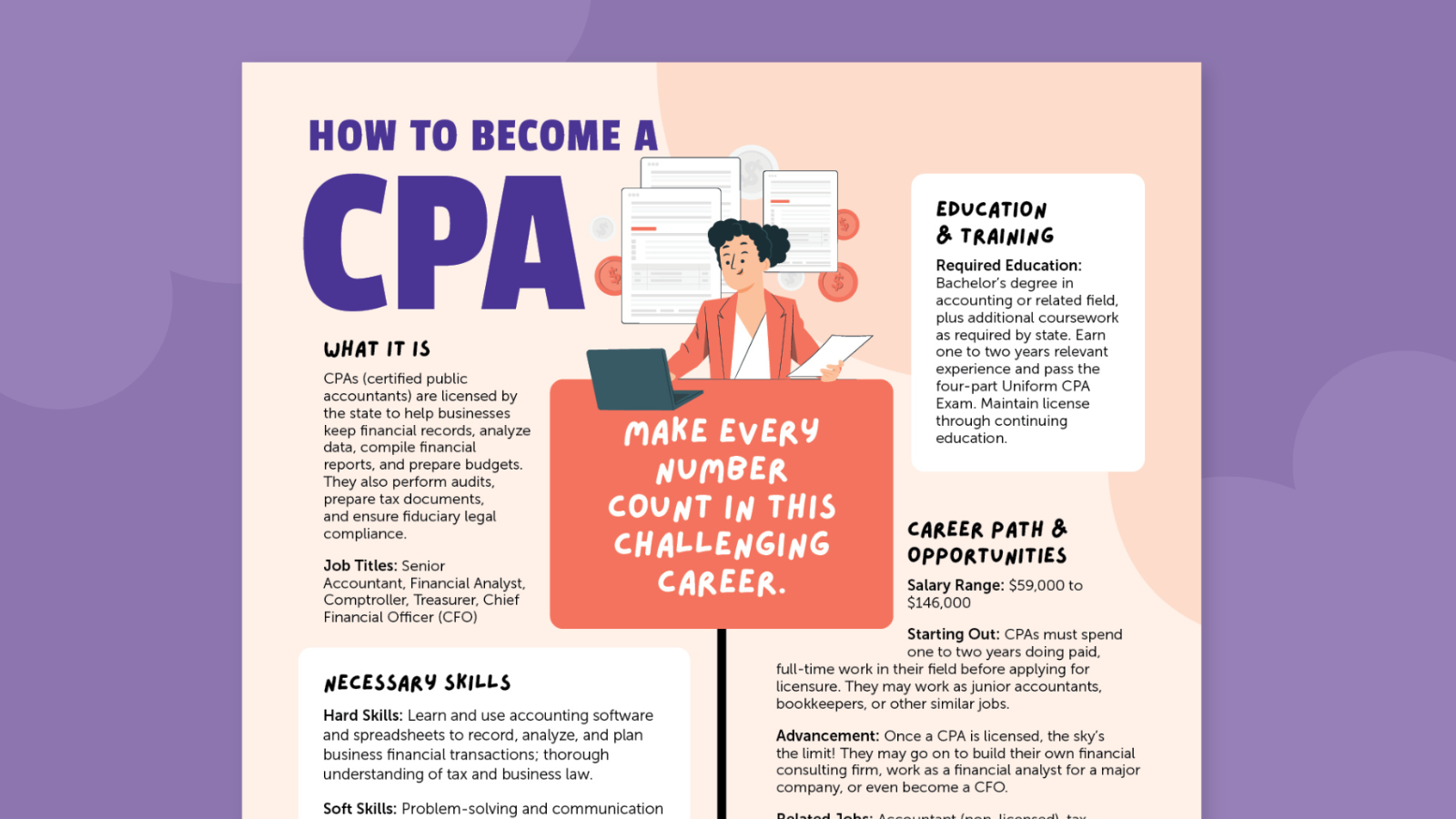

“How to Become a CPA” poster

Grab this free printable poster and hang it in your classroom or career counselor’s office!

How to become a CPA FAQ

What is a CPA?

Typically, certified public accountants shortened to CPAs are those who work with businesses to help manage financial transactions. Keep records, analyze data, edit financial reports, and create budgets. The CPA also performs audits, prepares tax documents and ensures legal compliance for the business.

CPAs are different from regular accountants. After completing certain educational requirements and licensing exams, they are licensed by the state in which they work. By obtaining this certification, employers will know that potential employees are fully qualified to perform all important accounting tasks. The CPA completes continuing education requirements to maintain your license throughout your career.

Why is it a CPA?

“Two words: Infinite possibilities require a CPA, from public accounting firms to your favorite sports franchises.” CPA Ed Duarte is Chief Financial Officer of Miami’s Foreign Parts Distributor and the current chairman of FICPA’s board of directors. He is extremely enthusiastic about his field and encourages all high school students to consider their incredible possibilities.

“First of all, there is always a high demand for our services, giving us built-in job stability,” explains Duarte. “Companies in all industries require CPAs such as financial reporting, tax compliance and strategic consulting.

What is the average salary for a CPA?

As Duarte points out, one of the great benefits of being a CPA is that these accountants tend to earn higher salaries than uncertified people. In the US, CPAs earn around $93,000* per year on average. (Salary ranges from $59,000 to $146,000). In comparison, uncertified accountants earn an average of $65,000 per year. That’s a pretty big difference!

*Note: As of February 2025, salary information is actually available for each Ch.Com.

What does CPA do every day?

More than you think! Duarte said, “There are no typical days.

“You may be perceived by an accountant, but this is more experienced and more work than you would become a CPA, so time management, communication and teamwork are really important skills.”

What skills do you need for a CPA?

“Accounting is a language of business, but it’s not just mathematics,” emphasizes Duarte. “From problem solving to using engaging stories, there is the wide range of skills needed to succeed in the profession, from business owners to investors.

A good CPA needs to get used to existing and emerging technologies. “Digital transformation is rapidly evolving our profession,” explains Duarte. “Currently, CPAs are at the forefront of data analytics, financial automation, artificial intelligence and robotics processing.

Does a CPA require a degree?

yes. Most people have a bachelor’s degree in accounting or related fields. Each state has its own requirements for the number and types of courses you need to take, both in accounting and in general business.

How to Become a CPA: Process Overview

Important: CPAs are licensed by state, so requirements may vary. Check with your state licensing board for the most accurate and up-to-date information.

Get a bachelor’s degree

The most common way to start your journey to becoming a CPA is to earn a bachelor’s degree in accounting or in closely related fields. While attending university, you will need to spend a certain number of hours in accounting and general business. These include subjects in taxation, auditing, business law and more.

Most states require a minimum of 150 hours of university classes to become a CPA. Many university degrees only take 120 hours to graduate, so potential CPAs will need to take additional courses to fill the gap. To ensure that you meet your educational requirements, choose a school that offers programs exclusively for future CPAs.

Pass the uniform CPA exam

Uniform CPA testing consists of four parts. All candidates must receive and pass Audit and Certification (AUD), Financial Accounting and Reporting (FAR), and Taxation and Regulation (Reg).

In the final part, candidates choose to specialize from three options: Business Analysis and Reporting (BAR), Information Systems and Control (ISC), or Tax Compliance and Planning (TCP).

To pass the entire exam, you must receive a score of at least 75 in each section. Most states allow individual portions of the exam to be taken individually, allowing for flexibility if you need to retry several sections.

Gain related work experience

The state generally requires future CPAs to acquire work experience in their field (usually one to two years of full-time paid work) before applying for a license. You can start while you’re earning your bachelor’s degree by completing an internship or choosing a summer job that offers accounting experience.

Maintain certification through continuing education

Once you have your CPA license, you will need to take and maintain a continuing education course. This will help you stay sharp throughout your career. Each state has its own continuing education requirements. Check yours to learn what you need.