Does it make sense? Among the White House’s demands for Venezuela is to “kick out” its harsh economic relationship with China.

The Financial Times declared that “Donald Trump’s actions in Venezuela pose a growing threat to China’s oil supplies.” Even Seymour Hersh reported:

Their abuse and crude language riveted the world’s media, while also diverting attention from the opportunistic Trump plan to not only unseat corrupt President Nicolas Maduro but, crucially, to cut off America’s economic rival, China, from its continued purchases of Venezuela’s cheap heavy crude oil.

Okay, but there’s a problem.

China is not dependent on Venezuelan oil

Mainstream media largely ignores this fact, but one thing is clear:

China is by far Venezuela’s largest oil customer (pictured left: https://t.co/9SokdGJ3Z6).

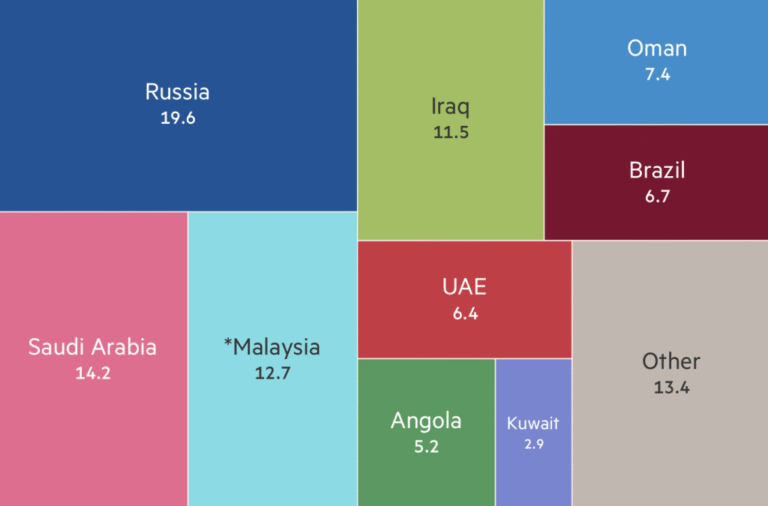

However, Venezuela only accounts for a small portion of China’s oil imports, and according to Chinese customs data, it is not even in the top 10 in 2024 (Figure on the right: https://t.co/WrXoVAQKlj). pic.twitter.com/YAJi8HhuF7

— Kyle Chan (@kylechan) January 7, 2026

Although China was the largest buyer of oil from Venezuela, these oil shipments accounted for only 4% of China’s oil imports last year. But Caracas supplies sulfur-rich crude used to produce bitumen used in construction and road construction, and Beijing was getting it at a deep discount thanks to U.S. sanctions on Venezuelan sales. According to the Business Times, Beijing has large reserves of the oil.

…The large quantities of sanctioned crude stored in floating storage will hurt Chinese buyers in the coming months. About 82 million barrels are currently on tankers off the coast of China and Malaysia, according to data intelligence firm Kpler. More than a quarter are Venezuelan and the rest Iranian.

China may take some blow from the US move towards Venezuela. In September, China Concord Resource Corporation (CCRC) installed a self-elevating offshore oil platform in Lake Maracaibo. From Venezuela analysis:

Privately owned China Concord has signed a 20-year contract to operate the Lago Cinco and Lagunillas Lago fields, reportedly investing US$1 billion with the goal of increasing production from the current 12,000 barrels per day (bpd) to 60,000 barrels per day (bpd) by the end of 2026.

Chinese oil majors Sinopec and China National Oil also have traditional claims to exploiting Venezuela’s oil reserves, but that seems unlikely if the US has its way. Still, let’s take a look at the composition of China’s oil imports, courtesy of the Financial Times.

As the Times points out, most of these imports from Malaysia are believed to be Iranian crude oil, which circumvents U.S. sanctions. And following the kidnapping of Venezuelan President Nicolas Maduro, American Zionists are once again focused on Tehran. Hirsch also reports the following obvious facts:

We hear that the next target will be Iran, another supplier to China, which has the world’s fourth largest oil reserves.

But even if Washington and Israel are ultimately able to overthrow the country’s government, relations between Beijing and Moscow will likely only grow closer. Let’s take a look at how its energy relationships have continued to evolve since Washington embarked on its grand plan to implement government in Moscow. First, let’s talk about natural gas. From Amwaj:

Following a summit between China, Mongolia and Russia in Beijing in September, Russia’s Gazprom and China National Petroleum Corporation (CNPC) agreed to launch the Power of Siberia 2 (PoS-2). The pipeline is designed to supply up to 50 billion cubic meters (cm) of gas to China annually. Although no firm timeline has been set, the project is expected to begin after 2030-31.

China and Russia have also decided to expand supply through existing gas pipelines. By 2028, Siberia-1’s power capacity will increase from 38B cm to 44B cm. On the other hand, the Far East route, which is scheduled to enter service in 2027, is scheduled to transport 12 billion cm of gas from 10B. Moscow also plans to increase liquefied gas exports to China through the new Arctic LNG-2 project and the existing Sakhalin-2 plant.

Despite Western sanctions against Russia, China began accepting Arctic LNG-2 cargoes in late August, becoming the project’s only major customer, thereby effectively keeping it alive.

Notably, Beijing is increasing imports from Russia despite analysts’ assessment that existing contracts are likely to cover the country’s needs for the next 10 years. It’s as if the Chinese government knows it plans to cut off its own supplies and relies on its most reliable and geographically convenient partners.

And it’s the same thing with oil.

Even if the United States were to crush other supplying nations and American pirates controlled most of the world’s oceans and blocked huge swaths of the oil trade, destroying its “Dragon Bear” hydrocarbon supply chain is an entirely different game than Venezuela or Iran, as the years-long failed Project Ukraine has shown.

But it’s not just about cutting supplies to China. As Nick Corbishley pointed out on Friday, even the most US-friendly countries in Latin America are struggling to sever ties with China. Even the US can’t do that. So what has Washington achieved on this front?

Big industrial planners or spoiled, destructive children?

Despite all the talk about Venezuela’s rich oil and mineral wealth, there are still many obstacles and someone would need to point to recent examples of the United States successfully building something.

Special attention to comrades:

Don’t be fooled by the lie that “it’s all about oil”

I have lived through multiple imperial wars where so-called “leftists” reflexively responded with the same lazy lines. “They’re just there for the oil.” I remember this clearly in the beginning… pic.twitter.com/i03Y48xA2n

—Chris Morlock (@CDMorlock) January 6, 2026

Morlock provides the following important notes:

Do you really believe that Trump is trying to become an industrial planner with his Palantir Technologies cronies? How can we somehow negotiate a $200 billion industrial oil expansion over 15 years in a country whose infrastructure has been deliberately strangled for 10 years without invasion, regime change, or national reconstruction?

This is a dream story within a dream story.

What is actually on the agenda in Venezuela is asset stripping, not asset exploitation. Companies in a position to “re-enter” Venezuela are overwhelmingly in good financial shape and have low productivity. Asset managers like BlackRock are in a position to absorb and restructure distressed sovereign debt and PDVSA-related debt, turning future production into a source of collateral rather than state revenue. Rather than adding capacity, the U.S. and European oil majors are waiting for production-sharing agreements, arbitration awards, and debt-equity swaps that would limit output and guarantee rents. Rather than expanding production capacity, sanctions relief is being used as a lever to discipline the country and force Venezuela into IMF-style restructuring, privatization, and legal subordination to Western capital markets. They want to make the Chinese pay for this oil in dollars, which is a bit of a nuisance for Xi Jinping and a foolish ploy against the West’s leasing oligarchs.

China reportedly holds approximately $19 billion to $20 billion in loans to Venezuela related to “oil loan” transactions. It’s not a huge amount, but it wouldn’t set a huge precedent if Caracas were to default on its debts and stop exporting resources to China.

“Control” existing production in the Western Hemisphere?

Oil majors are reluctant to enter Venezuela, but what about existing production in the Western Hemisphere?

Javier Blas writes in Bloomberg in the US that it controls all oil production in countries living under the “Don Roe Doctrine”, from Canada to Argentina. This corresponds to approximately 40% of the world’s oil production.

Blas now thinks the United States can control this vast territory, but with Canada as a client state and much of Latin America shifting to the right and toward the United States, is he right, at least when it comes to oil?

President Donald Trump now has his own oil empire. And I’m not talking about underground reserves, which take time and money to develop, but about the current barrels that are already flowing into the market1. With these resources, Mr. Trump has economic and geopolitical clout not enjoyed by any U.S. president since President Franklin D. Roosevelt in the 1940s. His country has access to vast oceans of oil at or near his home. The implications of unfettered access to Venezuela’s reserves, the largest in the world, were immediately clear to those in the energy and commodity business, especially to America’s adversaries. U.S.-sanctioned Russian oligarch Oleg Deripaska put it well on Saturday: “The United States will now have the means to keep oil prices close to $50 a barrel, giving us a future advantage against any forces that seek to suppress supply and drive up prices.” Kirill Dmitriev, a delegate from the Kremlin, said Venezuela’s seizure of power would give it “huge influence” on global energy markets. Effective control of the Western Hemisphere’s oil resources would bring about geopolitical changes. For decades, American military adventurism has been constrained by the energy cost implications of war. Today, the White House has advantages over oil-producing allies and adversaries alike, including Saudi Arabia, Iran, Nigeria, and Russia. The past 18 months have already revealed what these new hydrocarbon riches mean for U.S. foreign policy. The Trump administration took 11 unexpected steps, from bombing Iran’s nuclear facilities to helping Ukraine target Russian refineries.

There is also talk that the move against Venezuela could have a larger impact on neighboring Guyana in the near future.

While the world focuses on Venezuela, the real story may lie in neighboring Guyana. There, the world’s most important new oil frontier was under direct threat.

President Maduro’s claim to two-thirds of Guyana’s territory (the Essequibo region) amounts to more than 11 billion barrels onshore and… pic.twitter.com/tHC6Ljh81D

— Jack Prandelli (@jackprandelli) January 5, 2026

And then there’s the old “swingman” argument.

⚠️US reserves last only 7 years

But 13 million barrels per day are produced 🇺🇸🛢️

The US is not in the top 5 for proven oil reserves.

At current production rates, it has a useful life of approximately 7 to 8 years.

And yet…

America is the world’s oil swing machine

🔥 ~13 MB/day… pic.twitter.com/N4ssuY4aA6

— Jack Prandelli (@jackprandelli) January 9, 2026

But what about China’s role as a “swingman”? Kevin Walmsley said:

China is very well protected from oil supply-side shocks, no matter where they come from.

This is currently an alarming situation for economists and oil market experts. China is the world’s largest crude oil importer and the world’s largest oil consumer. Until recently, the traditional thinking was that oil supplying countries such as OPEC+ set the world price of oil, while major importing countries such as China set the market price. Now, if the market faces an oversupply, OPEC countries will temporarily set prices until they can curtail production to rebalance supply and demand.

However, new developments have overturned all that conventional wisdom. It is China’s huge and still growing oil storage industry. That puts a floor on world prices. The Chinese buy oil when the price is low enough and stash the surplus in tanks. But there is also a price ceiling, and if prices rise, China will simply cut back on imports or draw down inventories until prices fall again.

Where does that leave us? That sounds like a counter-strategy against Russia. Rather than blocking Russia’s ability to sell, Washington is now targeting China’s ability to buy. The real danger for China, and for the rest of the world, is not that the United States is likely to succeed. It means that the newly incarnated Washington believes it can intimidate, defeat, crush, and grab whoever it wants, wherever it wants. And treat the world as a game of risk.

This is a strategy map by. @conGeostrategy We must learn in the new cold war between Anglosphere and Dragonbear. Venezuela is no longer red. Greenland will face an increased American presence. The main interconnected flashpoints will be from the Arctic to the Indo-Pacific. pic.twitter.com/kUFtOUkPaZ

— Velina Chakarova (@vtchakarova) January 8, 2026