Propublica is a nonprofit newsroom that investigates power abuse. Sign up and receive the biggest story as soon as it’s published.

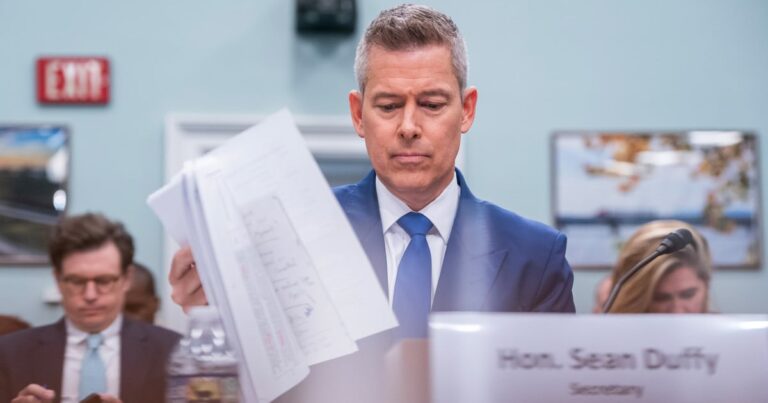

Two days before President Donald Trump announced his dramatic plan for “mutual” tariffs on foreign imports, Transport Secretary Shawn Duffy sold his shares in almost three dozen companies, according to records reviewed by Propublica.

The February 11 sales came near the historic peak of the stock market just before they began to slip amid concerns over Trump’s tariff plans, and eventually plunged after the president announced details of the new tariffs on April 2.

Disclosure records filed by Duffy with the U.S. Government Ethics Office show that he sold between $75,000 and $600,000 in shares two days before the February 13 release, selling up to $50,000 that day.

Transport secretaries usually have little to do with tariff policy, but Duffy presents herself as one of the intellectual ancestors of Trump’s current trade agenda. As a 2019 lawmaker, in his last government position before Trump lifted him to the Cabinet post, Duffy introduced a bill he called the “US Mutual Trade Act.” The proposed law, which failed to pass in many respects, reflects Trump’s mutual tariff plan. Duffy worked on Trump’s trade advisor Peter Navarro and his bill. Trump’s tariffs were “the culmination of that work,” and Duffy posted online, referring to his own bill at home.

Transactions by government officials notified by non-public information learned during the course of their official duties may violate the law. However, it is unclear whether Duffy has information about the timing or scale of Trump’s mutual tariff plans before the public does.

Trump has repeatedly committed to launching important tariffs through the campaign. However, in the first weeks of his term, investors appear to be assuming that not panic sales, but that Trump will not adopt the widespread taxation that led to a market crash following his “liberation date” announcement.

In response to a question from Propublica, a transportation department spokesperson said an outside manager had made the transaction and Duffy “didn’t give an opinion on the timing of the sale.”

His stock trading is “part of a retirement account and is not directly managed by the secretary. Account managers must follow the guidance of the ethics agreement, and they do so.”

“The Secretary strongly supports the president’s tariff policy, but he is not part of the administration’s decision on tariff levels,” the spokesman said.

The spokesman dismissed the notion that Trump’s knowledge of the coming tariffs can constitute insider knowledge because “President Trump has been discussing tariffs since the 1980s.”

Duffy is the second Cabinet Secretary to sell inventory at the right time.

Last week, Propublica reported that Attorney General Pam Bondi sold $1-$5 million worth of stake in the president’s social media company Trump Media on April 2. The government’s ethics agreement required Bondy to sell the shares within 90 days of her confirmation. After the market closed that day, Trump offered his tariffs and lureed the market.

Following the Propublica story, at least two Democrats from Congress called for an investigation. Bondi has yet to answer questions about whether she knows anything about Trump’s tariff plans before the public does. The Department of Justice has not answered questions about the transaction.

In the disclosure form for securities transactions by government officials, stating the exact amounts bought and sold does not require that they provide a wide range of scope for each transaction total.

He sold 34 shares worth between $90,000 and $650,000 on February 11th and February 13th, according to Duffy’s disclosure records. He had to sell the stakes of the seven companies for the first three months in accordance with the ethical agreement he signed to avoid conflicts of interest as Head of the Transportation Division. Cabinet members are usually required to sell themselves from economic interests that intersect with the role of departmental supervision, in the case of Duffy, which is related to the transport networks of the US roads, aviation and other countries. The ethics agreement was dated January 13th, and Duffy was confirmed by the Senate on January 28th. In other words, he was on sale until late April. His spokesperson said he provided an ethics agreement to his account manager on February 7th.

The shares he sold at the other 27 companies were not covered by the ethics agreement. Records show that these stocks were valued between $27,000 and $405,000. Among them was Shopify, whose merchant is being affected by tariffs, and John Deere, a farm machinery maker who projected hundreds of millions of dollars in new expenses for Trump’s tariffs.

Other companies sold by Duffy, such as gambling companies DraftKings and Food Delivery Service Doordash, are not directly vulnerable to tariff disruptions. But even those companies will be affected if there is less cash that is easy for Americans to use. Few stocks have been hit hard by Trump’s “liberation day” tariff announcement. The broad-based index, the S&P 500, fell almost 19% in the weeks following Duffy’s sales, especially after Trump announced details of his mutual tariff plans. The market rebounded as Trump unexpectedly returned many of these early tariffs.

There is no indication that cash from Duffy’s sales was immediately reinvested. He appears to maintain a portion of his portfolio, including the Bitcoin Fund, Treasuries, S&P 500 Fund and stocks of American biopharmaceuticals. (Duffy also bought Microsoft stock, one of the stocks he was prohibited from holding a few days ago on February 7th.

Trades by government officials notified by non-public information learned through their work may be in violation of suspending the trade of Congress’s knowledge or stocks. The 2012 law revealed that employees in the enforcement department and legislative branches are unable to trade stocks using private government information and require that they disclose the transaction promptly.

However, no lawsuits have been brought under the law, and some legal experts suspect they will withstand scrutiny from the court. Current and former officials also raised concerns that Trump’s Justice Department and the Securities and Exchange Commission would not actively investigate activities by Trump or his allies.

Duffy’s choice of president, who leads the Department of Transport, was somewhat unexpected. Duffy, who gained fame when he appeared on the reality show The Real World in the late 1990s, last served as Trump’s first term in 2019 as a Wisconsin House of Representatives.

As a lawmaker, Duffy introduced a bill that would make it easier for Trump, or the president, to collect new tariffs. The bill would have allowed the president to impose additional tariffs on imported goods if other countries found themselves applying higher tariffs on the same goods when they came from the United States.

Although the bill was not passed, Trump essentially assumes its power by justifying new tariffs in national security or in response to national emergency. His February 13 announcement asked his advisor to come up with new tariff charges for goods coming from countries around the world, based on the many restrictions that these countries say they place on American products, not just through tariffs but also through exchange rates and industry subsidies.

Trump administration moves to block Mexican politicians traveling to the US, saying it’s related to drug trafficking

Even Duffy’s bill and Trump’s tariffs were similar. Duffy has released a spreadsheet showing that other countries have used spreadsheets during his deployment to tariff certain goods at a higher rate than the US Trump has shown that his new tariffs were the same or lower than the trade restrictions other countries have imposed on American goods.

More recently, Duffy has been a booster in Trump’s trade policy.

“Liberation Day! We’re not going to take it anymore!” he tweeted two days after Trump announced mutual tariffs on April 2. “This week, @potus took a historic step towards stopping other countries tearing American workers apart and recovering fair trade. I’m proud to share the culmination of my work with my family this week.