Deep in the guts of JPMorgan Chase data centers and cloud providers, the artificial intelligence program, essential to the bank’s aspirations, becomes more powerful weekly.

Called the LLM Suite, the program is a portal created by banks to leverage the large-scale language model of world-leading AI startups. Currently, we use Openai and human models.

JPMorgan Chief Data Analytics Director Derek Waldron said that as banks offer more capabilities and platforms give more capabilities, the LLM suite is updated every eight weeks, with the platform offering more capabilities.

“The broader vision we are working on will make the future JPMorgan Chase a fully AI-connected company,” Waldron said.

According to Waldron, Jpmorgan, the world’s largest bank by market capitalization, has been “fundamentally rewired” in the upcoming AI era. Beyond Main Street and Wall Street Finance, the bank wants to provide AI agents to all employees, automate all behind the scenes processes, and curate every client experience with AI concierge.

If the effort is successful, the project could have a significant impact on bank employees, customers and shareholders.

With outsiders seeing the first demonstration of the AI platform on CNBC, Waldron showed a program to create an investment bank deck in about 30 seconds.

Take it out of the box

Since Openai’s ChatGpt arrived in late 2022, optimism about generative AI has boosted the market with profits from the tech giants and chipmakers closest to trade. Their growth is the hope that clients from AI-based companies will either increase worker productivity through layoffs or both, or reduce costs through layoffs.

But just like how internet stories unfolded in the 1990s, short-term expectations for AI may exceed reality. According to a July MIT report, most companies still had no concrete returns on their AI projects despite collective investments of over $30 billion.

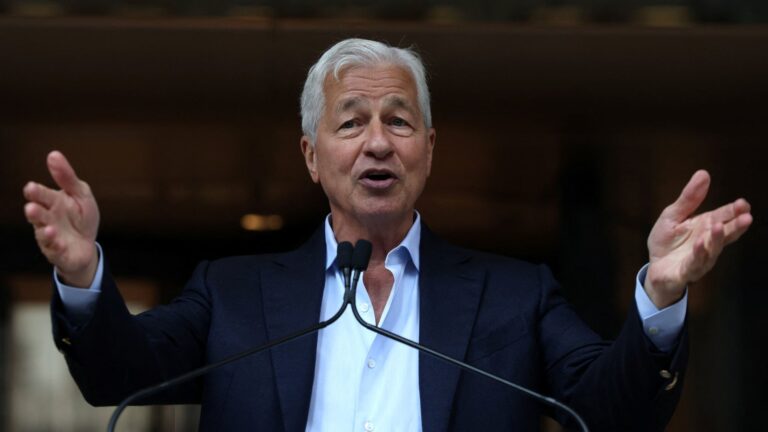

JPMorgan Chase & Co. Jamie Dimon, chairman and chief executive officer of the company, will speak during an event on September 9, 2025, honoring local construction workers who helped build the company’s new headquarters at 270 Park Avenue in the midtown area of New York City.

Shannon Stapleton | Reuters

For JPMorgan, even with a technology budget of $18 billion a year, it takes years to realize the possibilities of AI by sewing the cognitive abilities of AI models along with the bank’s own data and software programs, Waldron said.

“There’s a value gap between what technology can do and the ability to capture it completely within a company,” Waldron said.

“The companies are working on thousands of different applications. There’s a lot of work to connect these applications to the AI ecosystem and turn them into consumables,” he said.

If JPMorgan can beat other banks by incorporating AI, it will enjoy a higher margin period before other industries catch up. This first-mover advantage allows you to grow your revenue faster by chasing large slices of global finance’s addressable market. For example, banks can sell more middle market companies to investment banks.

It changes on the horizon

AI was a major topic, according to JPMorgan CEO Jamie Dimon’s refusal to identify him talking about private events during a four-day executive retreat held in July.

Amid concerns discussed at an offsite meeting held at a resort outside Nashville, it is possible that the AI-driven change will be adopted by the bank’s 317,000 workforce, and the apprenticeship model in sectors including investment banking.

If JPMorgan succeeds with its AI goals, it means that the largest and most profitable banks already in American history are set at new heights. Dimon has been leading the bank since 2005, leading record profits in seven years of the past decade, leading to turbulent periods.

As Waldron envisions, JP Morgan’s final state is the future in which AI is woven into the company’s fabric.

“Every employee has their own personalized AI assistant. All processes are driven by AI agents, and every client experience has an AI concierge,” he said.

JPMorgan laid the foundation for this since 2023, when it was accessible to Openai models via LLM suites. It was essentially a corporate chat GPT tool used to draft emails and summarize documents.

About 250,000 JPMorgan employees will have access to the platform, Waldron said. Half of them use it roughly every day, he said.

JPMorgan is currently in the early stages of the next phase of the AI Blueprint, according to an internal roadmap provided by the bank.

“As these agents become more and more powerful in terms of AI capabilities and become more and more powerful in JP Morgan,” Waldron said.

Nvidia deck

Waldron Computational Physics, a former PhD partner of McKinsey, recently demonstrated the LLM suite’s capabilities against CNBC.

He gave the program a prompt. “You are a technology bunker at JPMorgan Chase and are preparing for a meeting with Nvidia CEO and CFO. We will prepare a five-page presentation that includes the latest news, revenue and peer comparisons.”

LLM Suite has created a PowerPoint deck with a reliable look in about 30 seconds.

“You can imagine how that’s been done in the past. There’s probably a team of investment bank analysts who work long hours at night to do this,” Waldron says.

The bank is also training AI to draft other major investment bank documents, including “thickness” confidential memos that JPMorgan will create for future M&A clients, said those who attended the executive meeting in July.

Derek Waldron, JPMorgan’s Chief Analytics Officer.

Courtesy: JP Morgan

The prospect of workload collapse means that even if AI-enabled teams handle more work and market more companies, there could be fewer junior bunkers.

But it’s not just a tool to extract full value from this new, almost magical technology. You may need to change the way employees and departments are organized.

One proposal being discussed in major investment banks is to reduce the ratio to senior management of junior bankers from the current 6-1 to 4-1. In the new administration, half of these junior bunkers are not congregated in expensive New York, but rather Bengaluru, India and Buenos Aires, Argentina.

The AI-powered junior bunker was able to work on shifts around the clock, allowing him to pass the baton from one time zone to the next.

Less bankers on top of their pay will lower the cost structure of investment banks and increase revenue, executives said.

Structural shift

According to Waldron, LLM Suite is different from the technology that LLM Suite had to create bespoke automation tools for all different jobs, from traders to wealth managers to risk personnel.

The impact on workers is profound. AI empowers some workers, gives them more time and places them at the heart of the AI agent team. Others are replaced by AI, which takes over processes that no longer require human intervention.

Shift supports people who work directly with their clients, such as private bankers with a rich roster of investors, traders who serve hedge funds and pension managers, or investment bankers who have relationships with Fortune 500 CEOs.

Those at risk of finding a new role include operations and support staff who deal with the memorization process, such as setting up accounts, detecting frauds, and closing transactions.

In May, the chief of JPMorgan’s consumer bank told investors that operations staff will decline by at least 10% over the next five years thanks to the deployment of AI.

“In the AI world, there are still people who manage clients and have relationships with clients, but now many of the processes below are done through AI systems,” Waldron said.

ai fomo

However, how that future will unfold has not been written yet. Will businesses maintain AI-influenced workers and retrain them for the new roles they create? Or do they simply choose to cut their pay?

“No doubt AI technology will be changed to building a workforce,” Waldron said. “That’s certainly true, but I don’t think it’s exactly unclear what those changes will look like.”

More widely, Waldron said that workers will move from being the creator of reports and software updates or “manufacturer” of his term to being “checkers” or managers of AI agents doing the job.

The bank is closed to another frontier. That will soon allow generative AI to interact directly with customers, Waldron said. JPMorgan will start with limited cases, including allowing users to extract information before deploying more advanced versions, he said.

Despite market concerns that AI trade is a brewing bubble, corporate clients are actually worried that if they don’t start adopting it soon, they’ll fall behind and lose their share, said Avi Gesser, partner at Debevoise & Plimpton, he will advise businesses on issues surrounding AI.

“People are beginning to see what these tools can do,” Gesser said. “They said, ‘Wow, if you implement your workflow correctly, implement it properly and have the right guardrails, you could see how it saves you a lot of time and a lot of money and delivers a better product.”