Eve here. Rajiv Sethi unleashes false branding and justification of Trump’s tariffs. Don’s Get Me starts on the day of the Liberation Loser.

Seti mentions the omission of trade in services from Trump’s calculations. It will only evacuate not only high-tech players like Google, but also financial services companies.

I hope Sethi points out the stock market response as a measure of disastrous programs (particularly because Wolf Richter points out that stocks are still growing annually). “Flying to Safety” assets would be preferred for movement, estimates of economic impacts, and anecdotes.

Rajiv Seti, professor of economics at Bernard University. Originally published on his website

If you mean that mutual duties imply the imposition of import obligations on others that match what they are currently imposing on us, you may not be alone. However, police announced yesterday are based on different, obedient removals.

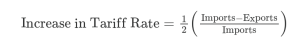

In short, the tariffs proposed to each country are based on bilateral transactions in goods as follows:

Here, the molecule is the bilateral trade deficit of the country’s goods, which is usually positive – with few exceptions, we buy more goods from our trading partners than we sell to them. If the above calculations result in negative numbers (or positive numbers below 10%), a fixed price of 10 perent applies.

For example, last year the trade deficit for goods with China was $295 million, and imports of goods was $4390 billion, with the new policy increasing the tariff rate (after rounding) of 34%.

What is omitted from this calculation is the trade in services with China, which had a surplus of approximately $27 billion in 2023. The following services are explained in detail:

The simple formula above is implied by the more complicated equations Ben posted the White House.

Here, the subscript I refer to the country, ΔT is a proposal for a change in the dual-sided tariff rate, X and M respectively indicate exports and imports on both sides, φ is this passing (a measure of the sensitivity of demand to price). The Management Economist is involved in these two parameters with 0.25 and negative 4, respectively, bringing the many simpler formula parenting expressions at the top of this post. This SEM is increasing by half to increase the final tariff rate.

There are many problems with this approach to trading Polly. I’ll mention just a few.

First, consider omitting the service. Imagine a country with a trade balance overall. But imagine a good deficit and a surplus in offsetting services. In this case, the country will be hit by tariffs, and the size of this TIFF will increase the volume of total trade. This means that if our goods imports and services increase in tandem, the rates increase while maintaining a balance of trade surplus. It is difficult to imagine that this cannot be retaliated in vain for a country that has been woven into it.

Second, consider multilateral trade flows. supos we have a national addiction. And the surplus with B ensures that trade with both countries is in good balance. Under the proposed formula, Bush countries will be hit by tariffs. As the total volume of trade rises during overall balance maintenance and transactions of the same pattern rise, the previous countries face higher rates, while the latter continues to face a lower 10% limit.

Third, it makes no sense to apply the same elasticity and pass the parameters to all trading partners. Imports automobiles and dental tools from Germany and cuts flowers and coffee from Colombia. Substitutes for Bese products differ as well as the conditions in which they are produced. For example, in industries with low profit margins, fees can be handed over to prices. And products with many available alternatives will have a more elastic price in demand.

Fourth, and in my opinion, such a ham handpoly would have a lasting effect on geopolitical alliances. We have already seen signs of an increase in coordination between the three Asian forces that have historically maintained arm length. Canada is about to escape from extreme dependence on our economy. The German sense of betrayal is clear. and so on.

The justification given by the White House for this policy initiative is:

The massive, permanent trade obstacles for annual US goods are screaming from manufacturing bases. We have suppressed our ability to expand our advanced domestic manufacturing capabilities. Damage important supply chains; favor defense industrial bases that rely on foreign enemies.

These are legal concerts. However, protecting industries from import competition is counterproductive. There are cases where it is done for manufacturing revivals and carefully crafted industrial policies. 2 And there are sectors that already enjoy global domination, such as the entertainment industry and Heiger Education. The former is hurt by tariffs, but the latter is as we speak, as we are. You will have an effect that will worsen our trade balance.

The economic issues we face are serious, but this is not a serious way to deal with them.

Market response to mutual tariffs.

_____

1It is difficult to escape the conclusion that a parameter value has been selected by working in the reverse direction from the desired endpoint. Previous versions of this post missed the fact that tariffs have been halved compared to the formulas posted. I would like to thank the alert reader for pointing this out.

Two sub-very well-known economists will oppose this claim. For example, Larry Summers argued that “it is wrong to think of manufacturing-based economic nationalism as a path to a higher lower or middle class living standard.”