What is going on here?

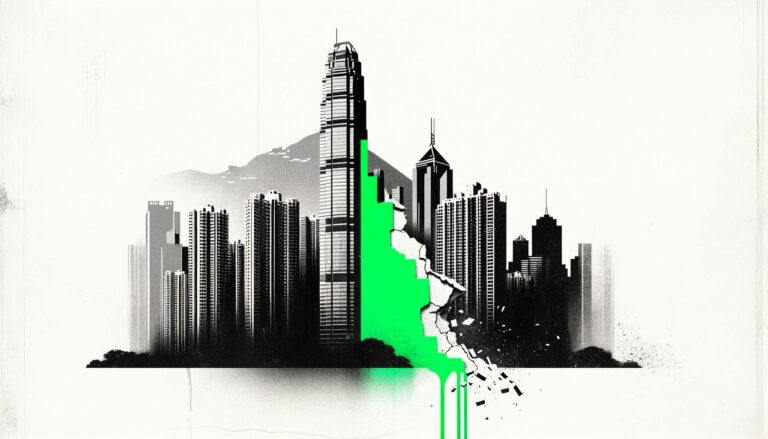

Hong Kong’s real estate market continues to face turmoil, with house prices falling for the fifth straight month in September, despite measures to revitalize the sector.

What does this mean?

Hong Kong property prices are on a downward trend, falling by 1.7% in September alone, but this is part of a broader 7.5% decline from December and a notable decline of 27.7% from the 2021 peak. It has become. This steady decline is driven by high mortgage rates and an exodus of professionals. Early attempts, such as easing restrictions on property purchases in February, briefly boosted demand, but enthusiasm has waned and developers have been forced to offer deep discounts to lure buyers. The government’s recent move to reduce the down payment ratio to 30% for all homes, including luxury homes associated with investment immigration, underlines its efforts to stabilize the market. Despite these efforts and a simultaneous 25 basis point interest rate cut by major banks such as HSBC, which mirrors the US Federal Reserve’s actions, uncertainty remains. Analyst opinions are divided. Knight Frank expects prices to fall 8% this year, while UBS expects prices to rise 5% by 2025 if demand from mainland China grows and mortgage rates fall. I predict that there will be.

Why should we care?

In the market: Developers are feeling the squeeze as buyers are hard to come by.

Despite interest rate cuts by major banks, housing demand remains sluggish, reflecting the cautious attitude of buyers. Developers are being forced to offer homes at deep discounts to keep sales going. As markets navigate these challenges, prospective buyers and investors will need to monitor for policy changes and interest rate changes that could significantly change the current dynamics.

The big picture: Economic reversals are shaping real estate drift.

Hong Kong’s real estate challenges are tied to broader economic implications. Migration of professionals and fluctuations in mortgage costs have a significant impact on market stability. However, the real estate industry could stabilize or even rise due to potential growth in demand from mainland China and global interest rate trends that suggest possible moderation. This situation highlights how interconnected regional policy and international economic changes can significantly impact market channels.