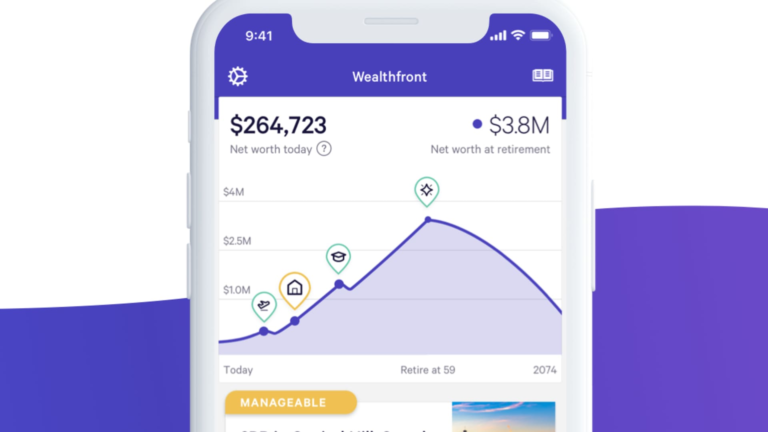

Wealthfront app.

Source: WealthFront

WealthFront, the startup that popularized the Robo-Advisor Style of Automated Investing, filed an early US offer on Monday, making it the latest in a wave of Fintech companies that will be released this year after Chime and Klarna.

The company in June filed a confidential application with the IPO, but up until now it has waited for its submission to be made public. This shows that Wealthfront is planning to launch a roadshow to market the stock to investors. IPOs usually last several weeks after the S-1 filing is published.

According to the filing, WealthFront, led by CEO David Fortunato, has $88.2 billion in assets on the platform and served 1.3 million customers as of July 31. Each filing generated a net profit of $194.4 million in fiscal year 2025.

“Our clients are digitally native, high-income people who are primarily responsible for savings and wealth accumulation,” the company said. “Digital natives usually save large liquids with long field of view and are not shaken by corrections and bear markets.”

This story is developing. Please check for updates.