Chinese e-commerce giant Alibaba has pledged to spend more than $50 billion on artificial intelligence over the next three years.

CNBC | Evelyn Chen

SHANGHAI – Chinese technology giant Alibaba has already recouped its investment in artificial intelligence in its e-commerce business, Vice President Kaifu Zhang told reporters on Thursday.

China’s tech giants are betting big that AI will generate profits, despite market concerns that companies are spending too much on the technology when it’s delivering too much. Alibaba announced last month that it would increase spending on AI and cloud infrastructure, and in February pledged to spend 380 billion yuan ($53 billion) on the technology over the next three years.

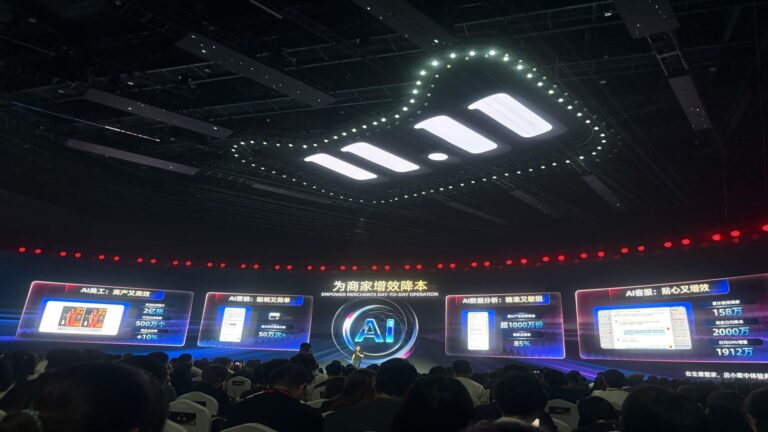

Zhang oversees e-commerce AI applications at Alibaba. Earlier in the day, we shared how the company has been deploying a variety of AI tools, from personalizing search results to improving the accuracy of virtual clothing try-ons.

The presentation came a day after Alibaba launched pre-sales for Singles’ Day, China’s biggest shopping event of the year, which is similar to Black Friday.

Chan said preliminary tests showed consistent results from the AI, including a 12% increase in return on ad spend.

“It’s very rare to see a double-digit change” in such tests, he said in Mandarin, as translated by CNBC. Zhang predicted that thanks to the integration of AI, there will be a “huge” positive impact on Alibaba’s total circulation during this year’s Singles’ Day shopping period, centered on November 11.

Alibaba’s China e-commerce arm remains the tech giant’s biggest source of revenue, worth $19.53 billion in the quarter ended June 30, up 10% from a year earlier.

Despite China’s lackluster consumer spending in recent years, during Singles’ Day last year, research firm Shintung estimated that Alibaba’s Tmall, Jingdong Market and PDD had sales of 1.11 trillion yuan, an increase of 20.1% from the previous year.

In its late August earnings call, the company cited AI and consumption as “two major historic opportunities” that will require investments of “historic scale” in Alibaba.

“Our top priority at this point is to make these investments,” CFO Toby Xu said at the time. “So we may be relatively unfocused on margins at the moment. But that doesn’t mean we don’t care about margins.”