Amidst the economic weakening of wide-preads, it should not be a surprise to measure a little bit of destructive Trump’s policies, including cutting and burning of federal agencies providing important public and business boost services, cracking modest chains and increasing inflation-induced tariffs. Consumer and business trust is just as slacking as Trump’s policy approval rating. Reviewing Posthast shows that the Fed is a new deny, although economical.

Donald Trump’s approval rate is entirely underwater.

Americans don’t support how HA deals with the economy, federal labor, foreign poli, or the way they come.

This is basically everything for the president. pic.twitter.com/tkzqcaiij

-JessicaTarlov (@jessicatarlov) March 13, 2025

Destruction: In a spectacular announcement, CNN senior data analyst Harry has just announced that Donald Trump has the lowest approval rating for the economy’s handling at this point in time. This is hage.pic.twitter.com/urlumjfmj

– Democrats win media (@democraticwins) March 19, 2025

The Wall Street Journal’s lead story is given predictions that it has been economically reset by Trump’s election. Corresponding headlines in the Financial Times are more direct, with the Federal Reserve reducing US growth forecasts as Trump’s police weight has become a forecast, but the Wall Street Journal reserves through the work of filling central bank ERMs.

However, at the heart of the journal story, Hage is failing, not even mentioning what the current predictions are. To do this, you’ll have to go to the Financial Times.

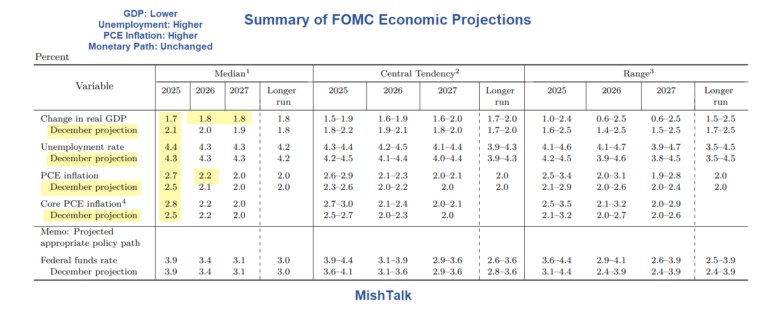

The Fed’s latest forecast shows that the officials, which are expected to expand GDP by 1.7% this year, will expand 1.7% this year, while prices are forecast to rise 2.7%. At the end of the two-day meeting on Wednesday, the polymaker put the central bank’s key interest rates on hold.

Bloomberg gave it that TL.

The Federal Reserve remains unchanged and buy time to assess how President Donald Trump’s policies will affect an economy facing both prolonged inflationary pressures and growth concerns https://t.co/sp5efwskin pic.twitter.com/56opsgnont

– Bloombergtv (@bloombergtv) March 19, 2025

Michael Shedlock provided the release data table:

A journal that describes the economic gear shift of a hard Trump suddenly, to the extent that many vulnerable travelers have whipped:

Since the emphasis on Donald Trump’s inauguration, the first forecast for the Federal Reserve has been highlighted in a modest and technical way by the central bank, with plans to push forward with the president’s broad tariffs turning the economic outlook into a mind.

The story continues by discussing how the soft landing scenario is out the window as prices rise while banging on investment, Confidenze Fairy and Groaf. Plus, all the risks appear to be on the downside.

The Fed Chair has just said what trusted economists, all economics textbooks, and all empirical research shows. Tariffs reduce production and increase prices.

This is to take on suppessial, people. (I’m also depressed.) pic.twitter.com/h0dj05stmq

– Justin Wolfers (@justinwolfers) March 19, 2025

By eviteing it all, the central bank has stuck with forecasting two interest rate cuts this year. That was pointed out by Evite Fed Chair Powell, who pointed out that there was a “level of inertia” among investors about the possibility that Emir’s desired rate reduction would be short.

However, the “inertia” statement is more than just a little project. The Fed believes that rising prices due to tariffs is a temporary shock and that prices indicate. However, the time frame of central banks differs from consumers, and many companies imagine it. Even after egg prices have stabilized with a new, controversial, normal, and even if, for example, they haven’t risen further in the last six months, buyers are still well remembered when it’s still cheaper. Keep in mind that this phenomenon suggests how the Fed thinks about inflation expectations (as reflected in bond market yields).

The journal explained that it will pick up that the Fed office may use the usual approach given the tariff shock.

Officials may be struggling to declare price increases from time to time if set for a move.

Additionally, Fed officials are nervous that post-pandemic inflation may have given businesses and consumers higher inflation to more acceptance. Polymakers are paying close attention to future inflation expectations. This is because we believe that those expectations can be self-fulfilled.

The Journal used horrible words

Now, on the pink paper offered for a more urgent take:

The Federal Reserve has cut US growth forecasts, lifted infection prospects and highlighted concerns that Donald Trump’s tariffs will knock on the world’s biggest economy…

Progress inflation “is probably delayed for the time being,” Powell said. The Fed has fought to bring inflation back to its 2% target and stop its most severe price pressure in decades.

The Fed also announced that it could roll out its balance sheet from $25 billion to $5 billion a month starting in April by reducing the pace of quantitative tight programs and reducing the amount of U.S. Treasury debt.

Using a chaos generator from Trump can lead to potential customers being very fluid and throwing darts. Readers report major falls in traffic at local stores. The journal reported veltostine at all levels of the income scale. These are no precursors for a happy citizen or a healthy economy.