Fatcamera | E+ | Getty Images

Housing Tax and Expense Bills will drive millions of Americans out of their health insurance rolls as Republicans cut programs such as Medicaid and Affordable Care Act and fund priorities from President Donald Trump.

The Congressional Budget Office, a nonpartisan legislative scorekeeper, predicts that roughly 11 million people will lose their health insurance, as per the provisions of the House bill, if enacted in its current form. The bill estimates that an additional 4 million or so insurance will be lost as the unextended Obamacare subsidies expire.

The uninsured rank will inflate as a result of insurance that adds barriers to access for some people, such as certain legal immigrants, increases insurance costs and deny benefits entirely.

The law known as “One Big Beautiful Bill Act” could change with Senate Republicans now taking that into consideration. Reducing healthcare has proven to be a thorny issue. For example, a small number of GOP senators — enough to make the bill a torpedo — should not go back to cuts to Medicaid.

More details from personal finance:

How the impact of debt on the House GOP Tax Bill will affect consumers

3 Three important money moves to consider while the Fed keeps interest rates high

How child tax credits will change as Senate debates discuss Trump’s giant buildings

The bill will add $2.4 trillion to national debt over a decade, the CBO estimates. According to Penn Wharton’s budget model, that’s after cutting more than $900 billion from healthcare programs during that time.

This reduction has been a sharp shift after an increase in health insurance availability and coverage over the past 50 years, including Medicare, Medicaid and the Affordable Care Act.

“This will be the biggest withdrawal of health insurance we’ve ever had,” Burns said. “It makes it really hard to know how people, providers and states react.”

Here are the main ways the bill can increase the number of uninsured people:

The population due to proposed Medicaid reductions is not “safe”

House Speaker Mike Johnson was portrayed at a press conference after passing President Donald Trump’s agenda on May 22 in Washington, D.C.

Kevin Dietsch | Getty Images

Experts say federal funding cuts to Medicaid will have broad meaning.

“Frankly, the population is not safe from a bill from Medicaid that cuts more than $800 billion in 10 years, as states have to adjust.

According to Orris, the new work requirements apply to states that have expanded Medicaid are the new work requirements, as most people lose Medicaid and therefore become uninsured, as they lead to most people losing Medicaid and thus becoming uninsured.

Work requirements affect the eligibility of individuals aged 19-64 who are not eligible for exemptions. Affected individuals should demonstrate that they have worked or participated in qualified activities for at least 80 hours per month.

The state must also ensure that applicants meet the requirements for at least one month prior to compensation, and at the same time, that they implement a redecision at least twice a year to ensure that individuals already covered comply with the requirements.

R-La in a Sunday interview with NBC News’ “Meet the Press.” House Speaker Mike Johnson said: “We will not lose Medicaid compensation unless 4.8 million people choose to do so.”

The Congressional Budget Office estimates that it will encourage adults with 5.2 million labor requirements to lose federal Medicaid compensation. While some of them may obtain coverage elsewhere, the CBO estimates that the change will increase the number of uninsured people by 4.8 million.

These estimates can be modest because they do not include anyone who is eligible for the exemption to properly report working hours or submit appropriate documents if they are eligible for the exemption but does not submit appropriate documents if they are eligible for the exemption.

Overall, 10.3 million people lose Medicaid, which will lead to 7.8 million people losing health insurance, Burns said.

Proposals create state Medicaid funding challenges

Supporters protecting our care support will display a “Hands-Off Medicaid” message before the White House before President Trump’s speech to Congress in Washington, DC on March 4th

Paul Morigi | Getty Images Entertainment | Getty Images

The state uses medical provider taxes to generate Medicaid funds, but the House proposal will stop using these taxes in the future, Orris noted.

As a result, due to low revenue and federal support, states face tough choices that they need to cut or cut state budget compensation to maintain their Medicaid programs, Orris said.

For example, home-based services could face cuts to maintain funding for mandatory benefits such as inpatient and outpatient hospital care, she said.

The House proposal will also be delayed until 2035, until two Biden-era eligibility rules aimed at making Medicaid easier to register and renew Medicaid, especially for seniors and individuals with disabilities, Burns said.

The state also provides compensation for undocumented immigrants, which would reduce the federal matching rate for Medicaid spending, she said.

Affordable care methods reduce “anxiety” but “consequential”

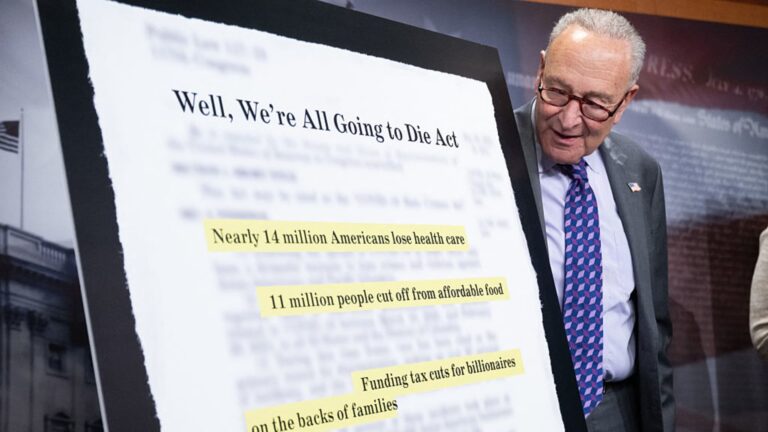

Senate minority leader Chuck Schumer, DN.Y., spoke at a June 4 press conference in Washington, D.C., about the healthcare impact of the Republican budget and policy bill, also known as “One Big Beautiful Bill Act.”

Saul Roeve | AFP | Getty Images

Over 24 million people are enrolled in health insurance through the affordable care law market.

They are a “important” source of coverage for people who don’t have access to health insurance at work, such as self-employed low-wage workers and older people who don’t yet have Medicare qualifications, according to the Center for Budget and Policy Priorities, a left-leaning think tank.

House law would “dramatically” reduce ACA registrations – so the number of people with insurance is, written by Drew Altman, president and CEO of KFF, a nonpartisan health policy group, due to the combination of the effects of several changes rather than one major proposal.

“Many of the changes are technical and unstable, even if they are consequential,” writes Altman.

Expiration of ACA subsidies adds compensation costs

The ACA registration is the highest ever. Registration has more than doubled since 2020. Experts are largely attributed to the strengthening of insurance subsidies provided by Democrats in the US Rescue Plan Act in 2021 and then extended by the Inflation Reduction Act until 2025.

These subsidies, known as “premium tax credits,” effectively reduce consumer monthly premiums. (Credits are charged at the time of tax, or households can choose to acquire them in advance via a lower premium.)

The council has also expanded the subsidy eligibility pool for more middle-income households and reduced the maximum annual contributions they make for premium payments, experts said.

According to KFF, the enhanced subsidies cut household premiums by $705 (or 44%) in 2024, down from $1,593 to $888 a year.

House Republican laws do not extend strengthened subsidies. In other words, it will expire after this year.

According to the Congressional Budget Office, roughly 4.2 million people will be uninsured in 2034 if the expanded premium tax credit expires.

“They may just decide not to get it [coverage] “We’ve seen a lot of people who have had a lot of trouble with their health policy and medicine,” said John Graves, professor of health policy and medicine at Vanderbilt University School of Medicine.

CBPP estimates that compensation will be more expensive for others who remain in the market plan.

Add a deficit to eligibility, registration

Over three million people are expected to lose coverage under the Affordable Care Act as a result of the House Act, other provisions in the CBO Project.

Kent Smetters, professor of business economics and public policy at the University of Pennsylvania Wharton School, said other “big” changes include extensive adjustments to eligibility.

For example, the bill will shorten the annual open enrollment period to December 15 in about a month, rather than January 15 in most states.

CBPP said that by requiring all enrollees to take action to continue coverage each year, it will terminate automatic re-registration with health insurance used by more than half of those who renewed coverage in 2025.

Senate Majority Leader Sen. John Tune (R-SD) (c) will speak with Sen. John Barrasso (R-WY) and Sen. Mike Crapo (R-ID) (R) outside the White House on June 4, 2025.

Anna Moneymaker | Getty Images News | Getty Images

The bill also excludes subsidies and cost-sharing reductions by households until they have reviewed eligibility details such as income, immigration status, health insurance status and place of residence, according to the KFF.

Graves says adding manager deficits to health plans is similar to driving an Apple Cart down bumpy roads.

“The more roads you build, the more apples you’ll fall from your cart,” he said.

Subsidy compensation repayment

Another big name: the bill would eliminate the premium subsidy repayment cap.

Households receive federal grants by estimating annual income for the year. If your annual income is greater than your initial estimate, you will need to repay the excess subsidies during the tax season.

Current legal laws require repayment of many households. However, the House bill would require recipients of all premium tax credits, regardless of income, to repay the excess amount, regardless of income, according to the KFF.

Such a requirement sounds reasonable, but it is irrational and perhaps even “cruel” in reality, said Altman of KFF.

“The incomes of low-income people can be volatile and many market consumers are stitching together hourly wage jobs, running their own business, or multiple jobs, making it challenging, if not impossible, to fully predict their income for the next year,” he writes.

Reducing use by immigrants

The House bill also limits market insurance eligibility for some groups of legal immigrants, experts said.

According to KFF, from January 1, 2027, many legally presented immigrants, such as refugees, Asylees and people with temporary protected statuses, as well as those with temporary protected status, are suitable for subsidies insurance on the ACA exchange.

Additionally, the bill would prevent deferral measures for childhood arrival recipients in all states from purchasing insurance through the ACA exchange.

DACA recipients – a subset of the immigrant population known as “dreamers” – are currently considered “legally present” for health insurance purposes. This will allow you to qualify for registration (and obtaining subsidies and cost-sharing reductions) with 31 states and the District of Columbia.