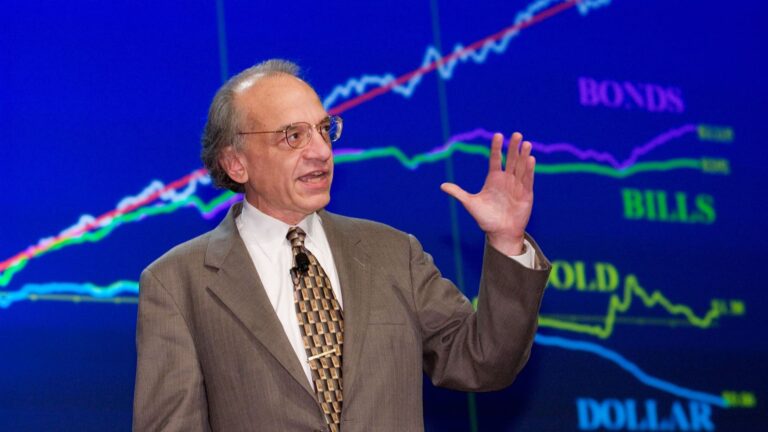

USA – November 10: Jeremy Siegel, Russell E. Palmer Professor of Finance at the Wharton School, speaks at the Securities Industry Association’s annual meeting on Thursday, November 10, 2005 in Boca Raton, Florida.

Matt Stroschen | Bloomberg | Getty Images

China’s control over critical rare earth materials is a “longstanding threat” to Western supply chains, and the United States should create a strategic stockpile of rare earth metals, Jeremy Siegel, professor emeritus of finance at the University of Pennsylvania, told CNBC’s “Squawk Box” on Monday.

“The lack of strategic reserves of rare earths is scandalous.” [and] “We had China monopolizing 90% of rare earth raw material refining. Recognizing the importance of these things, where were we?” Siegel said.

Siegel’s preliminary strategic proposal comes as the U.S.-China trade war escalates on Friday, with President Donald Trump vowing to impose “massive tariffs” on Beijing in response to restrictions on exports of rare earth minerals to the United States and threatening to cancel a scheduled meeting with Chinese President Xi Jinping. President Trump’s announcement wiped $2 trillion in value from the stock market.

The United States created the Strategic Petroleum Reserve in 1975 in response to the 1973 Arab oil embargo.

Nearly three-quarters of the world’s rare earth minerals, used in everything from smartphones to fighter jets, are now mined in China, and China processes 90% of the metal, according to Bank of America analysts.

“Export restrictions could create challenges for global supply chains,” BofA global economist Claudio Yrigoyen wrote in a note to clients on Sunday.

But Siegel said he was confident the U.S. and China would resolve recent trade tensions by President Trump’s Nov. 1 tariff deadline.

“It will be resolved eventually, and it won’t be too negative for either country,” Siegel said. Trump’s statement is “just a prelude to saying, ‘Okay, I have the chips, I have the cards.'” [and] You hold the cards…and let’s negotiate. ”

Siegel, author of 1994’s “Equity for the Longest”, said the Nov. 1 deadline is actually a sign that Trump wants to negotiate with the Chinese side.

“Mr. Trump said 100%.” [tariffs] But Siegel said, “Listen, I said the date of November 1st, which to me is like an eternity.” “This is actually the farthest tariff start date he’s ever set, which means he wants to get this problem resolved.”

Siegel added that the market is likely to rebound following trade talks between Washington, D.C. and Beijing. The S&P 500 was up about 1.2% in early trading Monday after falling 2.7% on Friday.

“Once we get through that, there’s no reason why we can’t continue to new highs given all the other good things that are happening,” Siegel said.

The S&P 500 is recouping about 40% of Friday’s losses early Monday, while the Nasdaq Composite Index rose about 2% as technology stocks rebounded from last week’s losses.