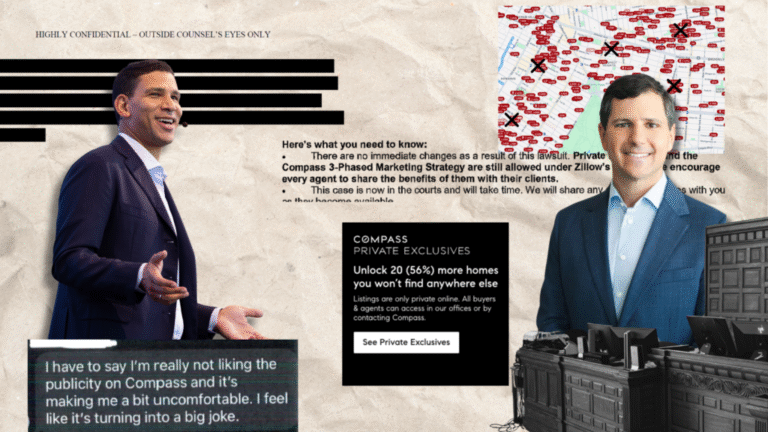

Court documents released as part of the lawsuit between Compass and Zillow also include an analysis Zillow conducted of potential threats to its future growth.

These documents are part of a vast body of material that provides valuable insight into Zillow’s internal decision-making during a period of growth and intense debate. The document primarily centers on the company’s response to the growing popularity of private listings over the past year.

But a series of emails and an internal Zillow analysis show the portal has identified Compass’ growing agent and client software suite as a challenge.

Participate in the INMAN Intel Index Survey

The company said the document notes that Zillow has steadily grown its tools and services used in the majority of real estate transactions. In addition to home search and lead generation, the company offers powerful customer relationship management tools, transaction management tools, and the industry’s most widely used tour scheduling software.

“Zillow’s software is essentially an operating system for the real estate industry,” Mike Delpreto, a prominent real estate technology strategist, told Inman last week. “People don’t realize how powerful that software is.”

But while Compass has grown exponentially to become by far the largest real estate brokerage in terms of agent count, sales volume, and sides, it has added services that could encroach on Zillow’s software space if used at scale.

“Just as Compass’ exclusive inventory threatens Zillow, so too does Compass and other software platforms trying to gain market share threaten Zillow,” DelPrete said.

Importantly, Compass announced the Compass One platform for customers on February 3, 2025. Less than two weeks later, Zillow’s senior director of strategy and partnerships, Steve Lake, asked strategic analysts to “competitively disassemble” Compass One, court documents show. Here’s what we found from that analysis:

Duplication with Zillow products

Zillow’s analysis positioned Compass One as a tool that extends customer relationships beyond closings and provides information for home searches, market analysis, and potential future transactions. The goal is to maintain consumer interest over the long term through Compass One.

“In a nutshell, the Compass One platform is a client-facing extension of Compass’ end-to-end agent platform, which Compass built with more than $1.7 billion in technology investments to unify CRM, marketing, and transaction management,” the analysis states.

In its analysis, Zillow noted overlap with some of its own products. Among other things, Compass One includes features that seem to compete with Zillow’s Zestimate. And instead of setting up a home tour through ShowingTime, which Zillow acquired in 2021, buyers can request a tour through their Compass One profile.

The portal also suggested that some Compass tools may be better than Zillow.

“While dotloop is a transaction management tool that allows agents to collaborate on documents, Compass One also provides clients with better insight into the steps of a transaction,” Zillow said. “Buyers and sellers receive real-time updates on tasks, deadlines, and documents during the transaction, all displayed in an easy-to-understand timeline.”

In other cases, Zillow thought its technology was superior.

“Although Compass has a more developed client-facing portal than Zillow, Zillow appears to have the lead in backend software as Compass currently lacks tour scheduling technology. [Zillow-owned CRM Follow Up Boss] is widely touted as the best CRM platform in the industry,” writes Zillow.

Compass confirmed to Inman that it has no plans to develop a national tour schedule product.

Zillow also found that Compass One could give brokers higher rates on ancillary service products, such as mortgage loans. This is a major growth area for portals.

According to Zillow’s analysis, “With greater integration of the deal process and greater control over agent-client communications, it makes sense to expect higher financing rates on Compass-driven deals.”

Citing ongoing litigation, Zillow declined a request for an interview regarding its analysis of Compass One and other documents.

The company noted in a statement that real estate companies like Zillow regularly evaluate new products and developments as “a standard part of delivering technology at scale.”

“For more than a decade, Zillow has been focused on developing tools that help real estate professionals succeed, and our performance reflects that long-term investment,” a Zillow spokesperson said. “Real estate professionals across the industry choose Zillow’s platform to grow their businesses and better serve their consumers.”

“Our approach has always been to build open solutions that work across the real estate ecosystem, not just a single brokerage, and we remain focused on continuing to innovate to support that goal,” the spokesperson said.

In fact, as part of its analysis, Zillow pointed out that agents have built-in benefits for becoming customers of the company. Agents and brokers frequently change brokers, and Zillow’s platform allows them to do so more easily than if they were entrenched in Compass’ internal technology, the analysis said.

The analysis also suggested that Zillow may consider accelerating the development of a “fully integrated customer-facing dashboard” that could improve the company’s value proposition and help “increase agent switching costs.”

Private listings and the “flywheel effect”

Zillow’s analysis suggested the portal could face additional risks if Compass requires agents to use Compass One rather than third-party options such as Zillow-owned Follow Up Boss or dotloop. Once communication between Compass agents and buyers and sellers begins within the Compass platform, elements of the transaction will be less likely to be transferred to Zillow products, the analysis said.

“If Compass agents are forced to use Compass tools on some listings, they will likely wonder: [Zillow] These products are great at largely offsetting the inconvenience of using two different software systems for different clients, which can potentially lead to client abandonment. [Zillow products] among agents of compass,” the analysis explains.

Compass currently has no restrictions on the tools or services agents can use, the company told Inman.

Zillow is also concerned about a “flywheel effect,” where agents and consumers feel they need to work with agents from brokerages with strong privately listed networks, an issue at the heart of the lawsuit between the two companies.

“This could lead to even lower values.” [total addressable market] for [Zillow products] “If other brokerages follow in Compass’s footsteps, they will develop internal tools to block it,” the analysis said. [Zillow] Tools from Private Listing Network (PLN).

“If a significant portion of listings goes to PLN first and the brokerage firm gains control over software integration with the portal, there could be a reasonable trade-off for agents between CRM/software quality and the additional business pool they can access through PLN,” the analysis said.

Email Taylor Anderson