(Bloomberg) — India is becoming a destination for investors seeking relative refuge from the financial volatility associated with the U.S. election.

Most Read Articles on Bloomberg

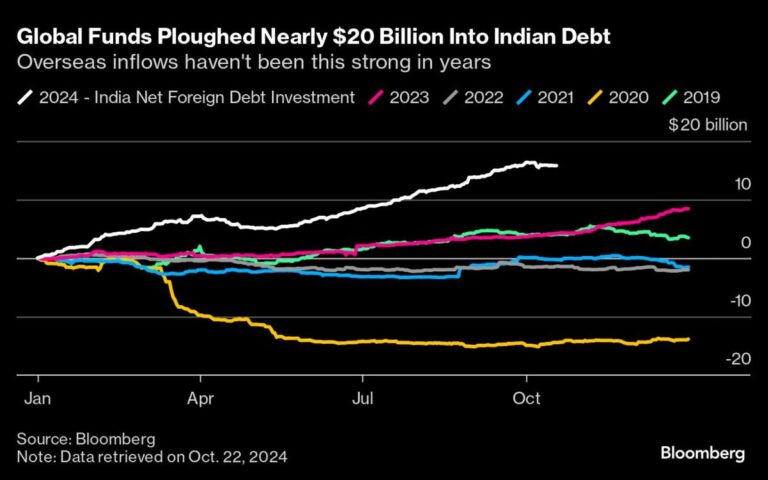

Steady inflows of foreign capital have put the country’s bonds among the top performers in developing markets this year, while the country’s stock market hit a record high last month, supported by solid domestic liquidity. . India’s appeal lies in a combination of structural factors, including stable political relations with both the United States and Russia, capital controls that limit the flow of hot money, and a currency that is less affected by large fluctuations in the dollar than its emerging-market peers. brought about by.

India’s disconnect from global markets was evident last week as the country’s government bonds held relatively steady despite a global sell-off in U.S. Treasuries. The country has become a key emerging market for Abdon as hedge funds brace for increased global volatility, especially ahead of the Nov. 5 U.S. presidential election.

“India’s local bond market is relatively insulated from global market volatility and has remained calm in the storm,” said Edward Ng, fixed income fund manager at Nikko Asset Management. “Bonds” could outperform in a strong dollar environment, he said.

A key pillar of India’s resilience is its currency, which was once one of the most unstable countries in Asia. Due to the Reserve Bank of India’s intervention, the rupee has been hovering between 82.8 and 84.1 rupees to the dollar for most of 2024.

Indian bond returns in Indian currency have declined by just 1 percentage point this year, less than half the share of currency-related losses for all local currency bonds in emerging markets, according to data compiled by Bloomberg. .

Edwin Gutierrez, head of emerging market debt at Abdon, said in an interview that rupee volatility is “minimal.” “In this world of uncertainty, this is not a bad place to be.”

Admittedly, India is not a hotspot for global equity investors at the moment. Signs of slowing in the country’s robust economic growth and a rally in Chinese stocks led to $8.8 billion in outflows from domestic stocks in October, a record high. Although overseas capital outflows have leveled out due to buying by domestic investors, the stock market still has its worst month since March 2020.

story continues

The decline has not led to dramatic market movements. The 60-day historical volatility of the benchmark NSE Nifty 50 index is 13.2%, which is 1.95 points lower than the S&P 500 index, indicating relative stability in comparison.

UBS Global Wealth Management suggests the decline is a buying opportunity as India’s weaker growth and earnings appear to be temporary. This view comes after Goldman Sachs Group Inc. downgraded domestic stocks from tactical overweight to neutral last week.

India is not the only emerging economy with a low correlation to global sentiment. Amundi SA and William Blair & Co. LLC said they favor outlying markets such as Nigeria and Kazakhstan as potential buffers against disruption from the U.S. election.

But these alternatives lack the liquidity and depth of India’s $1.3 trillion government bond market or $5 trillion equities. The country is also expected to attract more offshore funds as part of its inclusion in JPMorgan’s bond index, and BlackRock Inc. and Amundi SA have launched ETFs to ride the wave.

India will join Bloomberg’s Emerging Markets Gauge from January.

Compared to other global assets such as dollar-denominated bonds, “Indian domestic assets remain quite attractive for us,” said Leonard Kwan, portfolio manager for T. Rowe Price Group’s Dynamic Emerging Fixed Income Strategy. They are being selected,” he said. As for India, it is “more overweight than in line with standards.”

Bloomberg LP is the parent company of Bloomberg Index Services Ltd., which manages indexes that compete with indexes from other providers.

what to see

China reports PMI data, gives an update on the state of business confidence after stimulus measures

South Korea is expected to see a contraction in industrial production and a decline in exports, while Taiwan’s GDP growth rate is expected to slow.

Brazil, Poland, Indonesia provide investors with latest information on inflation

South Africa to report trade balance update

–With assistance from Vinicius Andrade, Gizia Song, Finbar Flynn, Alex Gabriel Simon, Masaki Kondo, and Chiranjivi Chakraborty.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP