Eve here. In particular, the cheap Russian gas that German and Italian manufacturers rely on had submissions on the consequences of Haumann’s deindustrialization. However, I must confess that I don’t see much about the impact of China’s exports on Germany, which will hit hard before the self-harm of Russian gas. However, looking at the “catastrophic competition” between quite a lot of Eves and Chinese automakers’ illnesses, the Chinese EV and battery manufacturers, it’s not difficult to see why Germany is already wobbling before energy costs infuse it. Certainly, as this article points out, Chinese machine tools were the second route in which China eats German lunch.

Remember that the impact of the Chinese invasion sector is different from the cheap self-useful life. Energy-intensive concerns from chemical producers, paper plants, and aluminum manufacturers have started to rapidly cut production when energy prices increased.

Daria Marin, senior research fellow. Professor at the International Institute of Economics and Technology in Munich. Originally published on Voxeu

Trade with China expelled some of the American workforce in the 2000s, but Germany had not experienced the same shock at the time. The column argues that “Chinese shock” has been hit by the German economy individually in the core automobile and machinery sector since 2020. The painful departure of Tovoid America in the 2000s, Europe’s entry into the Chinese market must be conditional on the formation of a joint venture with European companies to maintain its global glory competitiveness. These joint venture shrouds are carefully designated to deliver technology transfers to Europe and build resilient upstream capacity on the continent.

In a series of influential papers, authors etc. (2013, 2016) Trade with China is a document that China destroyed much of the American workforce in the 2000s after joining the World Pursuit Biology (WTO) in 2001. In previous episodes of trade liberalization, workers submissions in the import sector were evacuated by foreign competition, but usually found work in the export expansion sector. However, the “Chinese shock” that the author and co-authors created in the 2000s were completely different. The competition was very quick, sudden and concentrated in a particular region, making the American factory world difficult and the sub-regions fully industrialized. Much of the world moved to the services sector, which paid more than before, with sub earning welfare salaries. In 2016, Trump won the election. (2020) Related to trade-related job losses.

Germany was not shocked by China in the 2000s.

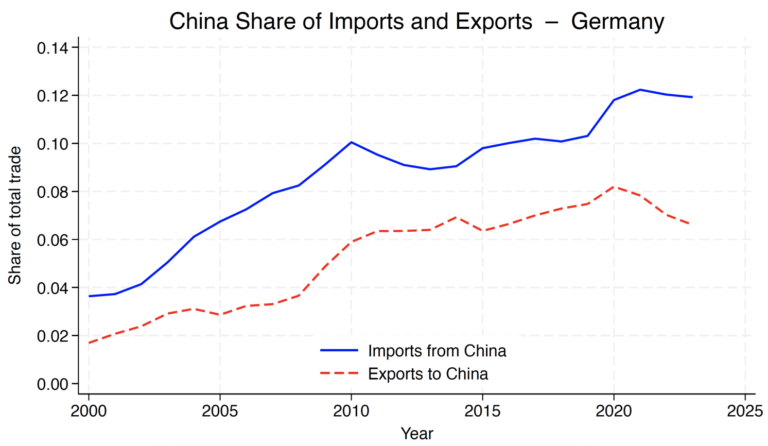

Germany did not experience a similar Chinese shock in the 2000s (Dauth et al. 2014), but the impact shock from China was as severe as the US. The change in the share of Chinee imports in the total imports of Peri1-27 was 213.5% from 3.7% to 7.9% in Germany (Figure 1) and increased by 188% from 8.6% to 16.2% in the US (Figure 2).

Figure 1 China’s share of total imports and exports in Germany

Figure 2: China’s share of total imports and exports in the US

In contrast to the US, Germany’s exports to China were booming. STI export stocks to China increased by 227% from 3.3% of total exports in 2007 to 7.5% in 2019 as German machine tools and the automotive industry helped industrialize the Chinese economy (Figure 1). In the US, exports to China increased as the share of total exports rose to just 23.7% on the same poll (Figure 2). 1

2020 German China Shock

Trade with Germany with China has changed suddenly since 2020. Between 2020 and 2022, imports from China increased by more than 60% based on official data from the German Bureau of Statistics (Figure 3). In late 2023, Germany ended its nationwide purchase subsidies for battery electric vehicles, known as the “environmental bonus” that promotes the import of electric vehicles in particular in China. Furthermore, in 2024, the European Commission introduced tariffs on the import of battery electric vehicles from China by up to 45.3%. Brussels also issued a tariff on imports of mobile access equipment (construction equipment) from China, ranging from 20.6% to 66.7%. Import obligations have been introduced for a variety of chemical products. It will contribute to a sudden decline in Chinese imports from 2023 to 2024.

Figure 3 Imports from China have exploded since 2020

The historical changes in German trade patterns with China can be seen in Figure 1. Since 2019, China’s share of German imports has increased by 30% from 10% to 13% within three years. Exports to China also suffered, and China has found 20% of total exports.

What drives this trade pattern? Figure 4 documents the two core German industries (automobiles and mechanical tools) experienced historical change. In both industries, Germany has stopped becoming a net exporter to China. Auto exports to China fell dramatically by 70% between 2022 and 2024. Giant competition in China and China’s advances in electric vehicles have led to Chinese consumers shifting from Germany to the Chinese model. At the same time, after import duties on electric vehicles from China are not possible, they will import from China more than twice as many times from 2020 to 2023 from 2020 to 2023. For the first time, automobile trade with China is balanced in the second half of 2024.

In machine trade, Germany has already become a net import of machinery tools from China in 2015. After the introduction of import duties, machine imports from China more than doubled between 2023 and 2024 between 2020 and 2024 have more than doubled. Exporting machinery to China is difficult. This development is dramatic given the importance of importing machinery from Germany for the industrialization of the Chinese economy.

Figure 4. Machine trade with German automobiles and China

The table has changed. China is now the world leader in batteries and electric vehicles (and machinery), while Germany was the world leader in combustion engines. China’s size, experience and subsidies helped China learn and expand its production. In a classic paper introducing learning curves into trade and trade models, Krugman (1987) shows that grants can speed up the learning process, increase productivity in the subsidy sector, and thus put competition at a disadvantage. Krugman’s theoretical argument recently discovered empirical support by Lane (2025). Using the Korean sector-specific industrial strategy under President Park Chong Hee as a natural experiment, he discovered in Revenge that subsidized industries experienced an average growth rate of 80% higher than you. The growth benefits persisted even when subsidies were removed, highlighting the learning effect. Therefore, Germany faces the threat of losing two core sectors to China’s competition. Europe needs to maintain import duties to promote learning in the face of a transition to electric vehicles and battery technology. The European Commission should also encounter Chinese investment in Europe (Marine 2024).

Europe needs to have conditional market access for joint ventures

Germany and Europe should avoid the painful deindustrialization of America in the 2000s. The German China shock would be worse than what the US experienced in the 2000s, as automobiles and machinery are two core sectors of the German economy. These two sectors take on the majority of Germany’s R&D and play a key role in future technology and innovation. In the US, China’s shock has hit low-cost industries such as furniture, textiles and clothing.

To this end, Germany should reverse China’s industrial policy by making market entry into the European market a conditional on the formation of joint ventures with European companies. I warned in August about the possibility of China’s shock for two years (Marin 2023a, B), and proposed that the European Commission should mediate a partnership with China by providing China with access to the European market in search of commitment to investment companies. Over the past 20-30 years, China has requested foreign investors to establish joint ventures as a condition of entry into the large Chinese market. By working with Chinese electric vehicle and battery manufacturers, German has been able to acquire technical expertise in electric vehicle and battery to remain competitive worldwide. The European Commission adopted this policy in 2024 (Financial Times 2024) and introduced the “Industrial Action Plan for the European Automobile Sector” in 2025 (European Commission 2025).

Early challenges and failures by European companies, production batteries without foreign partners, are reinforcing the need for partnerships with China. Two important examples are the joint venture between Northvolt and AC (Airbus battery), Mercedes, Stellantis and Total Energy. At Boest, the core problem was expanding production. During the startup phase, European battery companies experienced a battery scrap rate of almost 90%. They make this a valley of death until the batteries are profitable (Les Echos 2025a, B, Financial Times 2025). But by the time they make a profit, they may be out of the market. By partnering with Chinese EV and battery companies, European companies can skip the launch phase and move directly to profitability.

For this to work, joint venture agreements with Chinese companies must be carefully designed to ensure Chinese technology investments are transferred to Europe. The danger is that you remain trapped in assembly activities without learning before you become. The European Commission should request a share of 50/50 ownership between European partners and Chinese partners, and request that China send 25-30% of Chinese experts to these joint ventures to train European partners. Local European input requirements are not desirable to build a resilient upstream capacity.

summary

This column records the arrival of China in Germany, threatening its core sectors: cars and machinery. We will also discuss what the European Commission is showing to prevent an industrialisation shock even worse than what the US experienced in the 2000s.

See original bibliographic submission