Eve is here. There are some things you can’t say very often. In this case, the subject is the causes of inflation, which still plagues many Americans. The obvious culprit is Biden’s massive stimulus package, which has become a favorite pastime. But a closer look reveals that the idea is, in the words of the loudmouths, “neat and plausible, but wrong.”

The initial driving force was the supply chain shock of the coronavirus. That’s why there were significant increases in some items such as wood, meat, and eggs (due to chicken culling), but not in others (gasoline). But as Tom Ferguson and Servers Strom explain, a further driver was elite spending. Remember the much-maligned “greedflation” when some companies raised prices simply because they could, rather than due to rising labor or material costs? Those excess profits were used by capitalists It went into the pocket of

Another factor not mentioned here: Even if statisticians claim that inflation has eased (the items they measure are regularly purchased by middle- and low-income Americans), Their timeline is that of Wall Street and the world (even before you get to the fact that it may not be fully aligned with the timeline). Fed: Months, quarters, at most a year. The rise in inflation in categories that many consumers consider essential was so large that, despite the fact that the rate of increase has slowed significantly, it remains a persistent new high compared to a few years ago. are.

Written by Thomas Ferguson, Research Director, Institute for New Economic Thinking, Professor Emeritus, University of Massachusetts, Boston. Mr. Servers Strom, Senior Lecturer, Department of Economics, Delft University of Technology. Originally published on the New Economic Thinking Institute website

That must be the Wall Street Journal’s DNA. The usually cautious Nick Timiraos focuses much of his commentary on “How Democrats Blow Up Inflation” on the current debate that the “Biden stimulus” somehow caused global inflation in 2021. There is nothing else that can easily explain why this is the case.

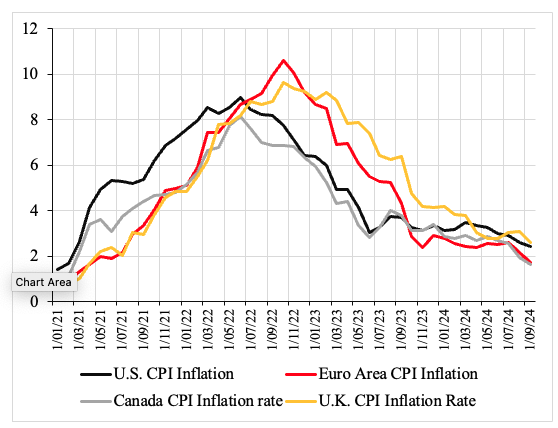

This argument doesn’t make much sense because, as many studies have proven, the biggest drivers of inflation are supply-side factors, which affect virtually everyone, regardless of stimulus. did. This is illustrated in Figure 1, which shows consumer price growth from 2021 to 2024 for the US, euro area, UK, and Canada. Consumer price inflation in the euro area and the UK has peaked at even higher levels than in the US, indicating that all countries are experiencing a very similar inflation experience.

Figure 2 shows the structural government deficit (as a percentage of potential GDP) for these four countries from 2021 to 2024. It is clear that the US government has a much larger structural budget deficit than the governments of the euro area, the UK, and especially Canada. Despite these large differences in fiscal policy stances, the experience of consumer price inflation is surprisingly similar across countries (Figure 1). This is despite many studies showing that inflation was primarily driven by supply-side factors, including the 11-country study by Bernanke and Blanchard (2024). Not too much.

Figure 1: Consumer price inflation in the United States, Eurozone, United Kingdom, and Canada (annualized monthly inflation rate, January 2021 to September 2024)

Source: FRED database.

Figure 2: Structural government budget deficits (% of potential GDP) in the United States, Eurozone, United Kingdom, and Canada.

Source: IMF World Economic Outlook Database (October 2024).

Although we are not alone in this discussion, we were particularly displeased by the journal’s thoughtless resuscitation of this almost prehistoric line. Going back to the beginning of 2023, we tracked very carefully how federal spending flowed into the economy using a variety of data. When most supply-shock inflations occurred, it quickly became clear that most of the stimulus money had long since been spent. As we summarized, “The key data series, stimulus spending and inflation, are dramatically out of phase. The first recedes quickly, but the second emerges persistently.” do.”

In addition to climate change, war, and other shocks that everyone but the Journal seems to recognize by now, we have identified another source of inflation that the Biden administration never attempted to address. That is a huge increase in spending by the wealthy. As two subsequent studies have shown, the firehose of affluent consumption continues to drive inflation, particularly in the services sector.[1]

There is nothing mysterious about the source of this expenditure. Most of it stems from the historically unprecedented (in peacetime) massive increase in wealth among high-income groups generated by the Federal Reserve’s quantitative easing program.

But what’s strange is that both of these arguments are supported in recent research, even by the Federal Reserve.[2]According to Joe Manchin, it is simply foolish for the Journal to continue to preach the gospel as if there is no evidence to the contrary. And Democrats and anyone interested in a serious postmortem of the election need to get their facts straight if their deliberations are to be anything more than hollow predictions.

memo

[1] Ferguson and Storm, “Trump vs. Biden: The Macroeconomics of the Second Coming.” Good policy or luck? Why did inflation decline even in the absence of a recession?

[2] See Thomas Ferguson, “The INET Study and the 2024 Election.” SH Hoke, L. Feler, and J. Chylak, “A Better Way to Understand the U.S. Consumer: Disaggregating Retail Spending by Household Income.”