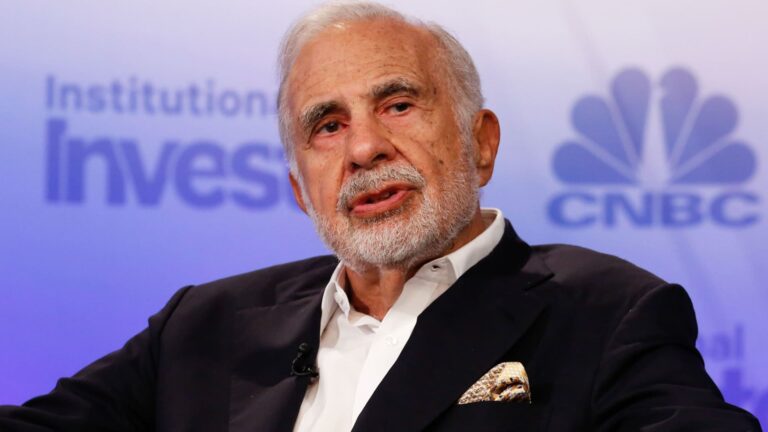

Carl Icahn speaks at Delivering Alpha in New York on September 13, 2016.

David A. Grogan | CNBC

Billionaire investor Carl Icahn has acquired a large stake in auto service chain Monroe Co., making it its largest single shareholder, his latest move in the auto sector.

In a new regulatory filing, Mr. Icahn disclosed ownership of 4,439,914 shares, or 14.8% of Monro’s stock. Filings show the shares were acquired by Mr. Icahn’s investment company. It’s unclear whether he intends to push Monro to change.

Mr. Icahn became the largest shareholder in Monro, formerly known as Monro Muffler Brake, surpassing BlackRock Fund Advisors, which held 14.11% as of the latest filing, according to FactSet data.

Monro’s stock price rose more than 13% in early trading Wednesday following the disclosure. The Wall Street Journal first reported the move earlier.

Stock chart iconStock chart icon

monroe wednesday

Mr. Icahn, 89, has remained active in recent years despite difficulties at his publicly traded investment firm, Icahn Enterprises. His investment company’s stock price has fallen about 2% this year after falling 50% in 2024 and 66% in 2023 after being attacked by short sellers.

His latest move adds Mr. Monro to a long list of companies, from JetBlue to Southwest Gas, in which he has taken large stakes and sought to influence corporate strategy. The investors previously owned Icahn Automotive, but sold the business last year as part of a broader restructuring of his holdings.

Monro stock had fallen more than 40% this year before Mr. Icahn’s deal became public. The company has struggled in recent years with declining same-store sales and rising labor costs.