Eve here. This post states an interesting point about the fact that rating agencies are granted submativity and private companies, and currently only Microsoft and J&J are AAA ratings only. If US Iself is injuring, it would be unfair. This post unlocks that problem. It also addresses the various views these agencies hold about US reserve currency status.

I don’t go to a considerable effort to break down the author’s financially orthodox beliefs, but readers find themselves going to comment.

In a February interview with Bloomberg, Stephanie Kelton claims the downgrade was the Treasury Department

US debt is non-problem, bond yields and liability costs are managed by the Fed pic.twitter.com/yjesg6nauw

– Fiat Money (@fiat_money) May 17, 2025

Robert N. Macquarie, Non-resident Senior Fellow, Boston University, Center for Global Development Policy. Associate member of the Faculty of History at Oxford University. Originally published on Voxeu

On Friday, May 16, 2025, Moody’s “Investor Services” will downgrade the US Treasury’s credit from AAA to AA+ with a stable outlook. This first sketches the stripped theory of the relationship between reserve currency and sovereignty valuation in a set of three columns. IT profiles wide-lect ad misinformation of the US Treasury Department’s Moody’s downgrade, often written as a downgrade as a US country, indicating why it matters.

On Friday, May 16th, Moody’s “Investor Services” will reduce the U.S. Treasury credit rating by one notch from Golden AAA to a stable outlook Sterling AA+. Moody’s had posted the US Treasury 18 months in notice. This may have the most important assessment action in the history of assessment. Or at least the second rating must be important.

To understand the meaning of this event, the first of three columns about VOX introduces the event and sketches the basic, reduced formal theory of the relationship between reserve currency and sovereignty valuation. This column is often written as a downgrade of the US Treasury, incorrectly and incorrectly reporting downgrades of Moody in the United States, showing why it matters.

In column 2, we dive into the experience of the relationship between sovereign ratings and government debt burdens and the views of the lift rating agency that the dollar reserve gives to US Treasury ratings. Economists’ history of guessing recipes for rating agencies’ secret sauces is only a long generation, and for many of them data has not confessed to the role that budget deficits or debts must play in assessments of sovereignty. For years, the data confessed under degraded interrogation. However, the relationship discovered a decade ago fits uncertainty with the US Treasury, which was rated AA+/AA+ by Moody’s, Standard and Poor’s (S&P), and Fitch. I have a variety of views on how the role of the dollar reserve strengthens the US Treasury Department’s Saverin rating.

In the third column, I ask what market prices reveal about market participants’ views on how the role of the dollar reserve supports the creditworthiness of the US Treasury. Market prices send a mixed signal regarding the appropriate accreditation of the opinions of rating agencies. Strong evidence points to the US Treasury Department not being treated specially in the global bond market. The third column closes with possible interpretations and warnings: if the policy is set on the theory that the rest of the world must or will buy as much debt as Treasury Secretary Becent Frog, if so, if there is a policy. The risk is that market participants lend enough ropes to the US Treasury.

Moody’s catches up

The Moodys were not the first move. Moves in line with Broucht Moody’s S&P rating. This reduced the number of sovereigns

In 2011, the S&P oversaw the US Treasury for a downgrade to enter the Scary Congress debt cap debate. It downgraded the US Treasury days after the debate ended without default on the grounds of fraud and unsustainable borrowing. Investors have had to sweat another horrifying debt cap debate, a decade behind. Moody’s will also adjust the rating and rating of Fitch, which eliminated the US Treasury debt trajectory and “government erosion” in 2023.

Moody’s was redrawing the line path with the tail of the default probability distribution. Moody’s default study suggested that downgrades did not imply moles more than the possibility of a US Treasury default within five years, rather than 0.0%. A small beer?

Stephen Chen, White House Sharpshoter, fight back with X. He missed it. Sovereign Rating game standards, Offt Contact Sport, Moody went down with ease.

The following Sunday, May 18th, Treasury Secretary Scott, the US Treasury Secretary, attended the NBC conference and said that Larry Summers of All People, when S&P downgraded the US Treasury rating from AAA to AA+. “I think that’s a metric that’s lagging,” Becent said. “I think that’s what everyone thinks about credit institutions.” In other words, the downgrade was President Biden’s fault. In 30 years, the US Treasury was traded for a while after Moody’s unnamed exceeded 5%.

The day after Moody’s announcement, Toby Nangle of Ftalfaville said in a musical question, “Is Moody’s US downgragg in question in question is in question?”, worry about your path through 111 comments.

But this is serious. Moody’s wrote:

This one record downgrade on the 21 Notch rating scale reflects a decade-long increase in government debt and interest payment ratios to significantly higher levels than similarly rated Savereigns. [italic added].

Successive US administrations and Congress have not agreed to measures to reverse the trend of large-scale prosecutor obstacles and increased interstitial costs over the year. We do not believe that mandatory spending and deficits will reduce the multi-under material that comes from considering current fiscal proposals. Over the next decade, government revenues remain very flat, while expecting a long deficit as qualification spending is tolerated. Second, a large, sustainable, financial deficit will increase the government’s debt and interest burden. The performance of US prosecutors can be worse than their own past, compared to other highly corrupt sovereigns.

The now possible angle is the importance of the dollar’s advantage as global money. Back to Moody’s:

The stable outlook reflects the balanced risks of AA1. The US holds exceptional credit strength, including its economy size, resilience, dynamism and the role of the US dollar as a global reserve currency. Furthermore, although the recent months have been marked by some degree of policy uncertainty, the US hopes to continue its long history of VRY effective monetary policy led by the independent Federal Reserve. [italics added; fingers crossed (McCauley 2025)].

Reserve Currency and Sovereignty Evaluation: Cocktail Napkin Theory

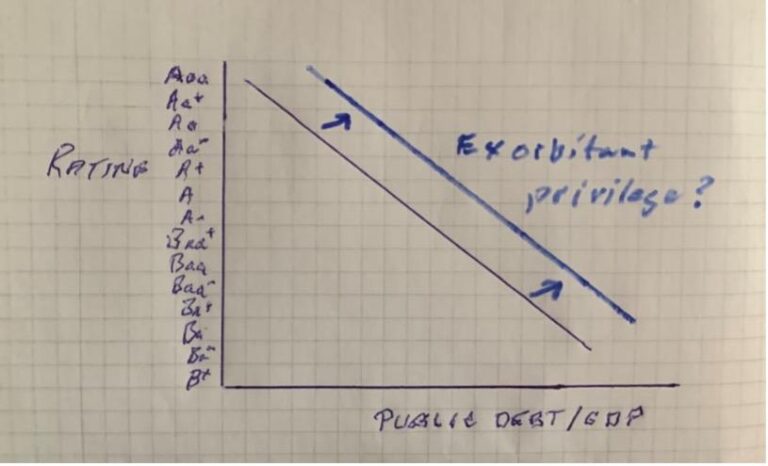

Perhaps the dollar as a global reserve currency gives the US Treasury a prisoner-based investor who eases the relationship between government debt burden measurements and sovereign ratings. The debt/GDP is on the horizontal axis in Figure 1, but has slots on your favorite scale (see below). We might call the shift in the northeasterly valuation deduction curve “exorbitant privilege.”

Figure 1. Government debt burden and rating i

Source: Author’s cocktail napkin.

But the role of the dollar reserves could also flatten the curve. Wings, this will reduce the incentive to order that house in Washington:

Figure 2 Government debt burden and rating II

Source: Author’s cocktail napkin.

For theory, cocktail napkin style.

What is the downgrade and why is it important?

In fact, Moody’s downgage was widely misdeclared to apply to the United States rather than the US Treasury Department.

Financial Times veteran Michael Mackenzie Bloomberg (although the Financial Times veteran John writer got it here the following Monday). Tony Rom, Andrew Duren and Joe Lennison of the New York Times. Kate Duguid, Peter Wells and George pilot the Financial Times.

Toby Nangle did it right the next day with ftalphaville. The praise for Matt Wiltz and Sam Goldfarb of the Wall Street Journal was Matt Peterson for getting the first draft of history right in his sister publication Barons.

To be fair to the fourth estate, many Wall Street analysts have similarly confused sovereign or government ratings with national ratings. Even a cautious scholar at New York University’s Stern School of Business has mentioned indifference to sovereign and national ratings.

The lesson is clear. Read the press release:

The ceilings of the US long-term and foreign currencies remain in the AAA. The local currency ceiling reflects the footprint of small governments in the economy, reflecting a very low balance between currency risk and payment crisis. foreign country [see Frances Fukuyama’s “Why doesn’t government work in the US?”] Open Capital Account [section 899?]risks of reducing agent transmission and conversion [italics added].

This is important. As Moody’s said, it downgraded many non-financial companies when it was downgraded after downloading Russian government debt and ceilings in Russia’s foreign currency in 2015.

The ceiling of the country generally indicates the highest valuation level that an issuer resident in that country can achieve for its type and currency tools.

To assume that if the credibility ceiling rage of the US country declines, the US state is not valued by all three major institutions. The Blue State Delaware and Virginia, Purple State University Georgia and North Carolina, Red State Florida, Iowa, Missouri, Ohio, South Dakota, Texas and Utah are coveted for AAA ratings.

Similarly, if a downgrade to the ceiling of a US country occurs, among top-rated US headcart trading companies, Johnson and Johnson may have lost their top-rated ratings as they were rated AAA/AA by S&P/Moody’s. (In a “very unusual” case, Moody’s assigns multinationals a higher rating than their local long-term and foreign countries ratings.) Should I place a band-aid on US debt?

The US Treasury Department’s Downgress did not downgrade the US state’s credit rating, but reduced credit rats in US government-sponsored companies that are below US mortgages. On May 19, Moody’s tracked down the US Treasury downgrade with downgrades of residential wards, Fannie, Freddie and Federal Mortgage Bank (the lender of penal-time resorts to US banks).

Fannie Mae, who thrives in the 17-year-old sanctuary, basts AA+/AA1/AA+ ratings from S&P/Moody’s/Fitch, like Freddie Mac. The Federal Mortgage Bank is currently rated AA+/AA1 by S&P/Moody’s. So Moody’s downgrade not only holds $23 trillion in US Treasury debt, but also puts the government-sponsored $9 trillion in debt that is outstanding. In short, the most consecutive downgrade ever for the global bond market would have diverged even more dramatically if Moody lowered the US country’s credit cap.

In the next column in this series, we face facts with the cocktail napkin theory sketched in this column. This highlights the role that rating agencies assign to the dollar reserve role in the U.S. Treasury credit assessment. The third column changes to market prices before laying out possible interpretations and warnings.

Author’s Note: Thank you to Claudio Borio and Frank Packer for the discussion.

See original bibliographic submission