This is Naked Capitalist Donation Week. 101 donors have already invested in our efforts to fight personal in the realm of corruption and predatory finance. Please participate. On the donation page, please show us how to offer via checks, credit cards, debit cards, and PayPal. Clover, or wise. Read on for why you’re doing this fundraiser, what you achieved last year, and why your current goals are strengthening your IT infrastructure.

Eve here. “How is your economy?” Leader query being deleted. The latest GDP review suggests that it may help you get a sighting. Even if the plural form of Anecdata is not data, you can understand what it appears to be unsummated.

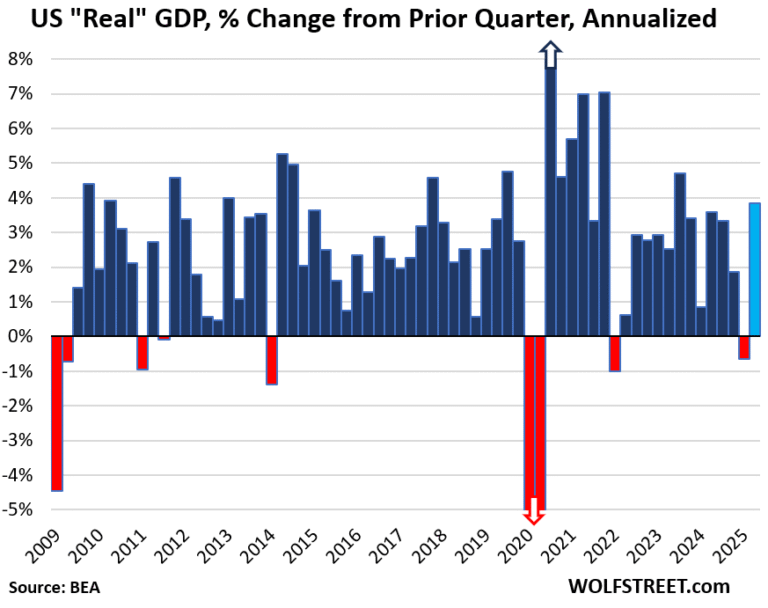

The big no here is the current second quarter GDP of 3.8%, a revival of twice as high as the original 3% level. That is in stark contrast to the growth of anemia employment. Also, inconsistent with many reports from many small businesses suffering heavily from tariffs, both in the press and the reader, they are unable to sell their products in something like price range, and they have great difficulty finding our sources, and make sure the bailout range is reduced.

Similarly, US growth has been increasingly helped by spending at various tops in the revenue chain. But from being so distant from luxury vendors to the collapse of art sales, there are fewer signs of health than solid health.

Perhaps what’s happening in the economy is similar to the stock market, with the average pro property paralleling GINORMOUS AI valuations in very few companies and Ginorsous AI’s “capital investment” as Ed Zitron is recorded in detail. AI is one sector with overheating activities. There are other strong VRY pockets.

by Wolf Richter, editor of Wolf Street. Originally published on Wolf Street

But government consumption and inventory were bigger drugs. Everything has been adjusted for inflation.

Back on July 30, the “advance estimate” of GDP for the second quarter showed a 3.0% growth suppressed by anemia consumer spending growth and plunge inventory. “Second Estimates,” released on August 28th, reviews second quarter GDP growth at 3.3%.

Today, the “third estimate” of GDP Revise Q2 GDP growth for the second quarter grew to 3.8%. This is the fastest growth since the third quarter of 2023, driven primarily by a large rise in consumer spending. This 3.8% growth rate is in the US hot zone, where average GDP growth over the past decade is just over 2%. All growth numbers are adjusted for inflation.

The “first estimate” of GDP growth is something that attracts all the attention in the media. Reviews are not usually the focus of attention. So, compare today’s “third estimate” with the “first estimate.”

Consumer spending growth was revised to up to 2.5% in the second quarter. The first estimate was a poor 1.4% worrying about increased consumer spending, and was kept at a second estimate of 1.6%. Today’s massive up-review to +2.5% almost doubled the initial estimate’s growth rate, and was the biggest contributor to the GDP overall growth review (all adjusted to inflation).

This 2.5% is healthy growth in consumer spending. The red line shows annual consumer spending for 2017 (correct size). The blue column shows growth rate as percentages (left scale).

Private fixed investments were initial estimates of a horrific growth rate of 4.4%, from 0.4% anemia. Today’s latest review contributed to an increase in overall GDP growth.

Equipment investments have been revised to a maximum of +15.0% investment in intellectual property with a maximum of 8.5% investment. Investments in the structure plummeted by 10.3% on initial estimates. This incursion has now dropped to -7.5% today.

However, fixed investments in housing (such as building single families and apartment complexes) were locked into the initial estimate with a drop of -4.6%. The decline rose to -5.1% on today’s third estimate, lowering the rise in private fixed investments.

Revised v, pressing the reverse method. First estimate:

Net exports (exports minus imports) have been revised low and worse.

Imports are slightly lower (-29.3%) than the original estimate (-30.3%). Imports subtracts from GDP. Exports fell 1.8%, at the same rate as the initial estimate. The export will be added to GDP.

Government consumption will shrink by 0.1% (federal, state and local governments combined) and will continue to grow by 0.4% on the initial estimate.

The private inventory entry deteriorated, subtracting 3.44% points from GDP growth, but initial estimates had 3.17 percentage points. Inventory spiked at Flint, tariffs in Q1, and in the second quarter the total of that range increased.

What’s down?

Strong second quarter growth came after an explosion of imports in tariff front-running negatively knocked on first quarter GDP growth (-0.6%). Consumer spending growth in the first quarter was also weak. So there was a lot of concern about growth. Additionally, the initial estimate of second quarter consumer spending growth (+1.4%) did not reduce TOSE concerns.

However, it should alleviate anxiety as growth figures for the second quarter of the review, especially consumer spending, are back in healthy ranges.

As the strong retail salt in July and August shows, Q3 consumer spending seems pretty good. So, despite a decline in government spending, waiting for the downward spiral of the economy might have to expand even further?