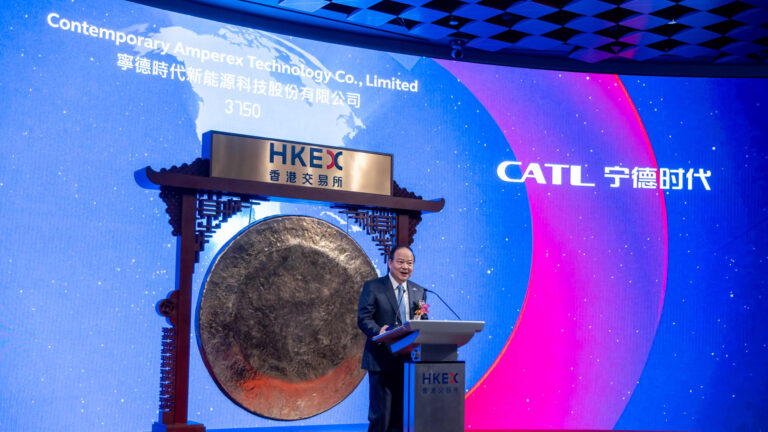

For Tesla Supplier Contemporary Amperex technology, selling battery packs to major electric companies is just the beginning of that ambition. “We believe the company is not just a hardware manufacturer, it is also a software ecosystem provider,” Morgan Stanley analyst led by Jack Lu said in a report Wednesday. They pointed to CATL’s artificial intelligence-powered tools to monitor batteries on the road and provide early safety warnings. “As AI develops, the ecosystem may evolve further and provide more value-added soft services to its customers,” said an analyst at Morgan Stanley, saying that improving safety will enhance CATL’s business partnerships and competitiveness. Morgan Stanley raised CATL’s price target for Hong Kong listed stocks to HK$445 ($56.69), up 14% from the previous HKD 390. The new price target is nearly 18% above where CATL closed on Friday after hitting a daytime high of 395 HKD on Thursday. This was the highest since CATL stock, which was listed in Hong Kong on May 20th, the world’s largest IPO in 2025. The company’s mainland-listed stocks are trading at an unusually large discount on Hong Kong stocks. Also, CATL appears to be one step closer to making revenue from licenses. Ford Asgemment US Automaker Ford plans to open a battery factory through a license agreement with CATL. However, the deal was under intense US scrutiny, while there were concerns that Ford would lose its advanced manufacturing tax credit. However, last week Ford predicted that Michigan’s Blueoval Battery Park would benefit from such a tax credit, and said it was “on track to start production of lithium-iron phosphate phosphate (LFP) batteries in 2026.” The release did not mention CATL, but analysts were hopeful. “This recent news is positive in that it appears to be implicit in a licensing arrangement,” Macquarie analysts Eugene Fuciao and Fergus Kwan said in a report Wednesday that the development “helps remove one important headwind of the stock.” Neither Catl nor Ford responded immediately to CNBC requests for comment. According to Macquarie analysts, if Blueoval is close to full by 2027, and if Blueoval is close to full by 2027, CATL could receive 1.3 billion yuan ($181 million). CATL stocks have a price target of 360 HKD. Despite US scrutiny, CATL continues to be under wider scrutiny in the US earlier this year. The Department of Defense has added CATL to its “Chinese Army” list, which prohibits the US Department of Defense from purchasing company products from 2026. “We believe that geopolitical risks between China and the US are already priced stocks,” said analysts at Macquarie. “The basis of strong revenue from an increase in European market share, consistent with an increase in shareholder revenue, should lead to a revaluation of the valuation.” CATL pledges that 90% of the funds raised through the public are approaching expansion into Europe, particularly the Hungarian factory. The company said last month that its subsidiary had signed a contract in Indonesia on a $6 billion project aimed at covering nickel mining and processing, battery production and battery recycling. “We are maintaining the CATL purchase rating,” an analyst at Bank of America, led by Ming Hsun Lee, said in a July 2nd report, “We are maintaining the CATL purchase rating,” and “Given the industry-leading battery technology and new product strategies, taking into account the new product strategies to protect market share, and the technology and scaling advantages to drive more space to reduce costs.” Analysts have a price target of 400 HKD on the stock. They highlighted that on CATL’s major business line, Xiaomi will use CATL’s batteries in its popular Yu7 SUV. [market] CATL is also building business partnerships with new technology in battery swapping and packs designed specifically for hybrid power vehicles. On Wednesday, Geely -Backed Electric Company Zeekr announced that the hybrid driving system is based on CATL’s “Freevoy Super Hybrid Battery.” Delivery in China is expected to begin by the end of September, according to a statement that CNBC’s Michael Bloom contributed to the report.