Eve here. The media’s main story is about Trump’s August 1 tariff save, but in contrast to the reaction, it’s a little too early in the way it’s analyzed. These tariffs will undoubtedly increase US inflation, even if sub-companies decline at a noble profit level (corporate profits have been a high percentage of GDP for many years). So, the combination of hot take on what Trump has produced will depend on new tools to estimate an increase in living costs.

Shortly after Trump’s tariff announcement, the Bureau of Labor Statistics relayed its employment report, which was incredible. Headline number, not only 73,000 new jobs are significantly lower than expected, but not only has the unemployment rate risen to 4.2%, but not so bad. But looking under the hood, that’s a hugely bad thing. From Bloomberg:

Rosenberg of BlackRock says that looking over the past three months, the reviews are shown in “dramatically different pictures.” Before these numbers, the average payroll calculation over the three months was 150,000. With reviews for May and June and new numbers for July, the average for three months is 35,000. That’s completely different.

Ah, and the reason for the big initial exaggeration, and reviews? The so-called birth and death model estimates employment growth due to new business creation. Those who followed the Econoblogosphere during the financial crisis phase are exaggerated structures, recalling that Barry Rattlez, Michael Sherk and the lodgings of the time did not regularly post results from the model of birth, advertised on scale to distort the overall results.

And even before employment data hit the wire, somming economists emphasized that increased tariffs would hurt demand. From another Bloomberg account:

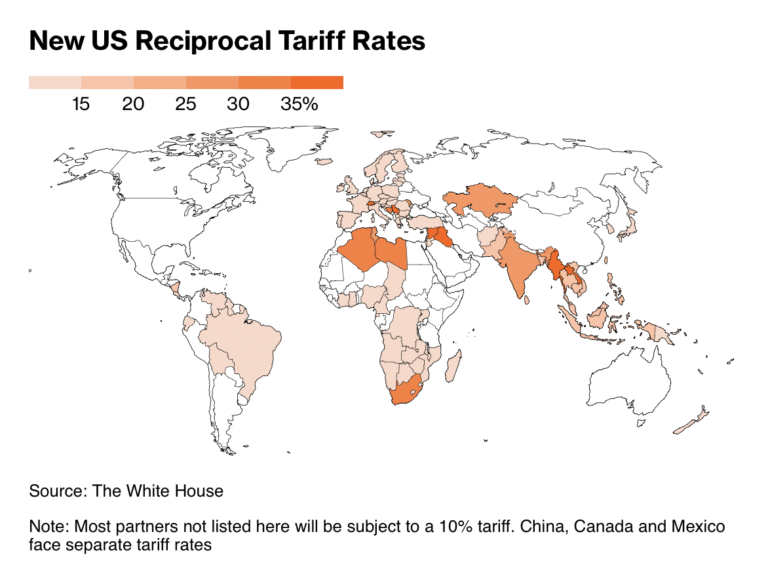

However, at an average of 15%, the world still faces US tariffs since the 1930s about six times higher than they did a year ago. Trump’s latest volley outlines a baseline tax of at least 10%, with a percentage of over 15% in countries with trade surplus with the US.

So far, the global economy is better than many economists who are Trump’s first tariff blitz. In a hurry to beat the rising rates, it spurred export frontloading, supported many Asian economies and protected US consumers from price surges.

It could all be about to change.

“For other parts of the world, this is a serious demand shock,” Ragram Rajan, former government of the Indian Central Bank and chief economist at the International Monetary Fund, who is currently a professor at the University of Chicago Booth Business School, told Bloomberg Television on Friday. “In the face of these tariffs, we will see many central banks considering cutting as other parts of the world slow down sub-watts.”

In other words, in the US, tariffs increase pressure on male dogs. That view is confirmed in a CNBC report.

The latest US customs policy is “not the end of the story yet,” said Stephen Brown, North American economics director for capital economics, on Friday.

“President Trump’s latest tariffs prevent the effective US tariff rate from rising to around 18% from 2.3% last year,” he said. It is higher than expectta, bringing the drawbacks of forecasting global economic growth and poses potential risks for US inflation forecasts, Brown said.

And after Jerome Powell pats interest rates and Trump screams for cuts, Trump only raises pressure on the Fed’s chairs and increases investors’ upsetting. But Powell’s concerns, concerns about rising prices due to tariffs, are not trivial as they will be burned in next month or two months. And, as we’ve been repeatedly depressed, rising interest rates at central banks can choke economic activity, but selling the money on sale doesn’t provide a boost. Most companies decide to expand their operations based on market conditions, like demand and competitive activities. The only companies where the money itself, which is inexpensive, could lead to an incumbent, could lead to an incumbent to increase their activities. These are primarily financial institutions, and financial speculators such as real estate developers and hedgees.

Common Dreams has published new ways to gain better applications for Trump Tarif’s actual costs and other poly measures regarding household budgets. I hope your sub will add to their toolbox on social media.

By Julia Conley, staff writer for Common Dreams. Originally published on Common Dreams

Six months after President Donald Trump’s second term, the Economic Justice Group on Thursday unveiled an interactive tool to help put many in the unmistakable sentiment that America reportedly reported on Republican leaders who promised “again, affordable.”

Using our economyless tool, Americans can see exactly how much essential prices have risen in ESIR states, and advocacy groups are linking the dots between the cost of living and rising Trump tariffs and Collate’s tax break.

The “Don’t Infect Your Plate” tool says Texas beef prices have risen nearly 47% since the beginning of Trump’s second term, but eggs are $3.19 more than before Trump took office.

In California, eggs cost more than $5.00 than before Trump’s second term, based on “historical trends, real-time supplier data and market analysis” the economy surveyed.

Trump and the Republic of Congress have argued that food prices will fall.

While they raise the price – we pay.

We have built a brand new site to keep our so account: https://t.co/h3lvqz2z6a tracks how GOP’s Poliz is increasing costs with real time and exhibits. pic.twitter.com/ykvzmv683z

– Unleashing our economy (@unrigouraconomy) July 31, 2025

Our economy has gained data from Kroger price data, and we found that in the states with Kroger stores, beef prices are rising by 16% to 72%, with the biggest prices rising in Alaska and Utah.

Egg prices in particular were Trump’s talk of the presidential election, but they rose in many states run by Kroger, with Michigan customers who won the president in 2024 up 58% against eggs.

“Trump and Congressional Republicans are self-injecting into the costs of the everyday goods that America relies on,” says Lea Tull, our economy’s campaign director. “Billionaires and businesses cash out Republican-backed tax credits, while working-class families pay higher prices for eggs, coffee and more.”

Our economy is plagued by reporting on Trump’s Tarif. Many of them are expected to be approved on Friday.

As Common Dreams reported this week, the advocacy group’s basic cooperation found that corporate executives used supply chain disruptions as covers to keep prices high, even after they used tariffs to justify price increases during the coronavirus pandemic.

“We certainly will reduce China’s tariffs, but for the June week or two weeks, we raised prices and raised prices without struggling with the changes in China’s tariffs, the CEO said in a recent revenue call.

Our economy has been plagued by recent polls showing that it overwhelmingly disapproves Trump tariffs, including 47% of Republican voters.

The Trump administration has also made many regulatory moves that benefit businesses that aim to take more money from households in working families, such as making it easier for consumers to subscribe to cancer, seeking cancellation of federal Biden-era Trade Commission rules. The FTC’s decision to stop lawsuits challenging PepsiCo price discrimination. The committee’s move has shut down public comments on corporate pricing tactics.

The interactive tool was announced a few weeks after the president signed the law. This includes cutting back on the length of public programs like Medicaid and the historical Suppler Event Nutrition Assistance Program, which increases monthly payments for student loan borrowers under the Revitalization Assistance Plan, reaching $117 billion in tax cuts of $117 billion in tax cuts.

Our economy unveiled its tools and we could see exactly how America has been affected by the high cost of living for the past six months.

Over half of respondents said “billionaires, businesses and Congressional republics are making life difficult,” while 60% said the Trump administration blames higher costs of living.

More than four people in five America said they are worried about the price of food, and nearly half say they are worried about their ESTA ability to pay rent and mortgages. Pern, 48, said it was difficult to pay an uneasy $500 bill, like home repairs and medical costs, without borrowing or using credit, and nearly 20% said it was “Vray difficult” to pay.

Even among households with a disadvantage of over $100,000, more than a third say they struggle to immerse themselves in their savings or meet surprising costs without using a credit card.

“The federal government is destroying programs like Medicaid and food aid, and federal regulators are giving businesses the green light to tear consumers, but families are forced to build their own EST ESTA safety net from the web of dangerous financial practices,” the TCF said.

The lifting of the economy would not invade our plates, and the group called for “a Republican-backed Polly, who took us here,” saying “We demand that Congress be the first to put the people working there.”