Eve here. We create an aside with links and posts on how the Rothy market is. Investors do not appear to show signs of fear. This is historically a sign of bad outcomes. Wolf notes some exceptions that require additional private equity funding.

The big point about Wolf is in the headline. The Fed may view that rate as stable for the real economy, but as far as many leveraged speculators are concerned, they find it attractive.

by Wolf Richter, editor of Wolf Street. Originally published by Wolf Street

There are exceptions. Some commercial real estate is depression, and the zero-home market is frozen.

At the Fed’s press conference on Wednesday, Powell reindexes that the Fed’s policy rate (4.33%) is still substantially higher than inflation, turning around n ways that the policy rate is mild or moderately “restrictive.” Overall CPI inflatable accelerat is due to 2.7% and CPI cores in June, from 2.9% to 2.9%, particularly non-residential services, and services, which are two-thirds of consumer summoning.

This means that the Fed’s policy rate is significantly higher than any of the theory’s inflation rates. This means that policy rates will turn into a financial position that will allow inflation to cool down.

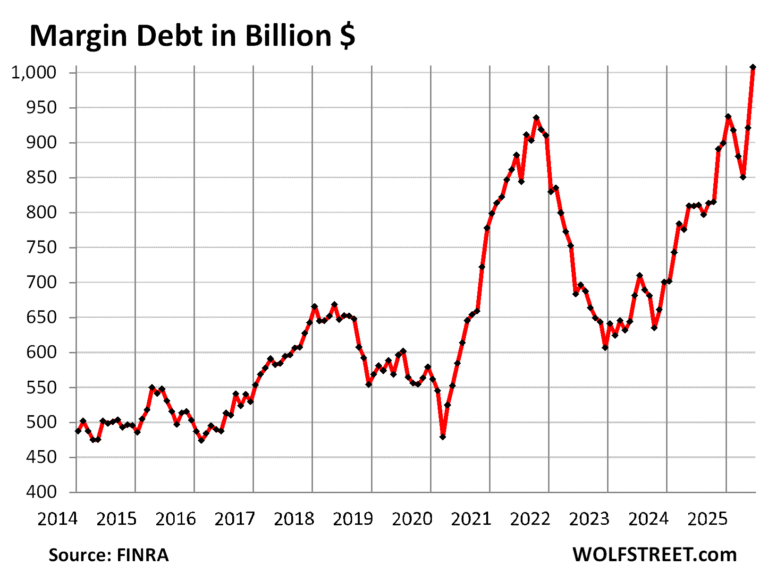

However, financial markets have beautifully blown this theory out of the water. They’re essentially ridiculing it. Stocks rise from record to record, and are very expensive by almost event measurements. Memestock mania once again burned in mass, and people united in a social medium where they were making bets on the shortest stocks, Coles, Opendor, Krispy Kreme and more. There are signs that other enthusiasts are taking the risk of hage, such as in full-scale basement, with fan attitudes all at once. And margin debt exploded for record amounts, records, and is on display in financial condition.

Among the left and right of the mania, Goldman Sachs reported 36% year-on-year spikes in second quarter stock trading volume, while Charles Schwab reported 38% year-on-year spikes and Morgan Stanley to a 23% jump.

Also, in the credit market, spreading between high-risk jack bonds and Treasury securities has been historically narrow, and it will be an exhibit of loose goosey financial position.

Certainly there are exceptions. Powell cited real estate as an example of a limited financial position. I cited both commercial properties. That segment has suffered from depression, including offices with record default rates. Also, as areas with home prices primarily 50% or more have frozen, the increase in mid-2022 in mid-2022 has already been incredibly long levels, and prices are economically meaningless. But it has not affected the entire economy to create a dent.

A relaxed financial display: Margin debt exploded, rising 8.3% in May and 9.4% in June to a record $1.01 trillion. In the dollar territory, June is the largest spike from the month to the month (+$87 billion). Combine margin debt with meme stocks, it’s magic.

In PERCantage terms, there were bigger spikes, such as in November and December 1999, just before the introduction of the dot-com bubble – less than three years later, Nasdaq Composite fell 78%.

Showing B of loose goosey financial terms: Junk bonds are entirely in Lalaland. The SP preed between BB Rated Juk Bonds and Treasury Securities has been reduced to 1.64 percentile points, according to the optionally adjusted spread of the Ice Bofa US Corporate BB Index. BB rated junk bonds generate just 5.64% on revenge (Wolf Street Cheat Sheet for corporate bond credit ratings by rating agencies).

The narrow SP between the BB valuation Juk band and the Treasury brokerage company is not paid for Taes’ risk as investors bid on the bond price like a substantial risk of default. They want to take a big risk to get a little more return.

There was even a narrower spread Apro dot com bubble, and there were a few others:

On March 9, 2005, the spread was narrowed to 1.65 percentage points. And in June 2007, just before almost everything exploded, they narrowed to 1.71% points.

And from off and on from November 2024 to February 2025, the spread was narrower or slightly smaller than it is now, with a presumably restrictive financial condition. During the lead-up and a few days later, during the horror parade of Rebation Day, the BB spread expanded sharply, peaking at 3.06% points on April 7th. But that’s gone now, and by July 25th, the spread had returned to 1.64 points.

All of this clearly shows that the Fed’s policy interests are not limited – but Powell wants to express this. The financial markets’ financial position is the most relaxed ever. There is no close fluidity anywhere. The market is still full of liquidity. There is nothing restrictive.