Most bond market investors, which provide funds for most mortgages, did not panic on Friday on Saturdays to report that the United States would impose tariffs on China, Canada and Mexico, but the details are rough.

INMAN ON TOUR: Raise the volume of real estate in Nashville! It connects to the pioneers of the industry and the top speakers, gain powerful insights, state -of -the -art strategies, and valuable connections. Enhance your business and achieve your bold goal -all with music city magic. Please register now.

Bond market investors who provide funds for most mortgages have not panicked on Friday, reporting that the United States will impose tariffs on China, Canada and Mexico on Saturdays, but how the housing builders have a duties. I am waiting for details about whether to do it.

Please participate in the Inman Intel Index survey in January

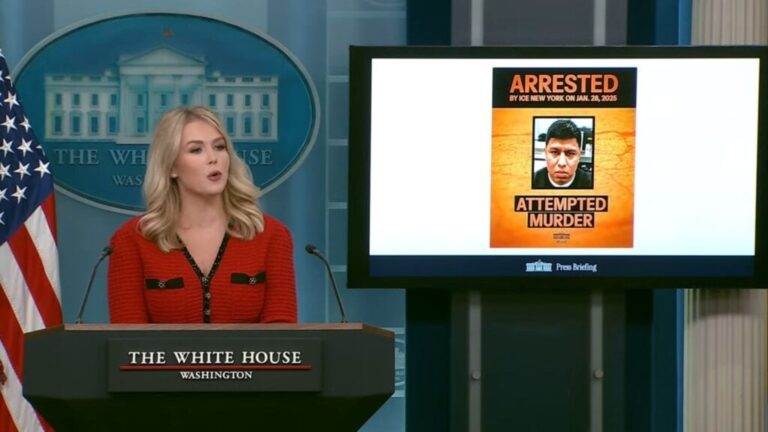

President Trump has previously stated that he intends to impose 25 % tariffs imported from Canada and Mexico. White House spokeswoman Calorin Ribit said on Friday that 25 % tariffs on Canada and Mexico and 10 % of the tariffs on China will come into effect on February 1.

Quoting an unknown management source, Reuters reported at the beginning of Friday that tariffs on Canada and Mexico products would come into effect on March 1, but could be exempted from a specific product.

The National Housing Construction Company Association (NAHB) has expressed “serious concerns” on Trump on Friday, expressing the potential impact on tariffs on affordable housing.

“Our sector depends greatly on the diverse and cost -efficient supply chains of architectural materials such as wood, steel, plaster, and aluminum,” said Nahb Chair CARL HARRIS on Friday. “While housing construction is essentially in Japan, architects depend on components produced overseas, and Canada and Mexico account for almost 25 % of the import of building materials. Added to these imports. Is to be a higher material cost, and ultimately hand over it to a house buyer.

The federal preparation system reduced short -term interest rates by three times at the end of last year, but the mortgage rates have risen. This is due to investors’ concerns that Trump imposes tariffs, reduces taxes, and expelled millions of immigrants. To be inflated.

(NAHB pointed out that immigrants accounted for 31 % of construction workers in the past, proposing immigration reforms rather than large -scale expulsions.)

The yield on bonds from the Ministry of Finance, a mortgage rate, has risen slightly on Friday afternoon transactions. After rising from 3.34 % to nearly 5 % from the first 52 weeks, the yield on the 10 -year note has withdrawn 50 Basis points, reaching 4.51 % on Thursday.

At a confirmation hearing on Wednesday, the billionaire Investor Howard Lutonic, a Trump commercial officer, rejected the worries that tariffs would resilience inflation, and called such a theory “nonsense.”

Lutonic said that if Mexico and Canada were tightening the border to stop Fentanyl entering the United States, they might win the exemption of specific products.

Deliver the Inman mortgage brief newsletter to the receiving tray. Weekly summary of all the biggest news in the mortgage and closing world held every Wednesday. Click here to sub -live.

Please email the matcarter