This is Naked Capitalist Donation Week. The 554 donors have already invested in our efforts to combat corruption and predatory top struggles, especially in the financial realm. Please participate. On the donation page, please show us how to offer via checks, credit cards, debit cards, PayPal, Clover, or Wise. Reading why we are doing this fundraiser, what we achieved last year, and what we are currently aiming to support the new Coffee Break/Sunday movie features

Eve here. It must have happened to me that venture capital funds and valuations are at least becoming AI Doma Domadat, just like public stocks. The following Wolf accounts are eye-opening.

A stock market crash will not cause a financial closing. The US and other countries avoided landing restrictions on margin after a major crash to limit such things. However, a downward trend in stocks can cause a serious recession. One reason is that many paper wealth lurks and reduces spending. The other is that for businesses that have hit crashes, they will crash with Acer because there is a fundamental business abolition due to the same fictional prospect that the bubble will become a poof or lose funds. For example, in the DOT COM era, many consulting companies, including McKinsey, who are inflated using Mania in response to Mania, are many consulting companies, including enthusiasts, to recommend what to do to older economic businesses, form incubators, and advise internet play in return for equity. McKinsey took over $200 million in writing, reducing North American staffing by 50% over two years, providing research for a bit. Therefore, don’t underestimate how far the collateral damage will grow.

by Wolf Richter, editor of Wolf Street. Originally published on Wolf Street

AI Startups’ aggregate aggregate valuation (the latest post-financing round valuation) rose from $1.69 trillion in 2024 to $2.69 trillion from $469 billion in 2020.

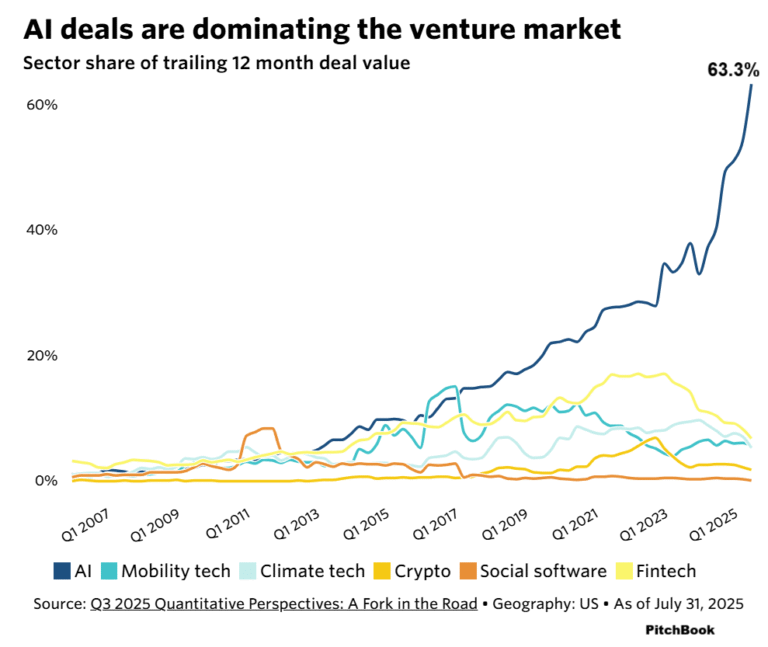

“AI transactions will now dominate the entire venture capital market with prosecutors’ clips, and warn the rapid concentration of investments during previous hype cycles such as crypto and mobility tech,” Pitchbook said.

AI startups increased from 63% of venture capital investments made during TTM 12 mouths (TTM) and 40% of TTM THRCH Q3 2024, from 23% in the TTM Thruh Q3 2020 (blue line in the chart).

According to CNBC, Openai was valued at $500 billion in its early Sepaner. In April, Openai raised $40 billion, primarily from SoftBank, and made its breathtaking money post money post money valuation to $300 billion in fundraising. The sky is not a limit.

Sources cited by CNBC say Elon Musk’s Xai is being filmed with abandoning its $200 billion valuation in a $10 billion funding round. Musk denied, “Fake News. Xai is currently not raising capital.” Well, not now. Or what?

According to humanity, after raising $13 billion in the Series F funding round, there is humanity’s rear at a post-money valuation of $183 billion.

and so on. These ratings of AI startups are daunting. How will Tobe’s final investors end their investments with their skin intact?

ASEE companies must be exposed to a huge valuation at HGE IPOs and then the stock needs to trade higher from there to allow slow investors to sell the stock without tanking the stock price.

ai-aything brings cash. 90% will import and take cash from all investors, and 8% will cut it in sub subjects, but 2% will become a $1 trillion company in IPOs, and 2 trillion shares will solve all the subjects.

Unfortunately, it’s the biggest AI-Aything IPO and the biggest IPO of 2025, and you’ve caused a lot of heart tolls. The stock rose 250% in the crack at a price of $33 at the IPO, then jumped again on the second day to peak at $142.92, then plunged to 63% to 51.87 Ally.

In the South, pre-IP investors still earn big profits, but most investors who purchased publicly traded shares are deeper into red. Additionally, when IP Pre-IP Investmers tries to sell removal haage stakes, they can crush their inventory even further.

However, Figma’s market capitalization is only $25 billion. AI-Comany CoreWeave, the second largest IPO of the year, has been on track since the IPO, but has a market capitalization of just $68 billion. They are an order of magnitude smaller than what late investors need to withdraw from ESIR Mega-AI companies.

How will these mega-valued AI companies be exposed at a large enough valuation of $500 billion, and Ben rises well from there, earning late investors unharmed on their skin?

Obviously, we’ve seen it over and over again in this immeasurable bubble. The sky is not at its limit, we have seen miracles happen every day. However, in these ratings, “the exit hurdle is very large,” Pitchbook said.