A recent Bloomberg article suggested that the Fed should declare a victory over inflation.

Certainly, declaring inflation that “the mission has been achieved” may feel premature, if not stupid. It’s not just about increased tariffs and reduced immigration. The economy has many structural factors pointing to more inflation. It’s a world where debt increases, labor falls, productivity growth slows, trades less and dollar-independent. Still, the victory of the declaration will make it easier for the Fed to formulate policies in the future.

First, there may be an inflation rate of less than 2% behind us. If so, the Fed should internalize this truth in its communication and policy. When you do the next framework review, you may need to increase your target rate from 2%. Nowadays, MS Infation is sometimes licked.

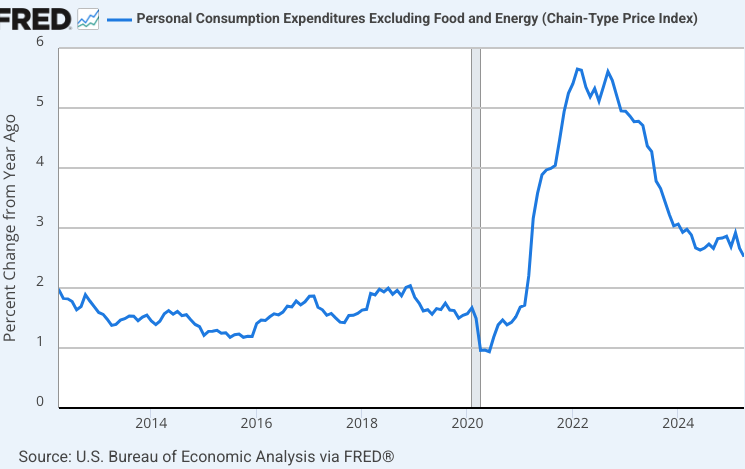

I’m not convinced that the victory has been achieved and I don’t think it’s a good time to raise our inflation targets. Here is the inflation rate for 12 months using the core PCE indicator:

Core inflation, which has recently dropped to 2.5%, is still above the Fed’s 2% target. Additionally, the Fed has flexible inflation targets. Under that kind of policy regime, inflation should be just under 2% during the boom and just above 2% during the recession. We are clearly in an economic boom.

There is no good economic debate to raise the inflation target by more than 2%. More importantly, even if a high inflation target is a good idea, it’s the best time to raise the target world between the next person with a rate near zero, not when the short-term interest rate is above 4%. Adopting a higher inflation target could be a powerful tool to stimulate an economy stuck at the lower zero limit.

In general, I am skeptical of the call to raise inflation targets. Doing so will reduce the Fed’s reliability as investors woven into them begin to doubt their commitment to low inflation. This can make it even more difficult to retreat inflation after long term consolidation of target rates.