We have tried to deny that readers have overinvestment or too much ability. However, we believe that the pattern needs to work in China, as more and more Hector companies in a wide range of industries are increasingly increasing to stop price cuts to maintain domestic market share. The reason for the alarm is that when the DER becomes established, it is more destructive to combat inflation and har is a har.

Chinese fans are particularly hostile to the suggestion that there is something offensive in the Middle Kingdom. But here, the more keen criticism comes from Xi On Down. Therefore, knee juak rejection is not a well-reported response.

To remind you of the negative effects of deflation, which is generally the product of the collapse of asset bubbles:

Generally, it means a drop in price (obviously the rate of decline due to product/service). They try to narrow down suppliers for Lower prices, fail to do so, cut purchases, or even shut down product lines when the margin is too thin. It also reduces prices to maintain a competitive position and try to cover the overhead. It can kick off the spiral of what 19th century economists called “catastrophic competition.” Railways are examples of textbooks.

Wages are sticky, so workers are more likely to face redemption times and layoffs than management seeking to accept lower wage rates.

A decline in prices will rated consumers as refraining from spending.

Deteriorating business profits and increasing unemployment rates also lead to tracking consumers and businesses

A drop in prices and a decline (or total wage REDM for business hours) can incredibly poverty the cost of debt (interest and principal payments) on actual terms. Their loans are now more valuable with real hair, so it has an effort to enrich lenders compared to other communities

Deflation also makes investments red. It is clearly not a good idea that there will be a cost to introduce new capabilities when the economy is a recession slide or when it falls into depression. The new Capacity Como Line has been exacerbated by expectations of lower prices.

As a result, dangerous assets such as stocks and assets are done badly in times of deflation. Cash and high quality bonds are the best holdings.

Next, sum up a high-level summary of the deflationary conditions from Twitter.

China is dealing with severe deflation:

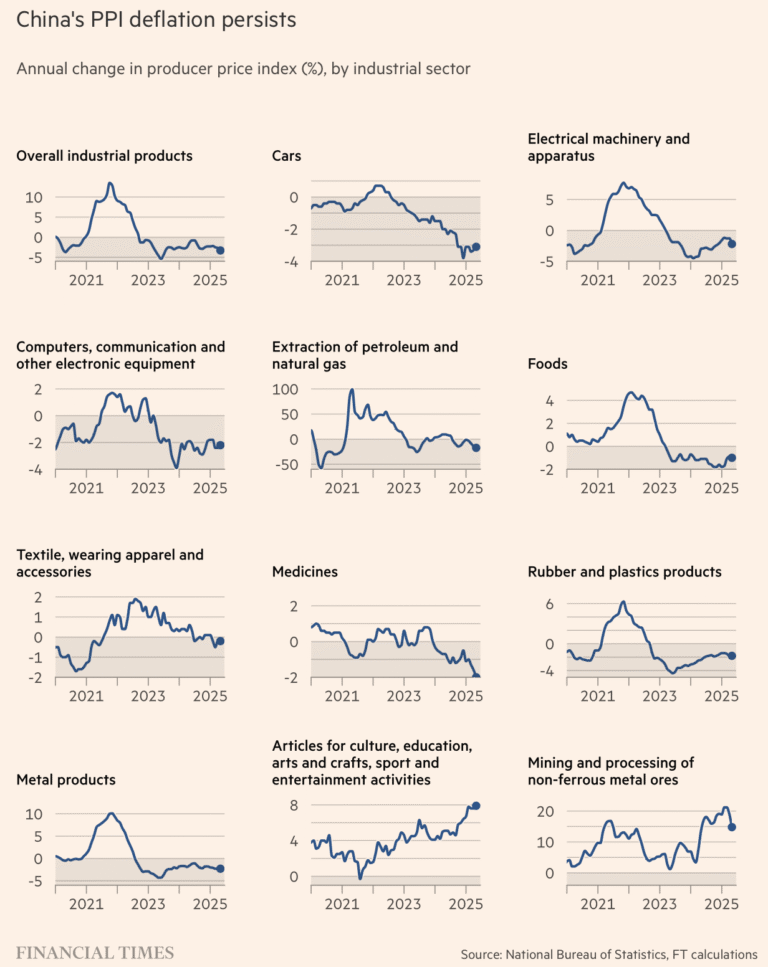

China’s producer prices (PPI) fell -3.6% in June, the sharpest decline since July 2023.

This also marks 33 consecutive factory gate deflation. This is one of the longest stripes on record.

Meanwhile, consumer prices… pic.twitter.com/rtu8vllhjq

– Cobessie’s Letter (@kobessiletter) July 12, 2025

Chinese producer price deflation intelligence. Now -3.6% ago. Economists don’t predict that.

The message to other parts of the world is clear. pic.twitter.com/3ouz0ltnc8

-PPG (@ppgmacro) July 9, 2025

China is bumping into an “impossible trinity.” By suffocating the lack of underestimating US liability for tariffs, monetary policy will also be able to confront the rising pressure. China concluded the song. Don’t lower it means that it chose defl… https://t.co/syjg8vmhpa pic.twitter.com/ukjbwhp4qh

– Robin Brooks (@robin_j_broks) June 29, 2025

Even before producer prices drop even further, there are many indications that China has too little capacity to demand, and the government has no good options. Remember, we have repeatedly explained that while interstrate can suffocate economic activity, selling money does not induce companies to go out and steer them. The only sectors that could respond that way are financial companies and other leveraged speculators.

Given the sighting of catastrophic competition with economists in early June, China’s current ultra-stable EVs are scaring China.

China’s ability to build electric vehicles (EVS) has caused unrest in countries with large automakers, urging governments to investigate Chinese subsidies to the sector and set trade barriers. But now it is China’s own government that is worried about how cheap EVs for producers are. The competition to the bottom shows no signs of disappointment, and the industry represents the broader challenges the economy is facing.

On May 23, China’s largest EV manufacturer, BYD, caused a shock wave when it significantly reduced the costs of 22 electrical and hybrid models. Now, the starting price of that chapest model, Segal, has a Falle from 55,800 yuan ($7,700). The move comes just two years after BYD originally unveiled an electric hatchback at an astonishingly low cost of 73,800 yuan.

On May 31, China’s Ministry of Industry told state-run news agency Xinhua, “Not to mention the future, there is no winner in the price war.” The ministry has vowed to curb cutthroat competition. On June 1st, the Communist Party mouthpiece Daily People argued that low-quality products at low prices could harm the reputation of “made in China” products.

The backlash comes when it cracks down on the unproductive, self-harmful competition between businesses and local governments that generate excess capital and reduce profits.

Amid concerns that a price war would become unsustainable, BYD’s stock fell after price cuts and official declarations. However, in order to stick to market share, other automakers have lowered their prices. Wei Jinjun, chairman of Farwall Motor, one of the Raganesto, evoked the collapse of the real estate market as an unhealthy and chantionary tale. “The evergrand in the automotive industry already exists now, but it’s not exploded yet,” he told Sina Finance to the news outlet, referring to the world’s most independent developer.

Or China’s July 8 Financial Times criticizes manufacturers over a price war because deflation is feared before producer price figures even appear more than expected.

China You have been strongly criticizing businesses and local governments for promoting overproduction that it blale blames for lowering prices.

Prices for Chinese producers have been embedded in deflationary territory since the 2022 Septent, listing challenges for policymakers who are used to relying on manufacturing and exports to promote economic growth.

In articles throughout the state and party media, Chinese President Xi Jinping and other major officials attacked what they call Neijuan, or what they called “retreat.”

The statement suggests that Beijing, coupled with weak consumer demand at home, is increasingly wary that new industrial production is fostering competition to the bottom of prices, which is examining deflation and increasing tensions with the country’s biggest trading partners.

Overcapacity is a sensitive issue for China, and it has tried to dispel complaints that its industrial policy is artificially flooding its partner market with low-cost products…

The growing chorus of official concerns thrilled the spec that Beijing is preparing to announce for a “supply side reform” match, or that the government to the industrial industry is preparing to control prices and reduce capacity…

Qiushi, the leading Chinese Communist Party’s policy magazine, admitted that “excessive capacities” was a problem…

Last week, Chairing the party’s central commijon oversight on financial and economic issues, XI said:

Economists were once again honed in Xi Jinping’s response in the Xi Jinping wage war at the end of June, before China reported a 3.6% decline in producer prices from the previous year.

In May, the state suppressed automakers to cut prices rather than raise them…

Carmeking is not the only part of the economy that is struggling. Factory gate prices fell year-on-year in May in 25 of the 30 major industries. With eight people, including coal mining and steel production, the drop was even steeper than the car. Average prices have been on the rise for 32 months across China’s vast industrial machinery.

Manufacturing investments in high-tech ventures in particular have been a bright spot for China’s attractive economy in recent years, as they siphon the long-term property crisis. But the rapid decline in industrial prices and profits raises questions about the feasibility of even this capital-fighting boom. Industries such as electric vehicles, lithium-ion batteries and solar panels were considered new engines of new growth that would fill the yawning gap left behind by the real estate sector. Now they also have deflationary scholarships…

According to Zhao Wei of Chinese brokerage Shenwan Hongyuan, the issue is the most severely plagued products such as cement, ceramics and glass, steel makers and products, which have fallen prices faster than last year’s national average. These parts of the economy also suffer from an extraordinary amount of Iraq. And, by his calculations, another 15 industries, from automobiles to cigarettes, show subrecession trends, including weak profit growth, rapid rise in debt, declining prices, or lower capacity utilization.

Between 2012 and 2016, China suffered for four and a half years of falling factory gate prices…

China’s production quotas and the capacity of excess industry such as iron. Thatch mergers and acquisitions to reduce competition. The mine was ordered to operate only 276 days a year. Authorities are also forced to strictly enforce standards for energy efficiency and pollution, and close out old, dirty plants. The policy is considered successful.

[Of the efforts so far this time] These interventions are less bold than the interventions of the 2010s. With many of the targets being different, the campaign could be more tentative, says Robin Singh of Morgan Stanley at Bank. In 2015-17, the industry suffering from overtraining was dominated by large state-owned enterprises. They were easy about the boss…

Today, many industries are struggling with regression. For example, electric vehicles and solar panels are registered by sophisticated commercial companies using cutting-edge technology.

The economist also points out that low consumer demand is making the photo worse. The fact that China has suspended the figures for young minors to publish ~20% says it is still guestized at over 17%. As I said, in the two years I’ve been here, I’ve seen evidence that China exports Deflation to Southeast Asia via a lack of many price increases.

Readers can tell Teselbus that China Ellen has plucked herself from a similar situation. But that was when Trump began a small war with China, when he took office. And, as shown, in previous house cleaning between supplies, China was able to actively engage in creative destruction by accelerating the captains of weak and inefficient companies. Today, the big sinners in Ruinus competitive games are often China’s most productive sector, even national champions like EVS. So I will continue to watch this issue.