In a recent post, I imagined a hypothetical situation in which cranberries were found to be a surefire way to prevent cancer. We explained how this causes a large change in demand, leading to an increase in price, which in turn leads to an increase in supply.

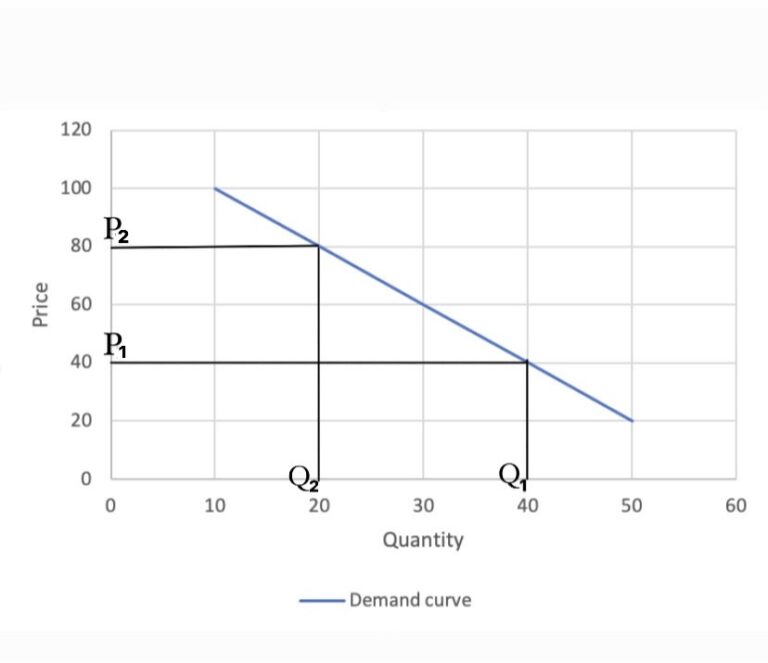

Suppose tomorrow that scientists announce that eating 100 grams of cranberries per day has been proven to prevent the development of cancer. What will happen in the short run?The demand for cranberries will increase significantly and the demand curve will shift sharply to the right. Cranberries, on the other hand, will be much more expensive, so even if demand increases significantly, the quantity demanded will not increase much, at least in the short term. What happens on the production floor? You would expect that any cranberry farm would make some adjustments to increase production, but those changes were not worth the cost. But as prices rise, these adjustments become worthwhile. Today’s cranberry farmers will want to immediately maximize yield and push as many cranberries out as possible.

In the long term, the hope is that they will increase cranberry production capacity, and that many others will also move away from growing blackberries and marionberries and start growing cranberries instead. . This also shifts the supply curve to the right, causing the market price of cranberries to fall again. The process of adjustment will take time, but if the goal is to ensure that many people have access to cranberries and their cancer-preventing benefits, implementing cranberry price controls will be our biggest enemy. Masu. It is occurring.

At least, the process I described above is what would ideally happen if cranberries were found to have such amazing properties. Realistically, I think that after the initial increase in demand and subsequent price spikes, the government will step in with price controls and regulate the cranberry market into oblivion. And part of what motivates these policies are the arguments we often hear in favor of price controls on some goods. The idea is that without price controls, we have needs because “only the rich” can afford to buy this or that. Price controls to ensure that the product in question is “affordable” to everyone. If the price of cranberries suddenly shot up to $1,000 a serving, there would no doubt be outrage, saying that only the wealthy could afford cranberries and their cancer-preventing properties. (This outrageous practice often tricks people into thinking it’s a lawsuit against price controls, but somehow ends up overlooking the distinction between “willingness to pay” and “ability to pay.”) is a basic but common mistake, because outrageous acts rarely improve a person’s reasoning abilities.

The problem with this way of thinking is that (similar to Ferengi economic philosophy!) you can’t think beyond step one. That’s right, if such a thing were to happen, initially only the “rich” would be able to afford cranberries. But the high price will bring huge numbers of people into the cranberry market, pushing the supply curve to the right and pushing the price back up. If you’re stuck in a static, one-level mindset, it can seem tiresome to talk arrogantly as if “only the rich” can afford this or that. . But if you can think beyond the first stage, you will see how wrong that view is.

Given that how you frame a problem has a huge impact on how people view it, here are some frames that you might find helpful: Today’s high prices allow the rich to subsidize access to tomorrow’s poor. In the case of cranberries, increasing supply requires expanding existing farms and creating new ones. This requires significant initial costs. Today, making cranberries sell at high prices to wealthy people is funding the very process of expansion, pushing the supply curve out and making cranberries richer for everyone else. In other words, by allowing the wealthy to buy at higher prices early on, they subsidize the process of ensuring that poor people have access to goods at lower prices over time.

This is not a fancy process. This reflects what we have seen throughout economic history. When there is a new technology, product, or breakthrough, it is usually very expensive in its early stages. However, over time, the cost will come down, making it more available and affordable. But to get to that stage, you first have to go through the “very expensive” steps to be able to offset all the costs spent bringing the product to market and the still-high marginal cost of production. . New product. Let’s take electric cars as an example.

A newcomer to the electric vehicle space is Rivian. The first two vehicles, the R1S and R1T, started at over $80,000 and could easily exceed $100,000 with a few basic options. But now Rivian is preparing to launch a newer, more mass-market vehicle at half the price of the earlier generation. In order for Rivian to be able to produce low-cost electric cars that were more accessible to the average consumer, it first had to go through the process of selling more expensive cars to wealthy consumers. These high-income customers bought the early $100,000 Rivian, allowing the company to begin producing more affordable vehicles.

Almost everything you enjoy today was once an expensive luxury that only the wealthy could afford. With this in mind, we can look back and imagine if any of these products, when they first hit the market, had been immediately price regulated to prevent “only the wealthy” from purchasing them. Ask yourself, would it have been? If we can understand why it was a bad idea in all of these cases, we can understand the same thing today. It is because the rich pay top dollar for something today that they will be able to buy it tomorrow. So keep this framework in mind when you’re upset about the high price of something. And always remember to think beyond step one.