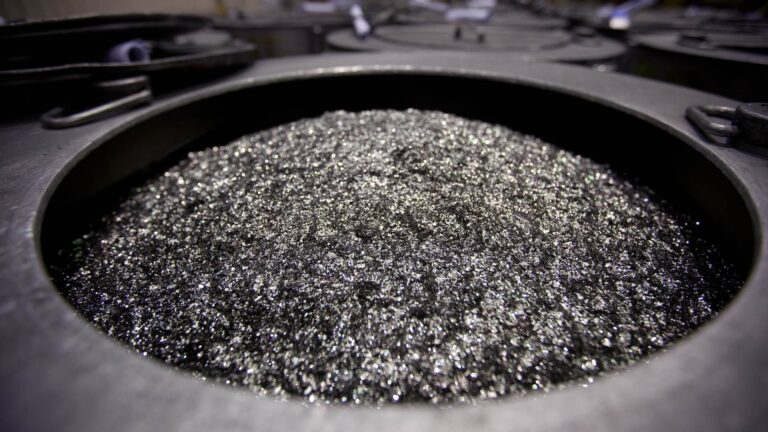

Annealed neodymium iron boron magnets sit in a barrel before being crushed by powder at the Magnography Tianjin Co. Factory of Neo Material Technologies Inc. in Tianjin, China.

Bloomberg | Bloomberg | Getty Images

BEIJING – As China grasps global supply of major minerals, the West is working to reduce China’s dependence on rare earths.

This includes finding alternative sources for rare earth minerals, developing technologies to reduce trust, and restoring existing stockpiles through recycled products that have reached the end of their shelf life.

“We can’t build modern cars without rare earths,” said consulting firm Alixpartners, noting how Chinese companies have come to control the mineral supply chain.

In September 2024, the US Department of Defense invested $4.2 million in Rarearth Salts, a startup aimed at extracting oxides from domestic recycled products such as fluorescent bulbs. Toyota Japan is also investing in technology to reduce the use of rare earth elements.

According to a US Geological Survey, China controlled 69% of rare earth mine production in 2024, controlling almost half of the world’s reserves.

Analysts at Alixpartners estimate that a typical single-motor battery electric vehicle will contain components that contain around 550 grams (1.21 pounds) of rare earth, unlike gasoline-powered vehicles that use around 140 grams of rare earth, or about 5 ounces.

Soon, first-generation EVs will recycle themselves and create a pool of former Chinese materials under Western control.

Christopher Ecclestone

Principal and Mining Strategist of Hallgarten & Company

More than half of the new passenger cars sold in China are battery-only hybrid vehicles, unlike the US, and most are gasoline-powered.

“As we slow down EV intake (in the US) and require future conversions from ice to EV format, our obligation to replace EVS Chinese-made materials is declining.”

“Suddenly, the first generation EV will recycle itself and create a pool of former Chinese materials under Western control,” he said.

According to Cox Automotive, electricity accounted for just 7.5% of new US vehicle sales in the first quarter, a slight increase from a year ago. Although about two-thirds of the EVs sold in the US last year were assembled locally, manufacturers pointed out that they still rely on importing parts.

“The current full-scale trade war with China, one of the world’s leading suppliers of EV battery materials, will further distort the market.”

Rare torque

Of the 1.7 kilograms (3.74 pounds) components containing rare earths in typical single-motor battery electric vehicles, 550 grams (1.2 pounds) are rare earths. Approximately the same amount, 510 grams, is used in hybrid powered vehicles using lithium-ion batteries.

In early April, China announced export controls for seven rare earths. These limitations include terbium, of which 9 grams are used in single-motor EVs, data from Alixpartners shows.

Data show that none of the other six target rare earths have been significantly used in automobiles. But it’s not just the April list. Another Chinese list of metal controls, which became effective in December, limits CE exports. This is 50 grams that Alix Partner said is used on average in single motor EVs.

Control means that Chinese companies dealing in minerals must obtain government approval to sell overseas. Chinese business news outlet Caixin reported on May 15, days after the US-China trade ceasefire, that three major Chinese rare earth magnet companies have received export licenses from the Ministry of Commerce to ship to North America and Europe.

The concern with international business is that there is little alternative to China to acquire rare earths. While a mine can take years to get business approval, a processing plant also takes time and expertise to establish.

“Today, China manages more than 90% of the global sophisticated supply of four magnet rare earth elements (ND, PR, DY, TB) used to make permanent magnets in EV motors,” the International Energy Agency said in a statement. This refers to neodymium, free odymium, abnormalities, terbium.

According to AlixPartners, for nickel metal hydrogen batteries, which are less commonly used in hybrid vehicles, the amount of rare earths is 4.45 kilograms, or nearly 10 pounds. This is mainly because this type of battery uses 3.5 kilograms of lanthanum.

“Around 70% of the 200 kilograms of minerals in EVs pass through China, but it depends on the vehicle and manufacturer. It’s difficult to put a decisive person on that.”

Power Projection

However, there are limitations to recycling, which is challenging, energy-intensive and time-consuming. And even if EV adoption in the US slows down, minerals are used in much more defensive ways.

For example, the F-35 fighter jets contain more than 900 pounds of rare earth, according to the Washington, D.C.-based Center for Strategic and International Studies.

China’s rare earth restrictions go beyond the closely watched list released on April 4th.

Large rocks containing chromite are crushed into smaller bite masses at the Afghanistan Yagrukill mine before undergoing a process of purifying and extracting ores that produce chromium, a key component of stainless steel.

Marcus Yum | Los Angeles Times | Getty Images

Over the past two years, China has increased its control over a wider category of metals known as key minerals. In the summer of 2023, China said it would limit gallium and germanium exports. About a year later, it announced restrictions on antimony, which will be used to strengthen other metals and bullets, nuclear weapons production and key elements of lead-acid batteries.

In October, the country’s top executive body, the Council of State, announced the entire policy to strengthen its management of exports, including minerals.

Weekly analysis and insights from Asia’s biggest economy in your inbox

Subscribe now

One limitation that surprised many people in the industry was tungsten, a key mineral designated in the US, but not rare earth. Very hard metals are used in weapons, cutting tools, semiconductors and car batteries.

China produced about 80% of the world’s tungsten supply in 2024, while the US imports 27% of tungsten from China, US Geological Survey data shows.

According to Michael Dornhofer, founder of the metal consulting company’s independent supply business partner, each electric vehicle’s battery usually uses about two kilograms of tungsten. He pointed out that the tungsten will not be able to return to the recycling chain for at least seven years, and its low-level use may not even be reusable.

“We do business as usual because 50% of the world’s tungsten is consumed by China,” Lewis Black, CEO of tungsten mining company Almonty, said in an interview last month. “The other 40% produced (in China) come to the West, which does not exist.”

He said when the company’s upcoming tungsten mines in South Korea reopen this year, it would mean there is enough non-Chinese supply of metals to meet our, European and South Korea’s defence needs.

But in the case of automobiles, medical and aerospace, “it’s not enough for us.”