On Monday, U.S. Vice President J.D. Vance on his visit to Armenia announced an $11 million deal for U.S.-made reconnaissance drones.[1] According to Vance, it is the first military technology sale from the US to Armenia, and one would suspect it won’t be the last.

It’s exactly what Iran and Russia feared when the US weaseled its way into the Caucasus with the Trump Route for International Peace and Prosperity (TRIPP), which is slowly aiding a Turkish-led march of Western NATO influence into the Caucasus—and potentially into Central Asia.

So what do Tehran and Moscow do now? While they enjoy the upper hand in this geopolitical game based on simple geography, the US and friends are transforming the terrain into a figurative minefield.

There are calls growing louder from both countries to act more forcefully to put an end to the creeping US and NATO presence in the Caucasus before they become an even bigger headache. Let’s first survey the lay of the land before looking at those arguments. For organizational purposes, we’ll trace Vance’s movements of last week and cover Armenia first and then Azerbaijan. In a Wednesday post we’ll deal more with Central Asia and how the Caucasus are viewed as a launching pad to the Great Game table.

TRIPP Wire

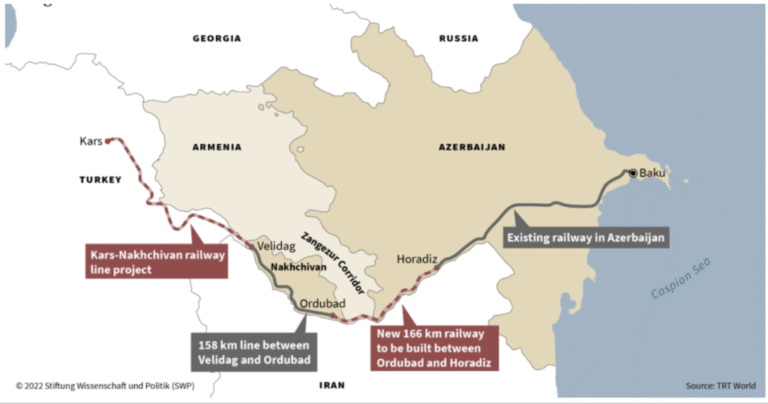

So much of the tension in the Caucasus is wrapped up in TRIPP and specifically 43-kilometer (27 miles) corridor across southern Armenia that would connect Azerbaijan to its autonomous Nakhchivan exclave bordered by Armenia, Türkiye, and Iran. TRIPP envisions rail and energy infrastructure moving through the passageway.

Russia had designs on a controlling stake in such a corridor, especially after it brokered the peace between Armenia and Azerbaijan following their 2020 war, but Moscow was pushed aside after a series of manufactured controversies.

Instead Washington and Yerevan have a deal for the US to hold a 74 percent stake in corridor infrastructure for fifty years, before dropping to a 51 percent stake.

Not only does this upset Moscow’s plans for more trade connectivity, but TRIPP will cut Iran out of its role as a go-around between Azerbaijan and its exclave—and Türkiye. From Tehran’s perspective TRIPP looks a lot more like an effort to sever its land border with Armenia—and with it, a land route to Russia—further encircle the country and bring hostile actors to its border, and march US/Turkish/NATO influence across the Caucasus to the Caspian—and potentially beyond into Central Asia.

On the one hand, TRIPP might be bringing peace and prosperity for a few parties that benefit, namely Türkiye, which is already taking steps to increase economic ties with Armenia. The two sides just agreed to allow direct bilateral land trade via Georgia, meaning intermediary companies will no longer need to reclassify Turkish goods as separate exports upon entering Georgia. Reopening the land border between Türkiye and Armenia might not be that far off.

These are all pieces of a vision to see energy and resources flow westwards from Central Asia across the Caspian through US/NATO-aligned states and thereby cutting out Iran and Russia, but there are a bevy of reasons that hasn’t happened yet, which we’ll deal more with on Wednesday.

This, along with unproven American nuclear reactors (also announced by Vance), could all change Armenia’s energy and economic calculus, but it’s all years away—if ever.

Russia Dominant Economic Player in Armenia Where June Elections Loom Large

As long as Armenia isn’t devoured by Türkiye and Azerbaijan in the meantime (both will surely be well represented by private investors being courted by TRIPP) , it could be beneficial to finally be developing trade relations and regional architecture with its neighbors rather than remaining isolated and wholly dependent on Russia for its security and economy.

The problem for Armenia is that it is still economically dependent on Russia, and it hasn’t just been trying to mend ties with its Turk and Azeri neighbors; it has torpedoed ties with Moscow in the process, blaming Russia for its problems as it opens its doors to US/NATO.

Simultaneously, by allowing actors hostile to Iran to set up camp on the Armenia-Iran border and playing a central role in US/NATO designs to run economic and military logistics from the Black Sea to the Caspian and into Central Asia, it has angered Moscow and Tehran.

That’s not a recipe for success.

Pashinyan’s government is selling the distant prospect of EU integration while framing any naysayers as pro-Russian agents. Back in February, the Armenian government approved a bill on starting the accession process to the EU, which should they follow through, will ultimately mean crashing out of the Eurasian Economic Union (EEU), which is Armenia’s lifeline. This will prove an unmitigated disaster for Armenia—and that’s if it’s only isolated to the economy and doesn’t go hand in hand with more conflict in the region.

According to Russian Deputy Prime Minister Alexei Overchuk, should Armenia leave the EEU, exports of Armenian goods will shrink by 70-80 per cent while energy and food prices skyrocket.

As Fitch Ratings notes, Armenia’s economy relies significantly on Russia for both trade and energy. For example, Armenia currently pays Russia $165 per thousand cubic meters of gas, well below the market price in Europe, and Russia is Armenia’s number one trading partner.

Russian TV host Vladimir Solovyov recently made waves when he suggested it’s time for a special military operation in Armenia. His comments:

“We must very clearly formulate our goals and objectives. We must explain: the games are over. To hell with international law and the international order. If, for our national security, it was necessary to start a special military operation on the territory of Ukraine, why, based on the same considerations, can we not start a special military operation in other points of our zone of influence?”

While Moscow has refrained from any drastic action thus far, there is evidence that trade between the two sides has plummeted. Russian figures say this is due to the reaction of Russian business to Armenia’s intentions to join the EU. Others say it’s because of less Armenian re-exports of Russian products (primarily of gold) and third country products to Russia. Either way, it’s a net negative for Armenia as a company like Mobile Center, which imports electrical equipment to Armenia,and sends much of it on to Russia, is among the top tax-payers in the country.

Despite efforts by Pashinyan and some Armenian media to lay the blame for the country’s problems (most notably the “loss” of Nagorno-Karabakh), public opinion on Russia remains mostly favorable while Pashinyan is far less popular.

It is rumored US public relations agency Edelman is trying to help Pashinyan rehabilitate his image, which is leading to daily TikTok videos accompanied by a shave and heart-shaped hand gestures.

#Armenian Prime Minister Nikol Pashinyan has a TikTok account where he shares moments from his personal life. pic.twitter.com/Hxeb7LWGtH

— JAMnews (@JAMnewsCaucasus) November 14, 2024

We can circle June on the calendar for when the situation in Armenia might come to a head. That’s when parliamentary elections are due in Armenia time when all sorts of shenanigans are to be expected.

Should the Pashinyan faction remain in power, more forceful measures from Russia might come on the economic front. Should the western wing lose and TRIPP come under threat, the US and friends will likely try the usual discrediting of the vote and color revolution playbook.

More Forceful Intervention in Azerbaijan?

VP Vance next stop after Armenia was Azerbaijan as the two countries signed a strategic partnership and talked up energy and trade corridors not just across Armenia, but also extending into Central Asia. We’ll detail why that is a pipe dream on Wednesday, but it’s safe to say Moscow is displeased with the direction Baku has chosen.

Marat Khairullin, a russian military correspondent, blogger and documentary filmmaker, makes the case that Russia will also have to deal more forcefully with Azerbaijan. In a piece titled ‘Aliyev Choked on Chutzpah or Why Azerbaijan Will Have to Be Bombed’, he argues the following:

Therefore, whether we want it or not, after victory in Ukraine, we will have to go to the Caucasus and deal with the same Azerbaijan to protect our economic interests.

…the paradox of Ukraine is that it received enormous benefits (primarily economic) from peaceful cooperation with Russia. But all that was thrown in the trash, and now Ukraine is perishing before the eyes of the whole world.

Azerbaijan has exactly the same situation. This country has enormous profits from a very promising transit – a major trade route from Russia to Iran and further across the entire East. And at the same time, it has immeasurable “chutzpah” to help Russia’s enemy Israel, to attack Iran.

Few know, but Israel gained access to airbases on Azerbaijani territory. For example, Israeli media openly report that the former Soviet military airfield in the village of Sitalchay was purchased by Israel back in 2012. A little later, large-scale leaks in “WikiLeaks” confirmed this. Simultaneously, Israeli human rights activists appeared in Azerbaijan who began explaining how the rights of Azerbaijanis are being infringed in neighboring Iran. They even created several centers.

…In Azerbaijan – Flight R-190, masterfully set up to be hit by Ukrainian drones. During approach to Grozny, an attack by Ukrainian drones began. Even preliminary investigation shows that all this was planned in advance.

…First, how do Ukrainian drones even reach the Caspian through the powerful Russian air defense region in the Black Sea area? There are strong suspicions that they are taking off precisely in Azerbaijan. Possibly from those very Israeli bases. No one has been caught red-handed yet, but recently there was a strike on Russian oil platforms in the Caspian, and, they say, some important telemetry was obtained this time. We’ll see.

All valid complaints. And just like in the economic war against Russia, gas is again playing a central role on the Azeri front. And once again math is not on the EU side.

In January Azerbaijani began natural gas deliveries to Austria and Germany as EU officials proclaimed that Baku is a new pillar in the EU gas market. There are a few issues here, however.

Here’s the rundown of Azeri production last year from News.Az:

Azerbaijan increased its natural gas production by 2.4% in 2025, reaching 51.5 billion cubic meters, up 1.2 billion cubic meters compared with 2024, the Ministry of Energy reported.

Production from the Azeri-Chirag-Guneshli (ACG) field totaled 14.1 bcm, Shah Deniz contributed 27.9 bcm, the Absheron field produced 1.6 bcm, and SOCAR-operated fields added 7.9 bcm, News.Az reports, citing AZERTAC. Gas exports remained stable at 25.2 bcm, with 12.8 bcm going to Europe, 9.6 bcm to Türkiye (including 5.6 bcm via TANAP), 2.3 bcm to Georgia, and 0.5 bcm to Syria.

But Azerbaijan still lags behind Russia in supplying the EU, and as we know, the bloc is struggling to rid itself of that affordable and readily available gas. Here’s the most recent European Commission Quarterly Report on Europe’s Gas Markets, which covers Q2 2025:

EU gas imports amounted to 75 bcm, a 9% increase quarter-on-quarter and an 8 % increase year-on- year. Pipeline gas constituted 54 % of imports (41 bcm), while the share of LNG was 46 % (34 bcm). Norway remained the EU’s biggest gas supplier (30 %, 22 bcm), closely followed by the US (27%, 20 bcm), North Africa (13 %, 9.8 bcm), Russia (12%, 9 bcm), Azerbaijan (5 %, 2.8 bcm) and Qatar (4 %, 2.7 bcm).

EU pipelines imports were 41 bcm, an 8% increase quarter-on-quarter and a decrease of 9 % compared to the previous year. The year-on-year decrease reflected the halt of Russian pipeline imports via Ukraine combined with a year-on-year reduction in imports from North-Africa. Norway provided over half of EU’s pipeline imports (54%, 22 bcm), followed by North-Africa (19%, 7.7 bcm), Russia (10%, 3.9 bcm), Azerbaijan (8%, 2.8 bcm)

Baku has been struggling to increase supply to Europe as it tries to use more renewable sources for domestic supply, and it has even been importing more Russian gas itself in order to meet its obligations to Europe—although recent tensions between Moscow and Baku have put that supply in doubt.

Azerbaijan also imports Turkmen gas through swap arrangements with Iran, meaning Turkmen gas goes to Iran and Iranian gas goes to Azerbaijan for domestic consumption so that Baku can send more gas to Europe.

So we have a situation where EU gas from Azerbaijan depends on Iran and Russia, and therefore US gas exporters to Europe stand to gain from increased tensions in the Caucasus. Less gas from Russia and Iran going to Azerbaijan means less Azeri gas going to Europe, which means the EU looks to other suppliers like the US.

Even if Azerbaijan dramatically increases its gas supply to Europe somehow without importing Russian or Iranian gas, Moscow would still stand to benefit. Why? Here’s Crude Accountability:

Russia’s Lukoil — a major private oil and gas firm with close ties to the Kremlin — holds a 19.99% stake in the Shah Deniz gas field, Azerbaijan’s flagship energy project and the cornerstone of the EU-bound Southern Gas Corridor (SGC). Lukoil is also involved in multiple segments of Azerbaijan’s gas value chain, including the Shallow Water Absheron Peninsula (SWAP) exploration project, the South Caucasus Pipeline, and the Azerbaijan Gas Supply Company.4 Through these stakes, Lukoil stands to gain an estimated US$ 7 billion in profits over the next decade from gas exports that, on the surface, appear to be purely Azerbaijani.

Crude Accountability also notes the obvious. The EU’s embrace of Azerbaijan as a strategic gas partner is more a reflection of geopolitical calculus than long-term energy strategy. It’s hard to see exactly what the geopolitical strategy is either, though, other than operating as US-Israel underling to create chaos in Iran and Russia’s backyard. I suppose they’re making progress on that end.

We mentioned at the top Washington’s drones sale to Armenia. Azerbaijan, on the other hand, continues to operate as a forward operating base for Israel. As Khairullin notes:

Azerbaijan promised back under Aliyev Sr. not to deploy foreign bases on its territory. It violated this – not only Israeli but also Turkish bases are already deployed. A proxy war is being waged against us from these bases – Ukrainian drones are at a minimum directly guided from these bases. If they are not taking off from there altogether.

At one time, the Caspian states agreed not to let outsiders into the region – to develop the territory only with their own forces, together. And now we see how Azerbaijan is violating this collective promise as well – it let in both Türkiye and Israel. American and British proxies. And opened the way to direct destabilization of all of Central Asia.

Khairullin doesn’t mention that Baku is also increasing its ties with NATO, with the Azerbaijani army is undergoing alignment with NATO standards and deepening its already-close cooperation with the Turkish military.

Where Is All This Leading?

Aside from a train crash, Washington and friends have three goals with a usual fallback option.

Encircle Iran while pursuing ethnic unrest with sizeable Turkic/Azeri population in northern Iran.

Cut Iran and Russia out of Central Asia-Caucasus-Europe supply chains.

Militarize those supply chain routes with Western-aligned governments.

It can be argued the fallback option or perhaps even the ultimate prize, however, is to goad Moscow and Tehran into conflict, thereby “extending” them and leading to internal upheaval that will lead to regime change in Russia and Iran. We’ve seen how well that’s worked in Ukraine, but as Alexander Mercouris says of the neocons in Washington, they have no reverse gear.

One could see how these developments in the Caucasus could be used as a bargaining chip in Washington-Moscow talks, and according to John Helmer, a faction in the Kremlin might be more open to such wheeling and dealing.

Still, even should a deal be reached that’s no guarantee the issues in the Caucasus will go away, and the conundrum for Moscow and Tehran is how to respond to these moves in the Caucasus when mutual economic and security rationality have been thrown out the window.

The current ruling groups in both Armenia and Azerbaijan no longer appear to be operating from a point of rational national interest. There are hypotheses for why, such as Pashinyan getting his hands on some fancy foreign real estate and rumors that in Baku the one pulling the strings is really Aliyev’s wife, who longs to escape the dusty Caspian shores for strolls on Rue Saint-Honoré.

She might get her wish because on the current path military option is growing more and more likely.

Notes

The drone sale to Armenia is actually for a significant amount of money when looking at it in context:

Traditional suppliers have primarily been Russia (to both sides), Türkiye (to Azerbaijan), and Israel (to Azerbaijan).