Eve is here. Even before the risk of President Trump’s price-based tariffs rising, key inflation indicators were trending in the wrong direction.

Written by Wolf Richter, editor of Wolf Street. First appearance: Wolf Street

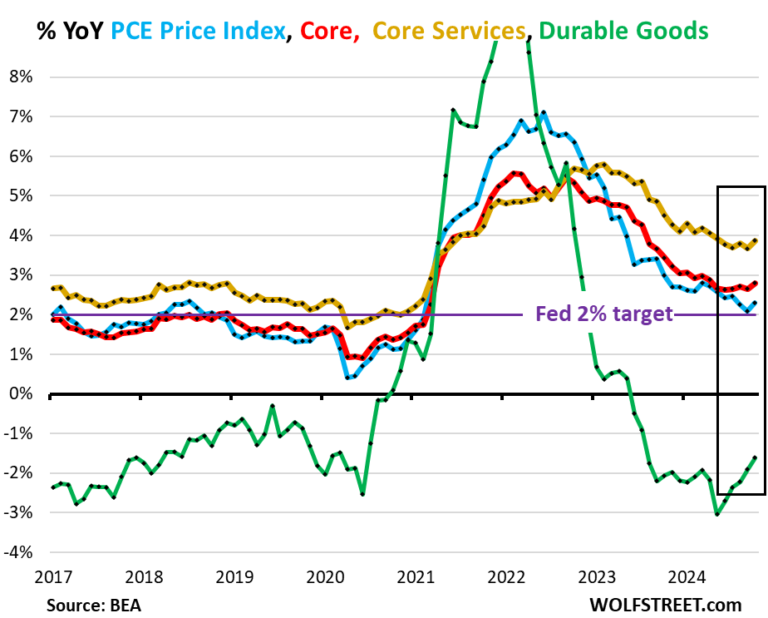

Inflation has continued in the service industry, and inflation continues to persist in the service industry.Inflation has become rigid in the service industry, and has recently accelerated again in the service industry. Services account for the majority of consumer spending. In addition, durable goods prices rose for the second consecutive month after falling sharply. However, today’s Bureau of Economic Analysis PCE Price Index shows that gasoline prices continued to decline and food prices rose slightly. This is the data the Fed prioritizes as an indicator of its 2% inflation target.

Three of the four major indicators also accelerated year-on-year in October. The overall PCE price index is +2.3% (blue), the “core” PCE price index is +2.8% (red), the “core services” PCE price index is +3.9% (gold), and the durable goods PCE price index is +2.8% (red). It has started to rise out of the ashes and the negative width has narrowed (green).

The Fed has already talked about reducing the pace of future interest rate cuts in recent days, including in yesterday’s meeting minutes and in speeches by Fed board members.

Driver: “Core Services”. The PCE price index for “core services” accelerated in October from September to an annualized rate of +4.4% (annualized +0.36%), marking the first significant increase since March (blue in the chart below). The three-month Core Services Index accelerated to an annualized rate of 3.8% (red).

Key services include housing, health care, financial services and insurance, transportation services, non-energy utilities, communications services, recreational services, food services and lodging, and “other” services. However, energy services such as electricity to households are not included.

Compared to the same month last year, the core services PCE price index accelerated to 3.9%, the largest increase since May. There has been basically no progress since May.

The “core” PCE price index accelerated in October from September to an annual rate of +3.3% (+0.27% annualized), the largest month-on-month increase since March.

This month-over-month acceleration was driven by an increase in the core services PCE price index (see above).

The “core” index attempts to show underlying inflation by excluding food and energy components, which can move up and down with commodity prices.

The 3-month Core PCE Price Index accelerated to +2.80% annualized, the third consecutive acceleration and the fastest increase since April (red).

The 6-month Core PCE Price Index accelerated to an annualized rate of +2.34% (red) and remained higher than at the end of last year for the entire year.

The Durable Goods PCE Price Index rose 0.7% in October from September (annualized +0.06% in conversion). deflation).

The month-on-month increase in October was due to automobiles, but prices for household furniture and electrical appliances, recreational goods and automobiles, and “other” durable consumer goods fell.

As a result, the negative range of the six-month index has narrowed (-1.8%, red line).

Additionally, the year-on-year rate of decline in the index has narrowed. See the green line at the top of the first graph (-1.6%).

Durable goods prices have trended downward on average in recent decades due to improvements in manufacturing efficiency, technology, and the offshoring of production to cheaper countries (globalization). For decades, the main driver of inflation has been services. During the pandemic, prices for durable goods have skyrocketed due to sudden demand fueled by massive economic stimulus, and consumers are suddenly willing to pay anything for goods, creating huge demand for goods. , overwhelming the supply chain and giving companies enormous pricing power. Its pricing power:

The overall PCE price index, which includes food and energy components, rose 2.3% year-on-year in October, compared to September (+ 2.1%). -1.0% YoY, -1.0% MoM (not annualized).

Food and energy prices account for the difference between the overall PCE price index (blue) and the core PCE price index (red). As food and energy prices soared in 2021-2022, the overall PCE price index jumped to +7%, while the core PCE price index, which tracks underlying inflation beyond commodity prices, rose to 5.5%. reached its highest value.

Energy prices have been falling sharply since mid-2022, with the overall PCE price index decelerating faster than the core PCE price index, with the latter reaching a higher level.