This is Naked Capitalist Donation Week. The 742 donors have already invested in our efforts to combat corruption and predatory looting. Please participate. On the donation page, please show us how to offer via checks, credit cards, debit cards, PayPal, Clover, or Wise. Read on to see why we are doing this fundraiser, what we achieved last year, and how we support daily links that reveal our current goals

Eve here. Subtime I feel like dope. Workers subtypes have obviously uncertain wages, such as taxi divers, gig workers, and employees with tips as signers, but how much time do you want to spend in a particular week or month? Instability in income is the fact that even if it is as low as having a “normal” job, it is an important mane that helps explain why poor people are approaching. In my youth, the low-wage workers who were careful about his spending could take his apartment to the point that he could save enough to buy a used car well within a year. The fact that rents are now high and most cars are purchased on loan gives most Wahlers a lot of base level expenses, one of the small income mouths away from living on the car and on the street.

Peter Ganon. Pascal Noel Patterson, assistant professor at the University of Chicago Economics Booth School of Business. Faculty Research Fellow National Bureau of Economic Research (NBER); Joseph Vavra, assistant professor of economics at the University of Business Booth School, Chicago. Alex Weinberg. Originally published on Voxeu

For the past decade, U.S. cities and states have been enacting “Fair Business Week” laws to stabilize workers’ schedules. This column uses administrative data on US workers’ salaries and corporate salaries to record significant monthly fluctuations in revenue. Wage instability is wide pretitude, undoubtedly hitting low-wage hourly workers, driven primarily by corporate labor demand, rather than work-related decisions such as child care demand. These variations represent genuine, welfare-related risks that will essentially shape the domestic nest and affect the economy.

For the past decade, cities and states have been enacting “Fair Business Week” laws to stabilize workers’ schedules. New York City’s 2017 Fair Work Week Legal Requirements Fast Food Industry Employers provide regular schedules at the start of employment, provide two weeks of notice for changes, and require workers consent and premium salaries needed for revision (Pickens and Sojourner 2025). Chicago requires employers to provide advance notice of employee schedules for 14 days, but provides exceptions to events outside of employer management, such as supplier delays and demand forces (City of Chicago 2019). Los Angeles, Philadelphia, San Francisco, Seattle, and other local governments either enact similar consideration regulations or are similar considerations.

Discussion of these policies on empirical questions: how wage volatility preheats, and do workers consider these fluctuations harmful? If revenue instability is wide-pand and unwelcome, scheduling regulations could improve workers’ welfare. If fluctuations are rare and operating poor, such rules can harm business efficiency without helping workers.

Ganon et al. (2025), we document that not only paying volatility, but also being very clunky enriched among low-wage workers. Lower-Incoma, hourly workers who tend to be more economically vulnerable face far greater income swings than their salty counterparts. For 60% of the US workforce paid per hour, these fluctuations form the source of spending, drive work bar servers, and quickly change work experience.

Previous studies using annual data documented acearneings risks over worker careers (Song etal. 2015, Moffitt and Zhang 2018, McKinney and Abowd 2023, Pruitt and Turner 2020). Our study highlights the causal relationship and pregnancy between monthly income fluctuations that are invisible in annual data.

Payroll data shows that workers experience significant monthly fluctuations in revenue

We record significant monthly fluctuations in monthly revenue using easy-to-understand management data from Worders (to your Chase Bank account via Paycheque Deposits) and businesses (through Payroll Processor). The monthly revenue volatility is substantial. It is about three-quarters of the month, and workers expect a different salary than the previous month. The median monthly change is 5%, for a quarter month, with wage changes of at least 17%.

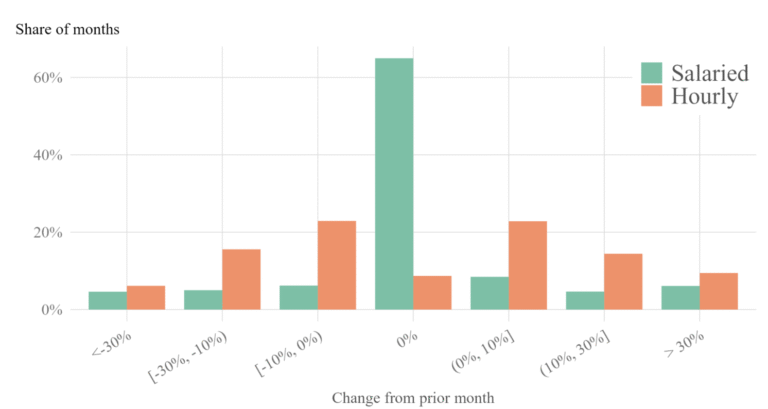

This volatility is concentrated in the timely world. Figure 1 illustrates this heterogeneity in revenue volatility between salary and hourly wages. For most mounts, there is no change in salary warder revenue. In contrast, for hourly workers, changes in monthly revenues are not a rare outcome.

Figure 1 Revenue Volatility Non-uniformity

Note: This histogram shows the distribution of changes in salary and hourly revenue with continuous employment. Because the number of pay varies from month to month, in this plot, changes in revenue are measured in terms of average monthly salary per paizek. Specifically, volatility estimates are calculated as the change in the median revenue for this month from the median revenue for the three months ago.

These findings raise two more important questions. Why does time move from mouth to mouth? And is this instability important for worker welfare?

Companies play a key role in driving monthly revenue volatility

We provide evidence that worker-related determinants such as temporary unpaid leave, child care requirements, and seasonal fluctuations do not explain revenue instability. Rather, companies are key to exposing changes in working hours. Thinking about it, this meaningful share of instability is thrust into workers and is outside their control.

Figure 2 shows the relationship between changes in total firm time and volatility of firm demand measured as labor as changes in workers’ wages. In other words, a significant change in the total amount of hours that all employees work is related to a significant change in the salary of individual workers.

Figure 2 Relationship between company-level volatility and individual workers’ volatility

Note: This diagram shows the relationship between business hours volatility and wage volatility of individual workers. Business opening hours volatility is measured by taking the total time for all workers in a company and calculating the median absolute monthly change. The wage volatility of individual workers is measured by taking the median absolute monthly change for each worker in the company. Each dot represents the volatility of the individual average workers in the group of companies with the volatility of the company in the signature.

Revenue volatility causes volatility in spending

Revenue instability affects the well-being of workers in two ways. First, we use bank account data to show that income volatility causes volatility in expenditures. When workers move to highly volatile businesses, expenditure volatility increases (Figure 3).

Figure 3 Relationship between income and escape volatility

Note: This diagram shows the relationship between individual volatility of monthly income and monthly expenditures. The volatility measure is a moderate change in individuals from the previous month. Consumption is measured as spending on non-durable goods and services using bank account data. Each DOT represents the average consumption volatility of a group of individuals with similar income volatility.

Second, we show that hourly workers are more likely to quit high-power jobs, and that corporate volatility affects the resignation rate of far more hourly workers than payroll workers in the same company.

Given that the volatility mentioned above costs the world, we are trying to understand how much the world world pays to avoid income volatility. Combined with the above empirical estimates and standard economic models of the labour market, we price how much volatility workers dislike. Median hourly workers were able to abandon 4%-11% of Inome to earn median income for Salaride. Facing the highest volatility, the world of low-incom has traded even more percentages of income for pay stability.

Our work shows that workers dislike enemy volatility, but furthermore, our work shows that we are struggling to understand whether corporate scheduling flexibility can help essential business needs.

Conclusion: Workers face substantial monthly earring risks as they are overlooked when analyzing annual data. This risk is primarily borne by hourly workers, literate low-income workers, driven primarily by fluctuations in corporate labor demand, inducing significant costs for large corporations around the world that are affected. This column shows that revenue fluctuations also represent genuine welfare-related risks that effectively shape household decisions and have the impact that accompanies the economy.

See original bibliographic submission